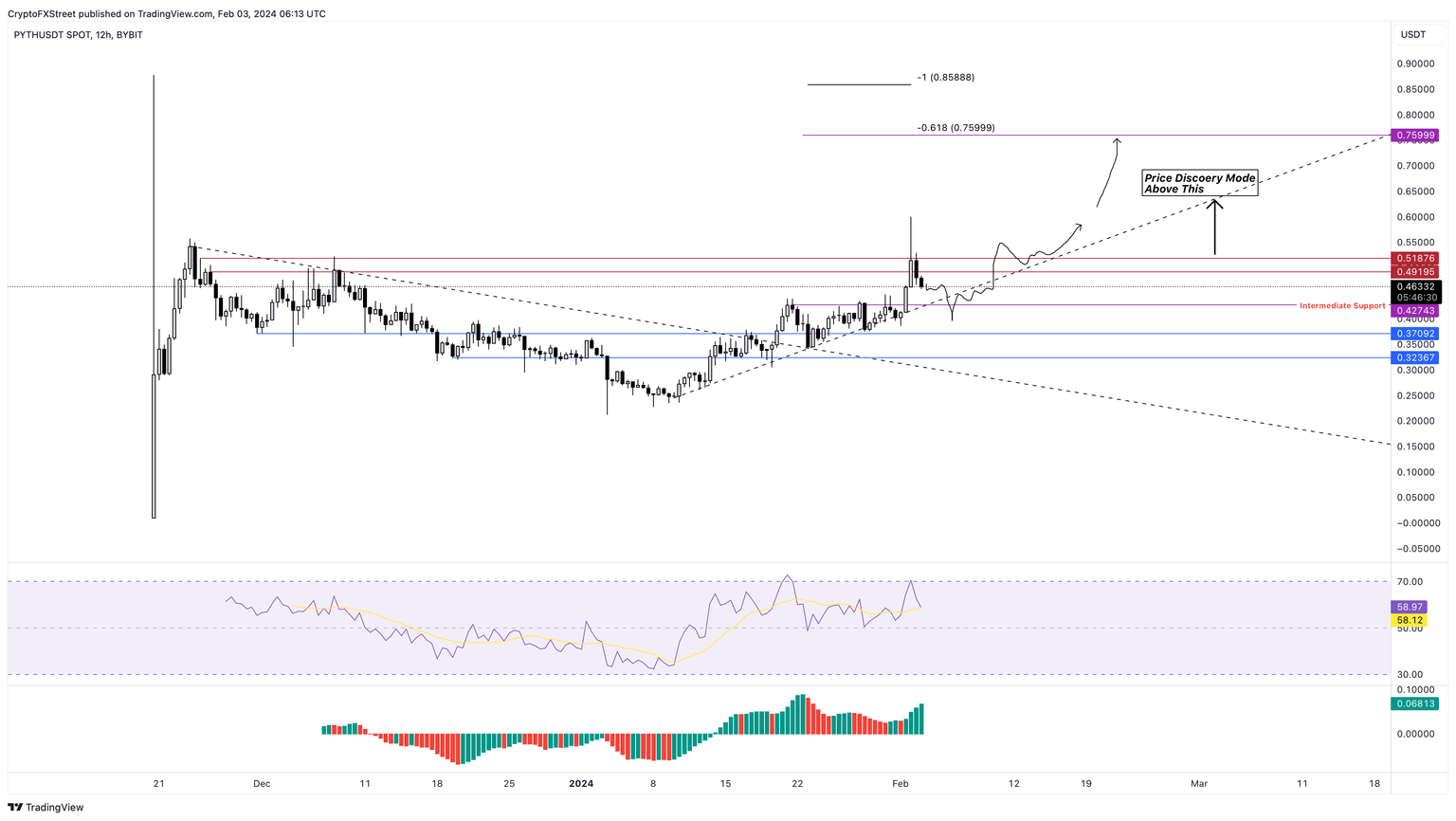

Pyth Network could enter price discovery mode if PYTH bulls defend $0.427

- Pyth Network price could slide another 8% before it stabilizes around the $0.427 support level.

- Deviation below $0.427 is likely, but a quick recovery could open the path for an 80% upswing to $0.759.

- A breakdown of the $0.370 support level will invalidate the bullish thesis.

Pyth Network (PYTH) price rallied nearly 50% between February 1 and 2 due to a sudden spike in buying pressure. However, the altcoin is undergoing correction to find a stable support level.

Also read: Bitcoin Weekly Forecast: BTC price remains indecisive despite strong fundamentals

Pyth Network price sets the stage for next leg

Pyth Network price consolidated for 11 days between January 21 and February 1 below $0.427. The breakout on February 2 led to a nearly 50% rally, but profit-taking reduced the total gains to 25% on candlestick closes.

Currently, Pyth Network price is retracing and is likely going to settle around $0.427. While there could be fluke deviations below this level, investors should not get shaken out. Instead, traders should watch for a quick recovery above $0.427. If successful, Pyth Network price could be setting the stage for the next run-up.

In this case, investors can expect the potential upswing to face a slowdown around the $0.491 and $0.518 resistance levels. But a decisive flip of these hurdles into a foothold will open the path for PYTH to rally 47% and $0.759.

This move would constitute a nearly 80% gain from $0.427.

Also read: Etheruem price rise remains restricted as “billionaire” wallets now hold a third of ETH tokens

PYTH/USDT 12-hour chart

Regardless of the extremely bullish outlook, Pyth Network price could fail to hold above $0.427 due to the current market conditions. In some cases, the deviation could occur below $0.370 as well. But a decisive twelve-hour candlestick close below $0.370 will invalidate the bullish thesis for PYTH.

This development could see Pyth Network price crash 12% and tag $0.323.

Also read: Lido DAO Price Prediction: LDO could fall 20% with the weekly supply zone holding as resistance

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.