Optimism price volatility rises, eyes 20% gain as Coinbase launches OP for futures trading

- Optimism price remains bullish despite the recent retraction, standing 91% higher since crypto markets turned bullish on October 18.

- Volatility is on the rise, up almost 5% in 24 hours as Coinbase launches OP for futures trading.

- OP could move 20% north to test the supply barrier extending from $2.601 to $2.710.

- A break and close below the midline at $1.752 would invalidate the bullish thesis.

Optimism (OP) price is a clear outperformer in the list of Layer 2 (L2) tokens rallying, standing 91% up since the market turned bullish, while its peer, Arbitrum (ARB), is up only 49%. It comes after OP featured in the altcoin bull cycle 2023 picks by analysts, as FXStreet reported.

Also Read: Optimism Price Prediction: OP range tightens before 20% rally

Coinbase launches Optimism token for futures trading

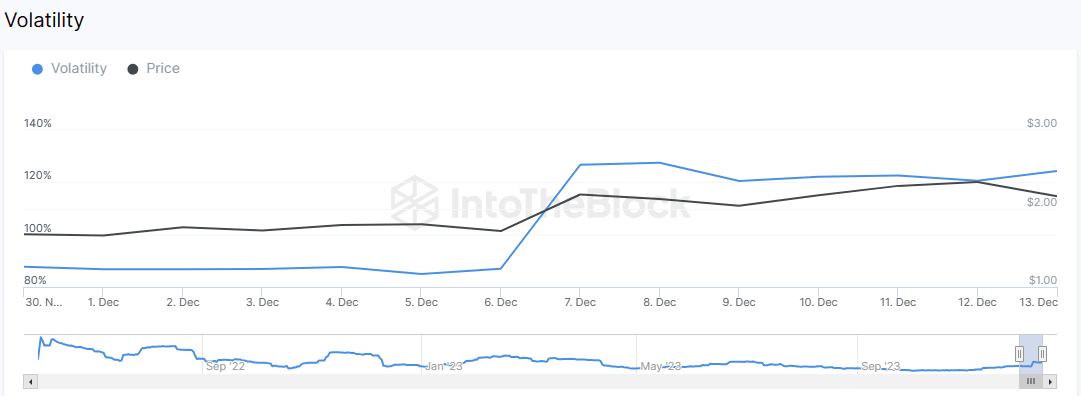

Optimism (OP) price volatility has increased over the past few days, rising in 24 hours from 120% to 124%.

OP Volatility

It comes on the back of news that US-based cryptocurrency exchange, Coinbase, has launched OP token for futures trading. This means OP traders will be able to enjoy higher leverage and lower trading costs. They will also be able to profit from movements of Optimism price.

Our OP-PERP, ARB-PERP, and ETC-PERP markets are now in full-trading mode on Coinbase International Exchange and Coinbase Advanced. Limit, market, stop and stop limit orders are all now available. pic.twitter.com/BFXxrsReFU

— Coinbase International Exchange ️ (@CoinbaseIntExch) December 13, 2023

Nevertheless, it is worth mentioning that risks will also be higher compared to the usual spot trading. Specifically, because of leverage, profits or losses become amplified.

Besides OP, other tokens that have also earned a place on Coinbase’s futures trading catalog include ARB and Ethereum Classic (ETC).

Optimism price outlook as OP volatility soars

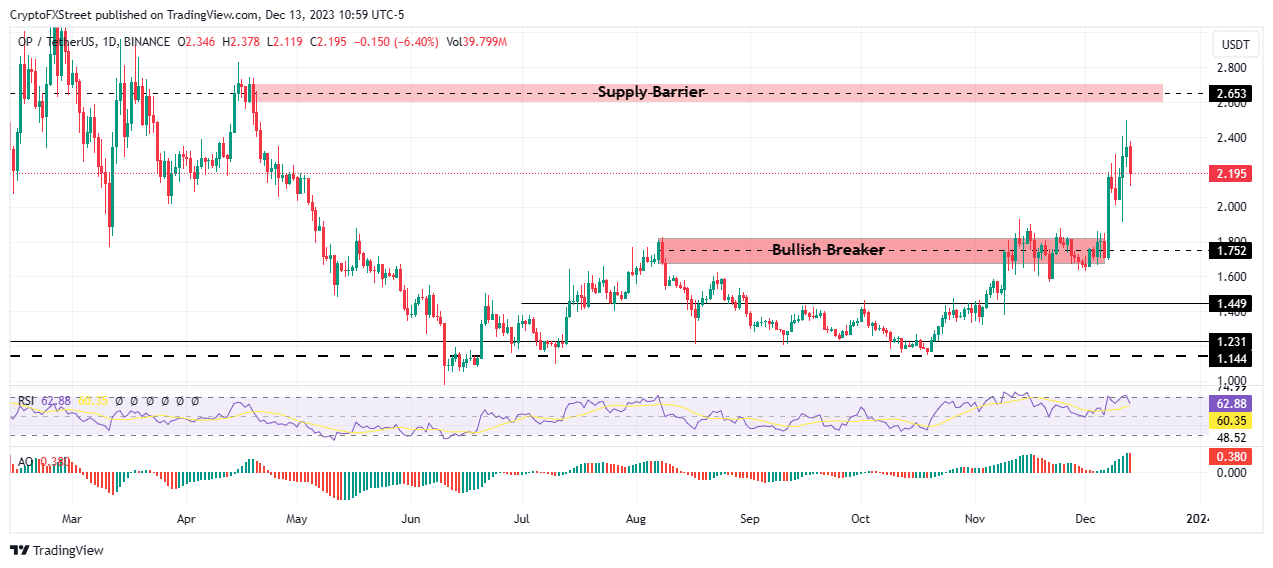

Optimism price remains bullish despite the 10% correction, considering the Relative Strength Index (RSI) remains above the 50 level. The Awesome Oscillator (AO) also accentuates the bullish outlook as it remains within positive territory.

Increased buyer momentum could see Optimism price pull north, reclaiming space above the $2.400 level. In a highly bullish case, the gains could extend for OP to tag the supply zone stretching from $2.601 to $2.710. Such a move would denote a 20% climb above current levels.

To confirm the continuation of the trend, Optimism price must record a decisive daily candlestick close above the midline of the supply zone at $2.653. This could set the tone for an extension to the $2.800 level, or better, the $3.000 psychological level.

OP/USDT 1-day chart

On the other hand, if selling pressure increases, Optimism price could extrapolate the fall, slipping below the $2.000 psychological level. This pullback might extend a leg down to test the bullish breaker. If the slump extends below the midline of this order block at $1.752, it would confirm the continuation of the downtrend and invalidate the bullish thesis in the process.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.