Etheruem price rise remains restricted as “billionaire” wallets now hold a third of ETH tokens

- Ethereum price has failed to breach the 50- and 200-day EMAs for about two months.

- Whale addresses holding over 1 million ETH now hold 32.3% of the entire circulating supply.

- Whales are likely to accumulate as they may see a prospect of a rally.

Ethereum price is finding difficulty in achieving a breakthrough for about two months now. However, this has not rubbed off on the investors in any way, who are standing more bullish now than they ever were, especially the big buck holders.

Ethereum price downtrend could end soon

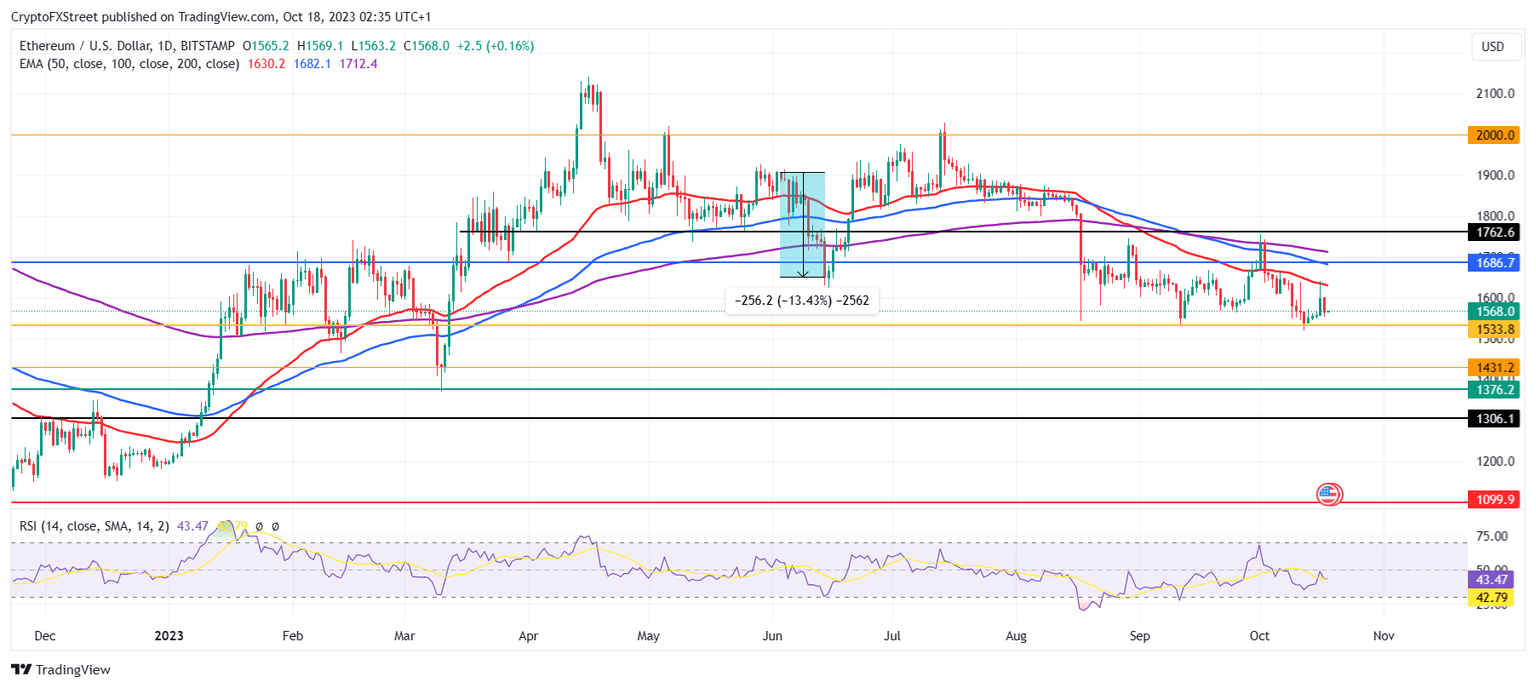

Ethereum price trading at $1,568 bounced off the support line at $1,533 earlier last week to increase slightly. However, the altcoin failed to breach through the 50-day Exponential Moving Average (EMA). Had it managed to do so, ETH would have been closer to reclaiming the resistance level marked at $1,686 into a support floor.

Nevertheless, Ethereum price still has a shot at recovery, looking at the Relative Strength Index (RSI). The indicator is hovering in the bearish zone around the neutral mark at 50.0, and upon further recovery, this line would be flipped into a support floor. This would then suggest a bullish signal has been confirmed.

ETH/USD 1-day chart

But if the bullish signal is not confirmed and the $1,533 support is lost, the bullish thesis would be invalidated and Ethereum price could fall below the $1,500 mark.

Ethereum whales could prevent a decline

The chances of the Ethereum price falling do exist, but the investors’ behavior would act as a shield protecting the altcoin from a bearish wave. This is evident in the way the whale holders are acting. Even though ETH is not a whale-centric coin, the whales play a major role in the price action since they are the biggest investors.

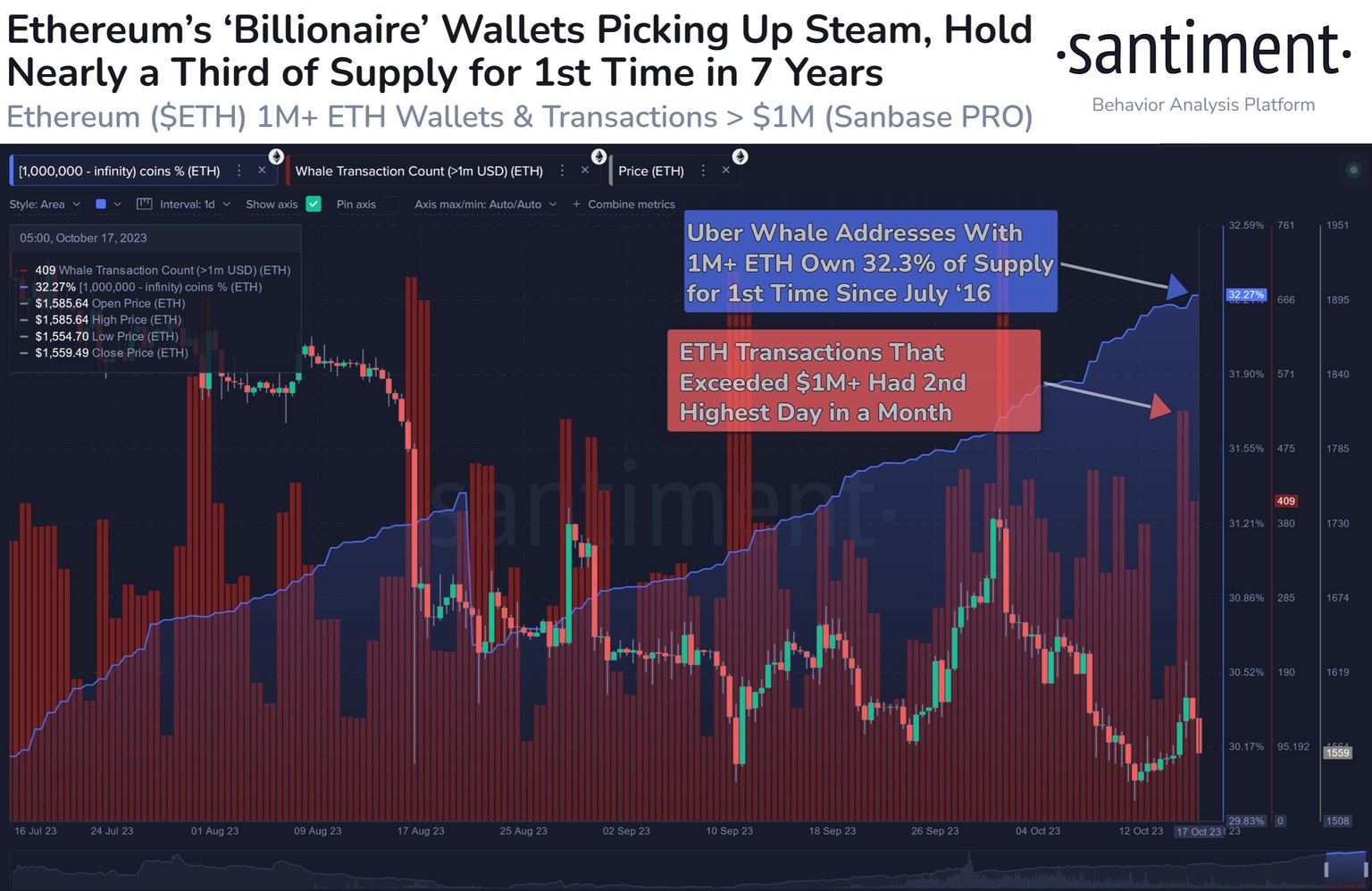

According to data from Santiment, the addresses holding more than 1 million ETH in their wallets have consistently accumulated and now hold about 32.3% of the entire circulating supply. This is the highest concentration of ETH in these addresses since July 2016, marking a seven-year high.

What is to be noted here is that this is not random accumulation, as one can note from the chart below that these whales began actively loading ETH right around mid-August when the Ethereum price fell. Since then, the total holdings have risen by more than 1.5% and are still growing.

Ethereum whale holdings

This will have a bullish impact on Ethereum price, which is exactly what is needed at the moment to push the altcoin back above $1,600.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.