Ripple price shows signs of imminent 20% upswing as fundamentals scream ‘Buy now'

- Ripple price found support after the profit-taking from its rally last week.

- XRP sees a clear technical pattern emerging, pointing to heavy buying at the dips.

- Expect price action to repeat its performance from last week with a retest at $0.5852.

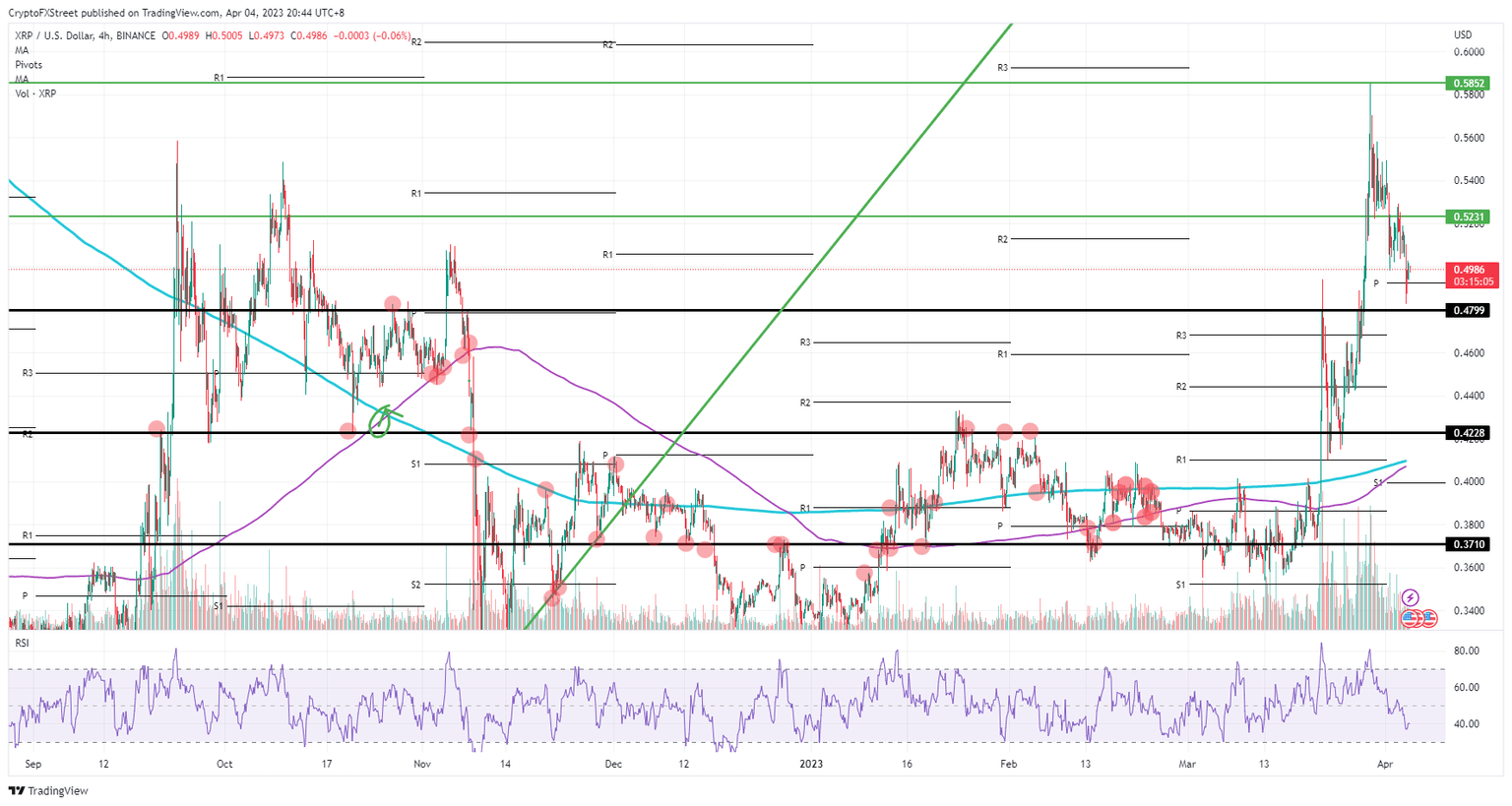

Ripple (XRP) price has been going fast and hard in both directions this past trading week with a greater than 35% price swing from top to bottom in seven trading days. As XRP price dropped after heavy profit-taking, the price looks to be rebounding now. With clear technical support identified and the relative Strength Index (RSI) below 50, XRP’s charts are screaming to buy now before it hits $0.5852 again on the topside.

Ripple price forming double top would be the best scenario yet

Ripple price was unleashed last week as volatility soared to new highs, hitting $0.5852 on the topside, a level not seen since May 2022. Unfortunately, a firm rejection and a large fade of profit-taking occurred. XRP plunged lower quite quickly in search of much-needed support.

XRP saw $0.48 stepping in and doing the trick again with a firm bounce higher up toward $0.50. As price action is near that level now, buying some stake in XRP makes more sense as the RSI trades below 50. While bulls are building up stakes again, a revisit of $0.5852 is inevitable and makes it perfect for a double-top formation with another 20% gain.

XRP/USD 4H-chart

The threat to the downside comes with the RSI still having some room to go lower in search of that oversold barrier. In previous days it has always done so before popping higher in the aftermath. That means that XRP could drop another 15% toward $0.42 and finally meet that oversold and technical pivot level for a bounce higher.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.