Ripple price looks ready to pump massively after the retest, here is the next target

- Ripple price is coiling on the 12-hour timeframe with hints of a breakout, judging from recent price action.

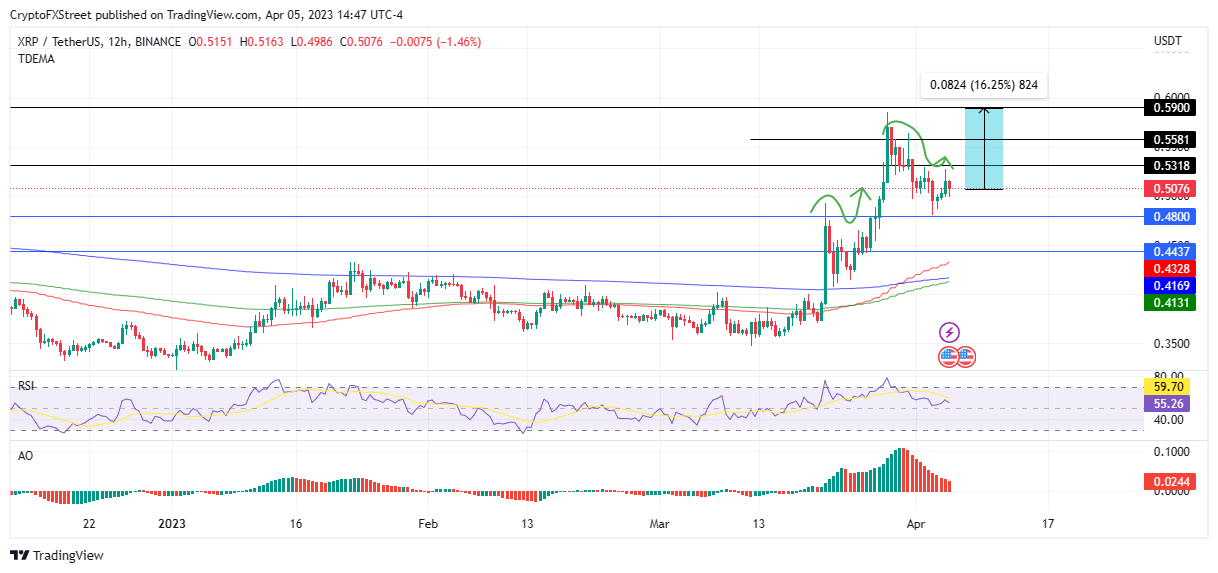

- XRP could soar 15% to retest the $0.590 resistance level after a March 29 rejection.

- A daily candlestick close below the $0.480 support level could invalidate the bullish thesis.

Ripple price (XRP) has recovered from a downtrend in the 12-hour timeframe after giving sidelined investors an opportunity to buy the dip. If the strategy works, the remittance token could mimic a recent price action and execute a massive pump toward a local high.

Ripple price readies for a 15% climb

Ripple price appears to be coiling up for a significant climb after breaking a downtrend pattern. The recent uptrend is attributed to the “sell the news” event as community members anticipated a summary judgment from Judge Analisa Torres in late March. After the judge delayed the ruling, the hype eased off, causing a decline in XRP price.

It appears that the downtrend gave leeway for sidelined investors to buy the dip as Ripple price corrected soon after. The gains come as buying pressure increased, kickstarting a northbound move that could see investors recoup recent losses.

If the XRP bulls sustain the current accumulation pattern, Ripple price could rally north, breaching the immediate resistance level at $0.531 first. A break above this level could see the altcoin shatter the $0.558 resistance level on its northbound move.

In highly bullish cases, Ripple price could spring up and tag the $0.590 resistance level, which rejected the altcoin on March 29, kickstarting the latest downtrend. Such a move would denote a 16.25% ascent from the current price. It would also be a watershed moment for XRP bulls given the level was last tested almost a year ago in May.

XRP/USDT 12-hour chart

XRP remains a closely watched asset as market pundits tip it for immense growth in the near term. With such an outlook, Ripple price could explode as accumulation grows on rate faster than sell-offs. This should escalate as the count down to the ruling continues.

On the downside, if selling pressure escalates, Ripple price could drop toward the $0.480 support level. A decisive flip of this support level into resistance will invalidate the bullish thesis.

In highly bearish cases, Ripple price could descend to take a breather around the $0.443 support level. Failure to use this base as the turnaround point could see the price cushioned by the 50- 200- or 100-day Exponential Moving Averages (EMAs) at $0.43, $0.416 and $0.413, respectively.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.