MATIC price crash triggers buying spree, 20% upswing likely

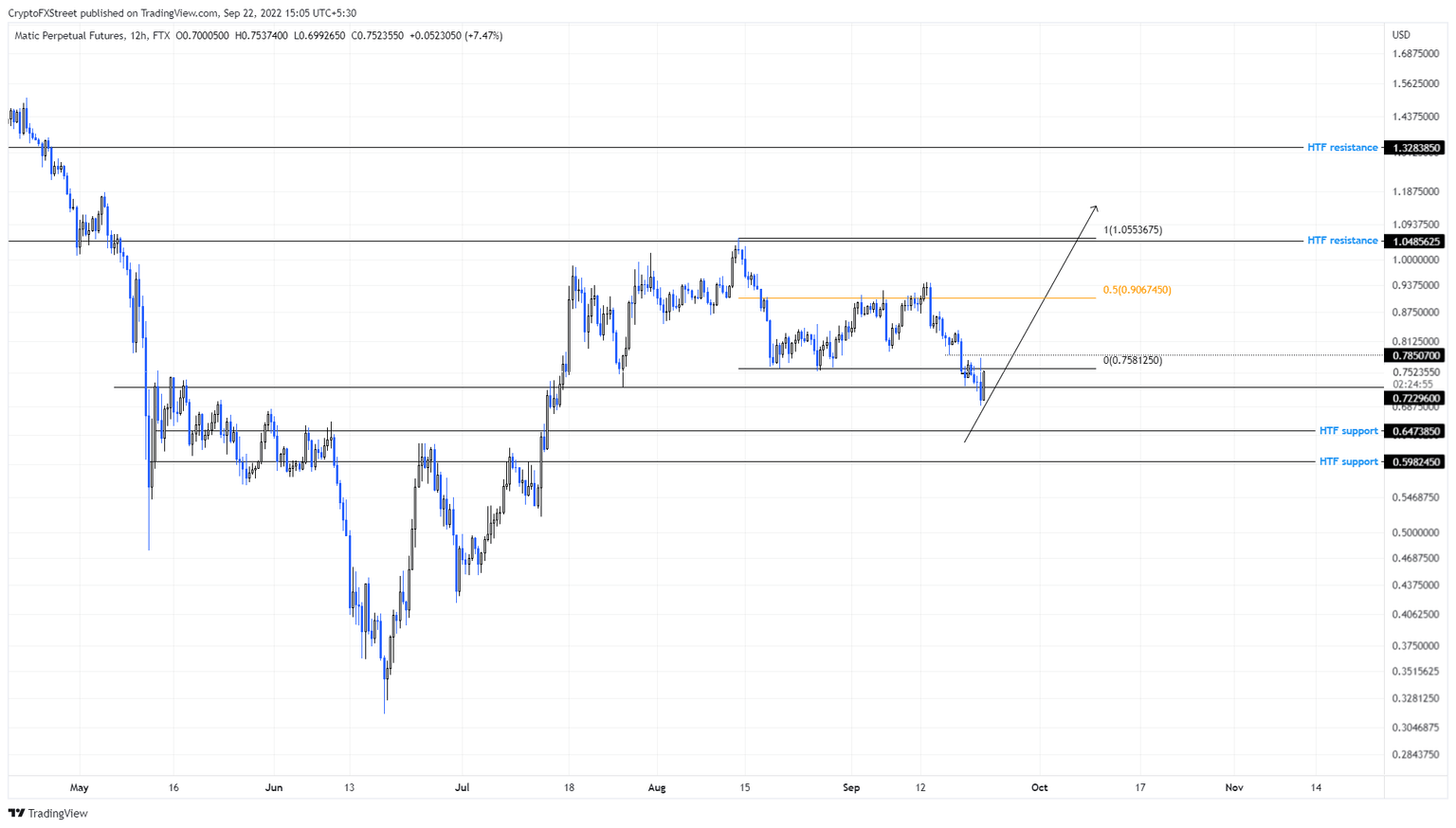

- MATIC price has recovered above the $0.722 support level after a minor deviation below it.

- This move hints at the start of a recovery rally to the $0.906 and $1.050 levels.

- If Polygon flips the $0.729 barrier into a resistance level, it will invalidate the bullish thesis.

MATIC price swept a crucial support level on September 21 after the FOMC meeting, which caused sidelined buyers to step in. As a result, Polygon has recovered quickly above the said barrier and is currently looking to flip another hurdle.

MATIC price to climb higher

MATIC price deviated below the $0.758 to $1.050 range on September 18 and was hovering below it. As Bitcoin price took a nosedive on September 21, so did many altcoins, including Polygon.

As a result, the Layer 2 token swept the $0.722 support floor to collect the sell-stop liquidity. This move was followed by a spike in buying pressure coupled with Bitcoin price flipping bullish, leading to a 9% run-up.

Going forward, investors should pay close attention to MATIC price recovery above the range low at $0.758. A decisive flip of this level will indicate that the bulls are back and that the uptrend is about to begin.

In such a case, the uptrend will likely pause around the midpoint at $0.906, which is the first important level to book profits. However, clearing this hurdle could propel Polygon to the range high at $1.05, coinciding with a higher time frame resistance.

This MATIC price move would constitute a 40% rally in total, but investors can book profits at the midpoint.

MATIC/USDT 1-day chart

On the other hand, if MATIC price gets rejected at the range low at $0.758, it will indicate weak buyers and could ruin the setup. In such a case, if Polygon flips the $0.729 barrier into a resistance level, it will invalidate the bullish thesis and handover the control to bears.

This development could knock MATIC price down to the $0.647 support level, where buyers could regroup and give the recovery rally another go.

Note:

The video attached below talks about Bitcoin price and its potential outlook, which could influence MATIC price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.