Pepe Coin bullish run will not happen until PEPE breaks and holds above this level

- Pepe Coin price remains far from its all-time high of $0.0000045000 recorded on May 5.

- PEPE must rise and hold above the $0.0000008045 mean threshold to bring the next possible run in sight.

- Upon doing so, the Fibonacci retracement levels could come into play, with the $0.0000010870 being a solid target.

- Meanwhile, the zone extending from $0.0000006829 to $0.0000007271 is a must hold.

Pepe coin (PEPE) price continues to struggle despite being the meme coin sensation at one point in its lifetime. The frog-themed token has taken to the trend seen among its peers in the meme coin ecosystem, including Dogecoin (DOGE) and Shiba Inu (SHIB), among others.

Also Read: PEPE price recovery fazed by split in the meme coin’s team and Telegram account hack

Pepe coin price must overcome this supplier barrier for a run

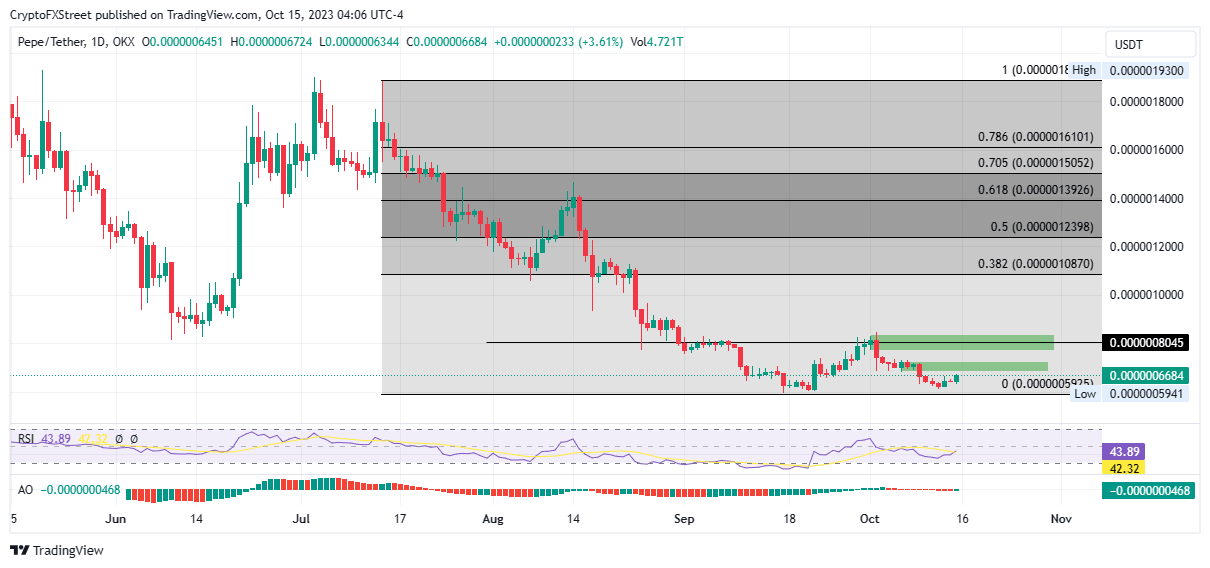

Pepe coin (PEPE) price remains at its lowest after an 85% fall from its peak price of $0.0000045000. The Relative Strength Index (RSI) momentum indicator has been bearish for the longest time, spending most of the token’s lifespan below the 50% level, showing momentum has been weak. A recent attempt to breach proved short-lived, as profit booking prevailed possibly as investors exited after reaching their breakeven around the zone extending from $0.0000007671 to $0.0000008392.

With PEPE holders holding out hope that this meme coin will restore its glory days, the run may not happen until Pepe coin price breaks and holds above the mean threshold of the aforementioned order block at $0.0000008045.

Above this level, the Fibonacci retracement levels would come in play, with 38.2% Fibonacci at $0.0000010870 being a solid target. A break and close above this level would pave the way for a move north, potentially going as far as the 50% Fibonacci at $0.0000012398. In a highly bullish case, the gains could extend to the 61.8% Fibonacci at $0.0000013926. A decisive daily candlestick close above this level would confirm the uptrend, bringing the $0.0000019300 range high in sight.

PEPE/USDT 1-day chart

Conversely, if another cohort of profit takers pulls the trigger, Pepe coin price could face a rejection from the immediate supply barrier ranging from $0.0000006829 to $0.0000007271. The ensuing selling pressure could send PEPE to the range low at $0.0000005941.

The position of the RSI still below 50 shows that momentum remains weak and Pepe coin price may not be able to overcome the aforementioned supply zone.

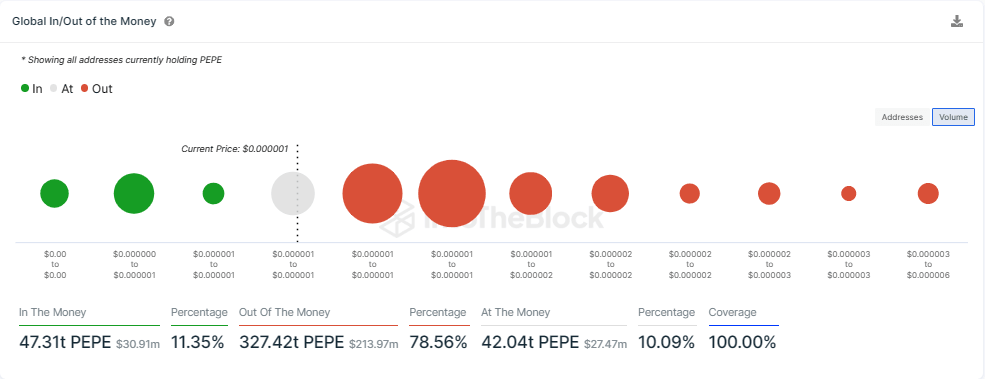

IntoTheBlock’s “Global In/Out of the Money” (GIOM) model reveals there is a strong supply barrier that will prevent the frog-themed meme coin from achieving its upside potential. Based on this on-chain metric, there are two major areas of interest between filled by a high number of investors that had previously purchased PEPE around this price level. Here, a combined total of approximately 38,110 addresses hold nearly 248.72 trillion PEPE.

PEPE GIOM

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.