Litecoin price to retest $200 before LTC resumes its uptrend

- Litecoin price is down over -10% since hitting $233.

- Retracement to the $200 level is likely to test as support.

- Failure to hold this support level could see a quick return to $180.

Litecoin price has significantly increased since the beginning of September, gaining as much as 35.4% from the September 1st, 2021 open. However, LTC price has topped out at $233 and now sees rising selling pressure.

If bulls cannot hold $200 as support, bears will likely gain control and push Litecoin price towards $180.

Litecoin price waits for a test at $200 to confirm support

Litecoin price is at an essential make-or-break level.

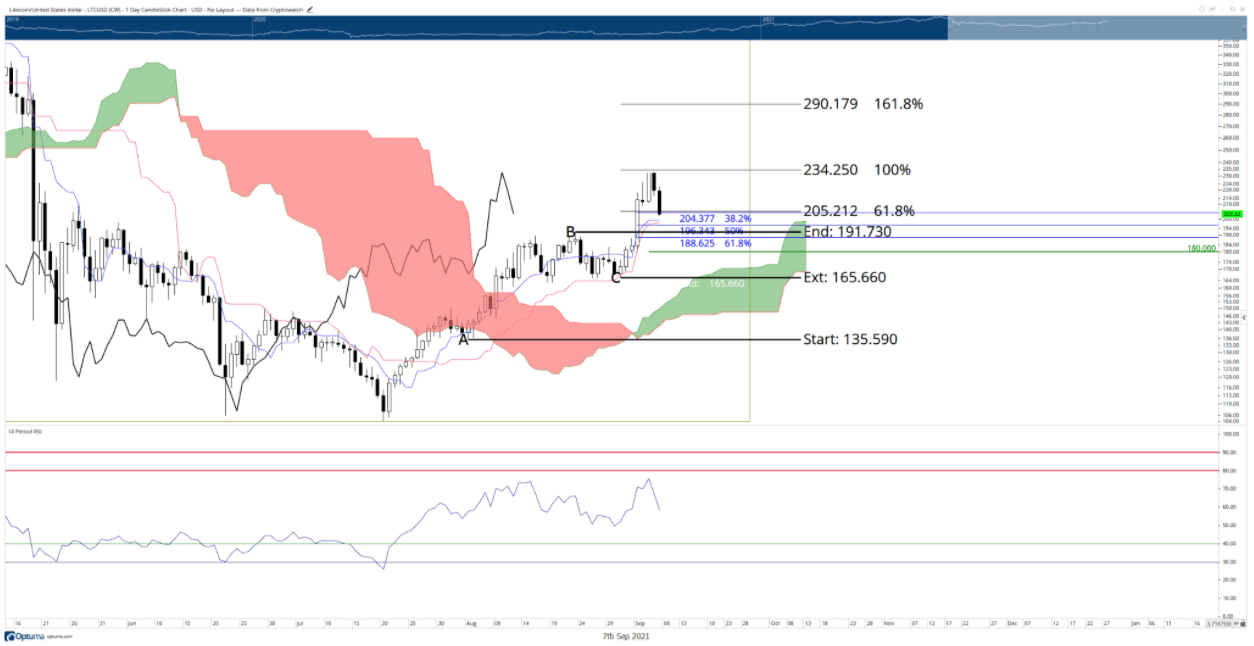

Over the past two daily trade sessions, Litecoin price has moved over -13.1% from $233 to today’s intraday low of $202.03. Strong support exists between the price ranges of $196.53 and $200: the daily Tenkan-Sen ($199.22) and Kijun-Sen ($197.96) both share a strong price confluence level with the 50% Fibonacci Retracement at $196.43.

If these support levels fail, then Litecoin price is likely to move to the next significant support at $180.

The $180 price level is the 2021 VPOC (Volume Point-Of-Control) in the 2021 Volume Profile. It represents the price level where the most amount of buying and selling has occurred.

A return to $180 would bring Litecoin back to a strong support zone and in a good position for bulls to confirm the VPOC as a primary support barrier before moving higher towards the 161.8% Fibonacci Expansion at $290.17.

LTC/USD 1-day chart

Bears will want to be cautious of the 61.8% Fibonacci Retracement at $188.62 as Litecoin price could find support and create a significant bear trap. Bears must also monitor the RSI levels.

If Litecoin price falls to $188.62 and the RSI makes a low at or below the August 30th, 2021 level of 49.45, hidden bullish divergence will be confirmed and likely trigger a strong upswing.

Bulls must watch the Chikou Span for any Litecoin price close at or below $165, as this may generate a flash crash towards $135.

Author

FXStreet Team

FXStreet