Ripple price likely to crash 25% as dead-cat scenario unfolds

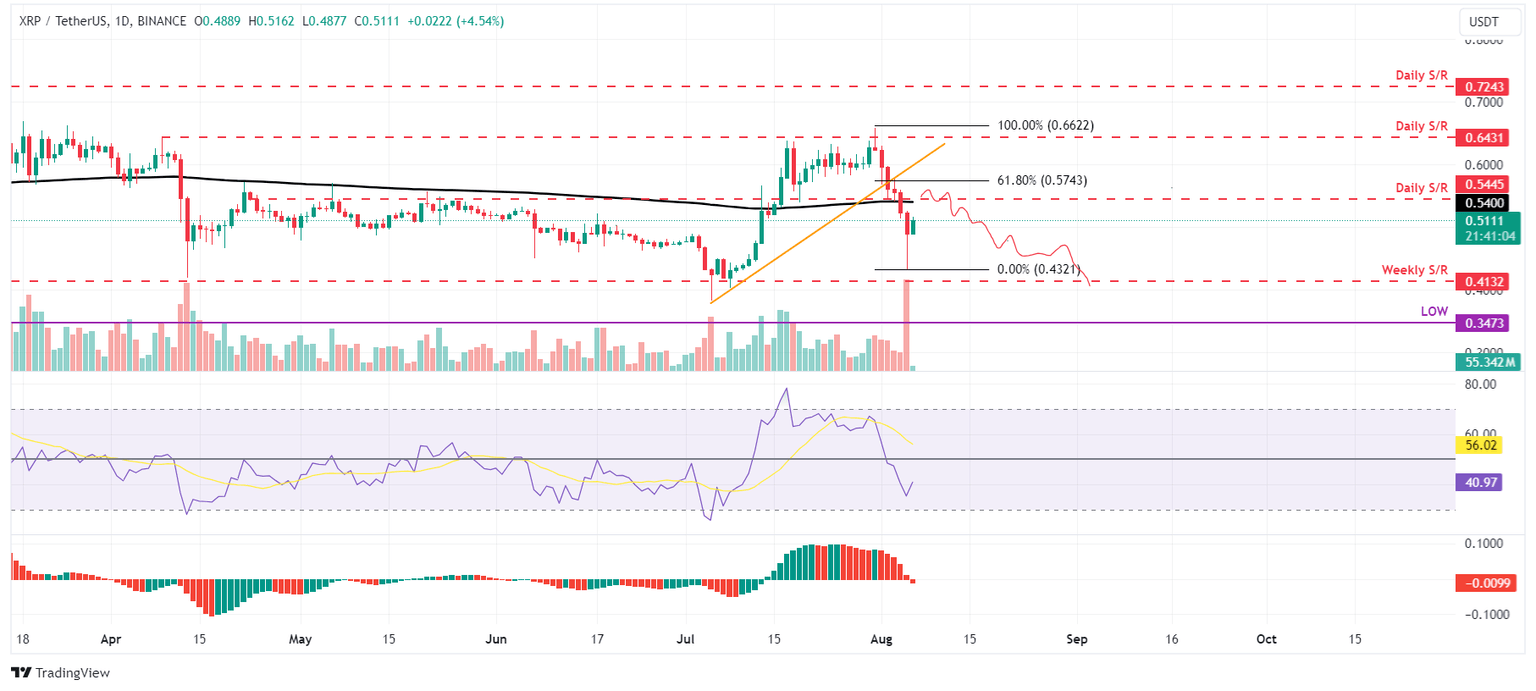

- Ripple price breaks below daily support level at $0.544, suggesting a bearish trend ahead.

- Sideline traders looking to short XRP can do so at the $0.540 and $0.574 zone.

- A daily candlestick close above $0.643 would invalidate the bearish thesis.

Ripple (XRP) price breaking below the daily support level of $0.544 indicates a shift in market structure from bullish to bearish. This suggests that sideline traders looking to short XRP should consider entry points between $0.540 and $0.574 in anticipation of the price resuming its downtrend.

Ripple price is likely to have a relief rally

Ripple's price fell below the daily support level of $0.544 on Sunday and dropped 6.7% on Monday. However, it saw a modest recovery on Tuesday, trading 4.7% higher at $0.511.

In this scenario, XRP might experience a dead-cat bounce—a brief price increase within a broader downtrend—potentially facing rejection from the former daily support level now acting as resistance at $0.544, which also aligns with the 200-day Exponential Moving Average around $0.540, marking it as a crucial reversal zone.

Failure to break above the $0.544 level might trigger a 25% crash, back to retest the $0.413 weekly support level.

The Relative Strength Index (RSI) and the Awesome Oscillator on the daily chart have dropped below their neutral levels of 50 and zero, respectively, signaling a bearish trend according to these momentum indicators.

XRP/USDT daily chart

On the other hand, if the Ripple price closes above the $0.643 daily resistance level, it would change the market structure by forming a higher high on the daily timeframe. Such a scenario might drive a 12% rally in XRP price to retest its next daily resistance at $0.724.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.