Bitcoin whale activity spiking to its highest in 2023 says this about BTC’s price

- Bitcoin price has noted an impressive rally to bring the price to $28,000.

- Whale transactions over the last week emerged as the highest in three months.

- BTC is gaining interest despite the ongoing banking crisis in the United States.

Bitcoin price restored its safe haven label earlier this week when it decoupled from the stock markets. The disastrous financial conditions that took down three banks in the United States have shown little to no effect on the biggest cryptocurrency in the world, regaining the investors lost confidence following the FTX collapse.

Bitcoin whale activity surges

Bitcoin whales became active once again in the last week as the banking crisis intensified. Transactions worth over $100,000 are usually classified as whale activity due to the sheer size of the value involved.

The movement of these whales highlights whether the cryptocurrency is heading towards an uptrend or a decline.

Over the past week, such whales conducted more than 10,000 transactions, which resulted in Bitcoin recording the highest daily average whale activity in 15 weeks. However, BTC was not the only asset as Wrapped Bitcoin (wBTC) also experienced a similar whale activity, recording over 930 transactions in the span of seven days.

Bitcoin whale activity

The weekly movement noted emerged as the highest week of 2023. This shows that interest in Bitcoin has risen significantly, with investors expecting a further increase in price going forward.

This is visible on the social volume of the asset as well, which shot up significantly in the last week. The recorded interest is the highest noted figure in nearly ten months at the hands of the investors since May 2022.

Bitcoin social volume

Thus, a consistently positive momentum could result in the Bitcoin price rising further.

Bitcoin price nears $30,000

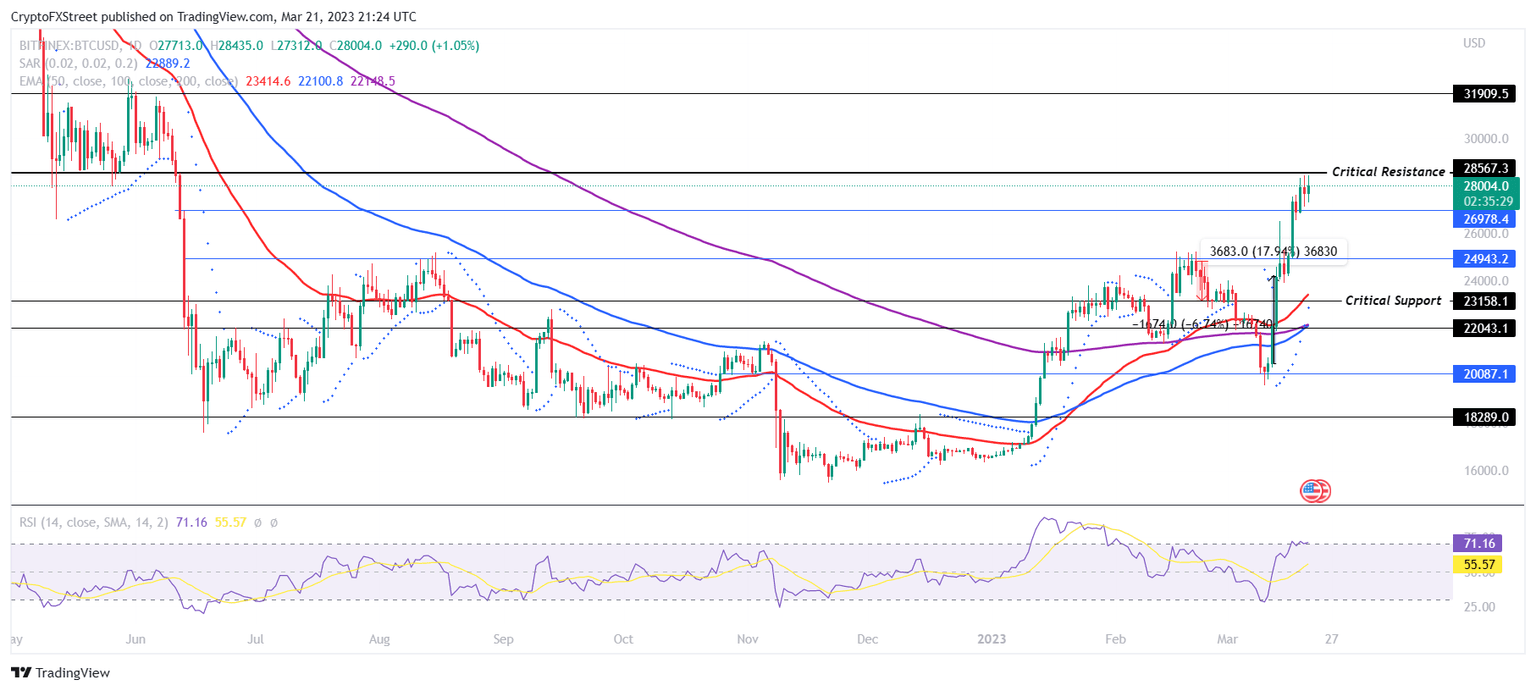

Bitcoin price has been on a consistent rise for the last couple of days that has led to the crypto asset rising from $20,000 to trade at $28,000 at the moment. The biggest cryptocurrency in the world is nearing critical resistance at $28,567, which if it manages to turn into support, would set BTC up for a rise to $30,000.

However, according to the Relative Strength Index (RSI), the bullishness noted over the last couple of days has pushed the asset into the overbought zone. This suggests that a market cooldown might be on the way.

BTC/USD 1-day chart

Thus, traders looking to long the asset must watch where Bitcoin price is headed. If corrections arrive and BTC declines, it would find opportunities to bounce back at $26,978 as well as $24,943.

Further decline would bring the cryptocurrency to the critical support at $23,158, losing, which would invalidate the bullish thesis and lead to a 20% crash.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B02.53.30%2C%252022%2520Mar%2C%25202023%5D-638150327857445806.png&w=1536&q=95)

%2520%5B02.38.29%2C%252022%2520Mar%2C%25202023%5D-638150328208444489.png&w=1536&q=95)