Shiba Inu inspired meme coin BONE notes first rise following the 55% crash in two months

- Bone ShibaSwap price, at the time of writing, was just above $0.82, marking the first green candle since the beginning of August.

- Selling pressure concerning BONE is rather intense in the market, however, no major dump has been observed.

- This pressure is also impacting the network growth of the meme coin, which measures the formation of new addresses on the network.

Bone ShibaSwap, also known as BONE, is one of the few meme coins that had a positive run on Monday. The meme coin is best known for being a token of the Shiba Inu ecosystem but is slowly emerging into an entity of its own, provided it can attract enough users to fuel its long overdue recovery.

BONE price rises but not for long

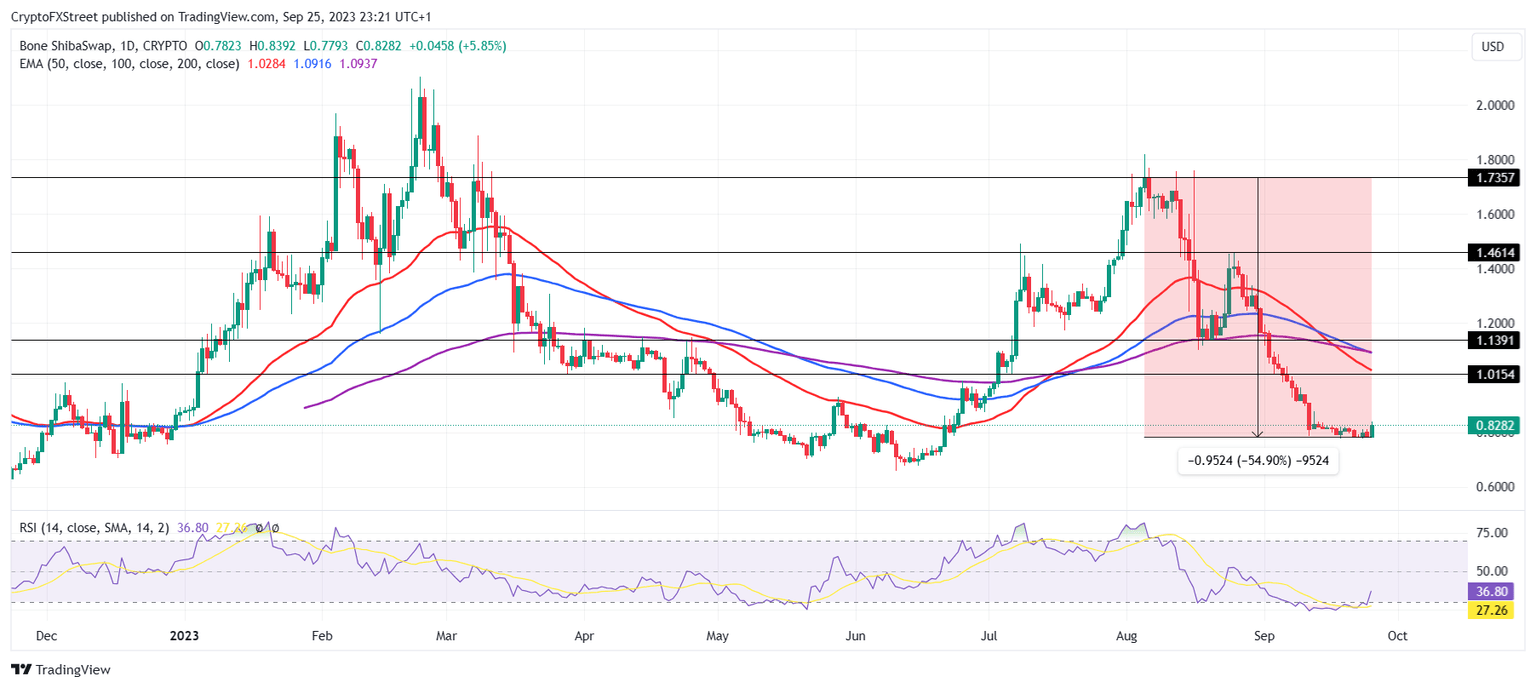

Trading at $0.82 at the time of writing, the meme coin was up by a little under 6% over the past 24 hours. Bone ShibaSwap rising by 6% is not a big deal, but considering the past couple of days, it makes all the difference.

Since the beginning of August, the altcoin has seen a 55% decline in value from $1.73 to $0.81. In this duration, the meme coin also witnessed a death cross, marked by the crossing of the 200-day Exponential Moving Average (EMA) and the 50-day EMA, which is considered to be a bearish indicator.

Combining this with the Relative Strength Index (RSI) shows that a clearly bearish outcome is likely as the indicator is deep in the bearish zone as of now.

A further decline would send the meme coin back to $0.68, which marks the year-to-date low Bone ShibaSwap price has hit. However, in the long run, if the altcoin manages to defy all odds and rise by 20% to make it to the barrier at $1.01 and breach it, BONE would invalidate the bearish thesis.

BONE/USD 1-day chart

Flipping this level into support would also enable the altcoin to turn the 50-day EMA into an ally, further substantiating a rally.

Chances of recovery - unlikely

The potential for an uptick following this rally is not too high. The reason behind this is the pessimism of the investors. The daily transactions conducted on-chain show that 20.58 million BONE worth around $16.82 million was moved at a price lower than the price it was purchased at.

This boosted the transactions at a loss, while transactions in profit only noted less than 500,000 BONE tokens bring moved around at a price higher than the purchase price. Generally, a rise in loss-bearing transactions is a suggestion that investors are losing their patience and could be prepared to offload their holdings. This increased selling pressure adds to the bearishness faced by the meme coin.

BONE transactions at a loss

Any selling would not only spook the investors holding BONE at the moment but also those willing to invest. New addresses formed on the network could see a further decline, which in turn would impact the network growth, which is at a two-month low.

The indicator is used to measure the traction of a project in the market, and in the case of Bone ShibaSwap, the interest of new investors is relatively low.

BONE network growth

Thus, the rise in BONE price may not bear any fruits as per the market’s expectations.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B06.12.59%2C%252026%2520Sep%2C%25202023%5D-638312923560673610.png&w=1536&q=95)

%2520%5B06.12.50%2C%252026%2520Sep%2C%25202023%5D-638312923718362198.png&w=1536&q=95)