Litecoin Price Prediction: LTC eyes 20% rally as it bounces off crucial support level

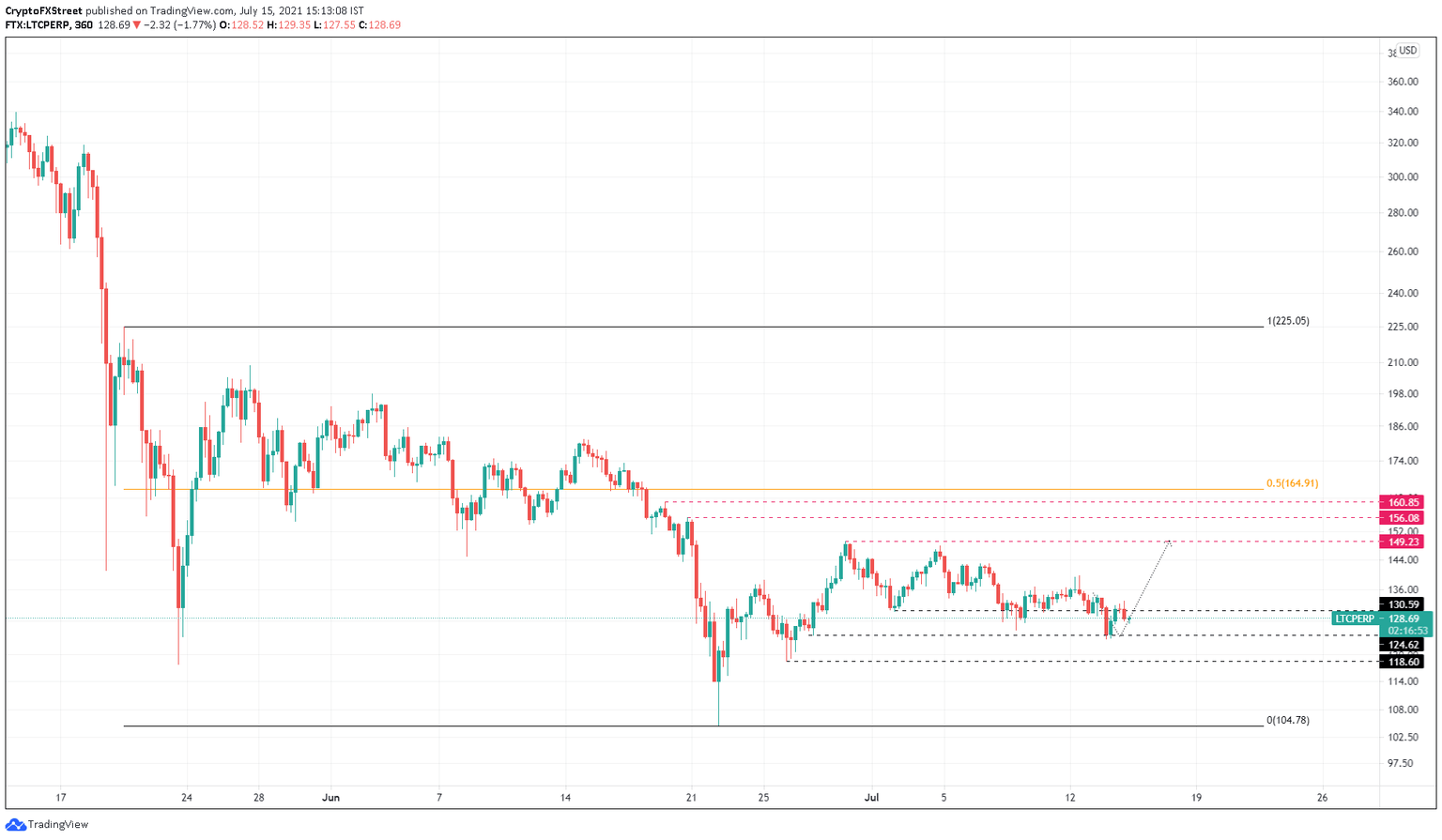

- Litecoin price is showing a bullish reaction as it tags the $124.62 support level.

- A further build-up of buying pressure is likely to propel LTC by 20% to $149.22.

- If the bears lead to a breakdown of the support floor at $118, the bullish thesis will face invalidation.

Litecoin price is currently indicating a reversal in price after a two-week consolidation phase. LTC is likely to retest the upper limit of this range in an attempt to shatter it.

Litecoin price ricochets off pivotal barrier

LTC price sliced through the $130.59 support level on July 14 but bounced off the immediate barrier at $124.62. This sudden surge in buying pressure leading to a minor upswing could be similar to the 20% impulsive move seen between June 27 and June 29.

Assuming this scenario plays out, investors can expect Litecoin price to rally 20% to tag $149.23. While this stubborn barrier has been prevented during three previous attempts, a decisive 6-hour candlestick close above it will signal strength among buyers.

Such a development might attract sidelined investors, extending the 20% leg-up by another 10% if LTC bulls manage to slice through $156.08 and $160.85.

LTC/USDT 6-hour chart

While it is optimistic to assume a bounce to push Litecoin price higher, investors should not disregard the possibility of a sudden downtrend. A potential spike in bearish momentum that pushes LTC below $124.62 will indicate a weakness among bidders.

If the sellers push Litecoin price below $118.60, not allowing the buyers to recuperate, it will invalidate the bullish thesis and, in some bearish cases, trigger an 11% sell-off to the range low at $104.78.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.