MicroStrategy buys $150 million worth of Bitcoin as institutional interest soars to eight-month high

- CoinShares report highlighted that the week ending March 24 noted the highest inflows since July 2022.

- MicroStrategy holds over $4 billion worth of Bitcoin after adding 6,455 BTC since last month.

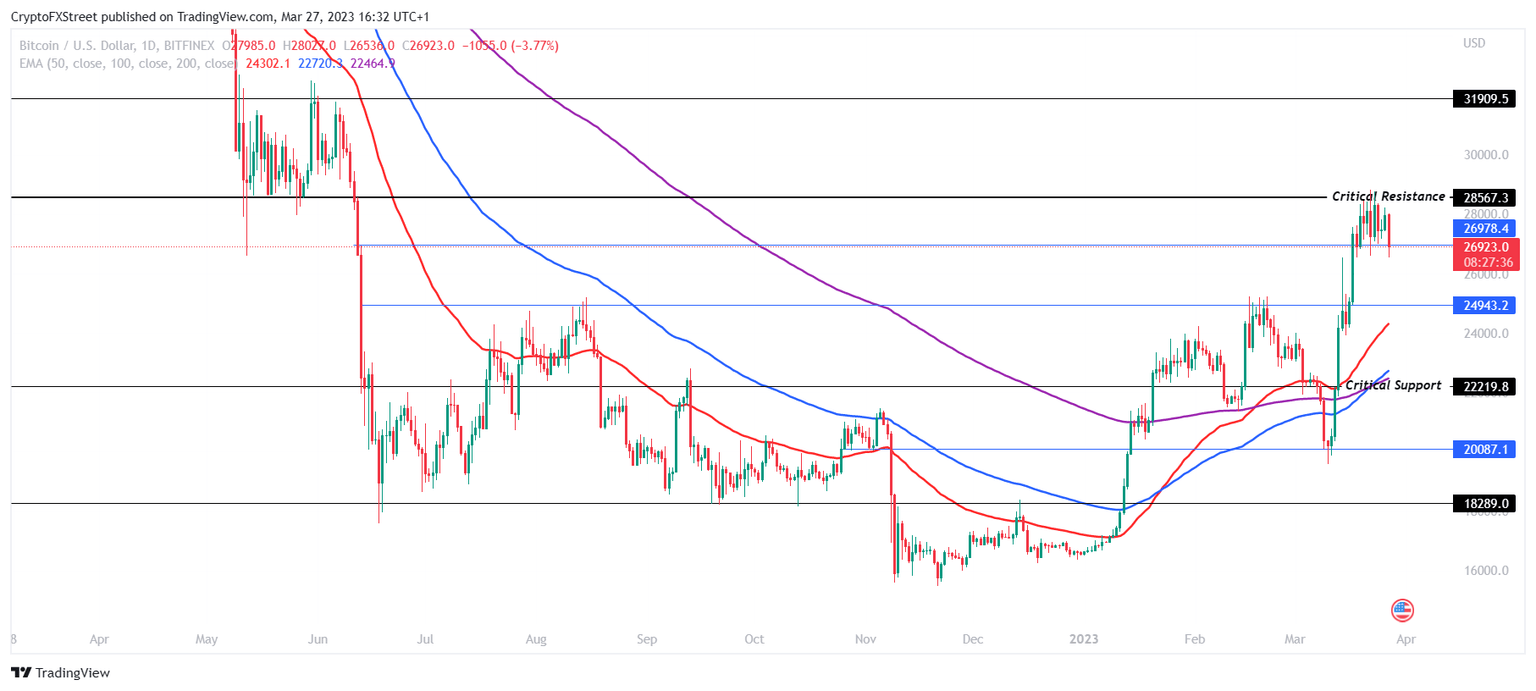

- Bitcoin price is trading at $26,923, struggling to breach $28,500 for nearly two weeks now.

Bitcoin has been noting increasing institutional interest for the last few days as whale movement on the network grew. At the same time, another major bitcoin holder MicroStrategy also dove back into accumulating BTC suggesting that the cryptocurrency could be taking a bullish turn.

MicroStrategy is back to acquiring Bitcoin

In a regulatory filing on March 27, Michael Saylor’s company announced that MicroStrategy had acquired about 6,455 BTC for $150 million over the last two months. The average price of each Bitcoin stood at around $23,238, bringing the total BTC holdings of the firm to 138,955.

This is the first purchase announced by MicroStrategy this year, as the last purchase was noted in December 2022, when the company had added about 2,500 BTC. Valued at $4.14 billion, the average price of each Bitcoin held by Saylor’s organization is close to $29,817. The current price of the biggest cryptocurrency in the world is around $26,780, which shows that Microstrategy’s investment is still at a loss.

Bitcoin price needs to be at a nine-month high and breach the critical support at $28,567 for the company to break even on its investment. However, BTC is treading in the opposite direction at the time of writing, trading at $26,923, falling by nearly 4%. Struggling to breach the critical resistance at $28,567 for about 14 days now, Bitcoin would need a push from investors to climb back to $30,000.

BTC/USD 1-day chart

If the price falls further and loses the support at $24,943, it would be on the path to testing the critical support at $22,219. Falling through it would invalidate the bullish thesis, potentially sending Bitcoin price to $20,000, marking a 20% crash.

Rising institutional interest could save Bitcoin from crashing

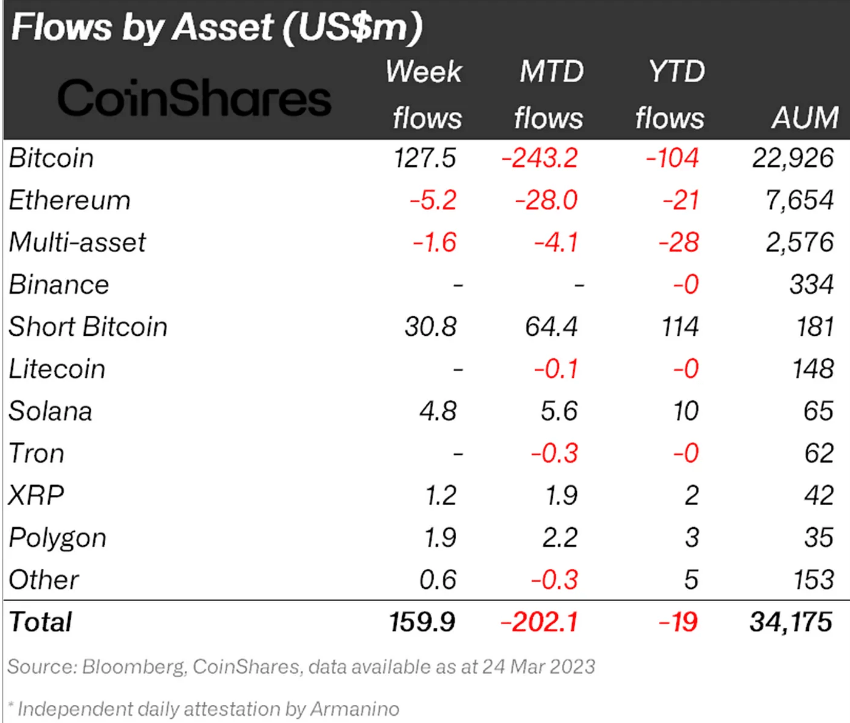

MicroStrategy’s move is one of the first few indications that institutions might be back investing in the crypto market and Bitcoin again. The CoinShares report highlighted that the weekly crypto asset flow for the week ending March 24 hit an eight-month high of $160 million.

Of this $160 million, $127.5 million was directed towards Bitcoin. Although considering the year-to-date flows, the asset is still noting a macro outflow of $104 million but rising institutional interest could flip that over the next few weeks.

Bitcoin institutional inflows

This changing interest was also observed a few days ago in the form of whale movement as big wallet holders’ activity became much more significant. As observed on-chain, the transactions worth more than $100,000, denoted to be whale activity, shot up to a 15-week high.

Acquisitions by large wallet holders are generally a signal that the cohort is expecting a price rise going forward, which usually plays out in their favor.

Thus Bitcoin investors looking to go long should look out for the opportunity to jump in should the pattern repeat this time around as well.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.