Litecoin Price Prediction: LTC needs to correct to stable grounds before 30% ascent

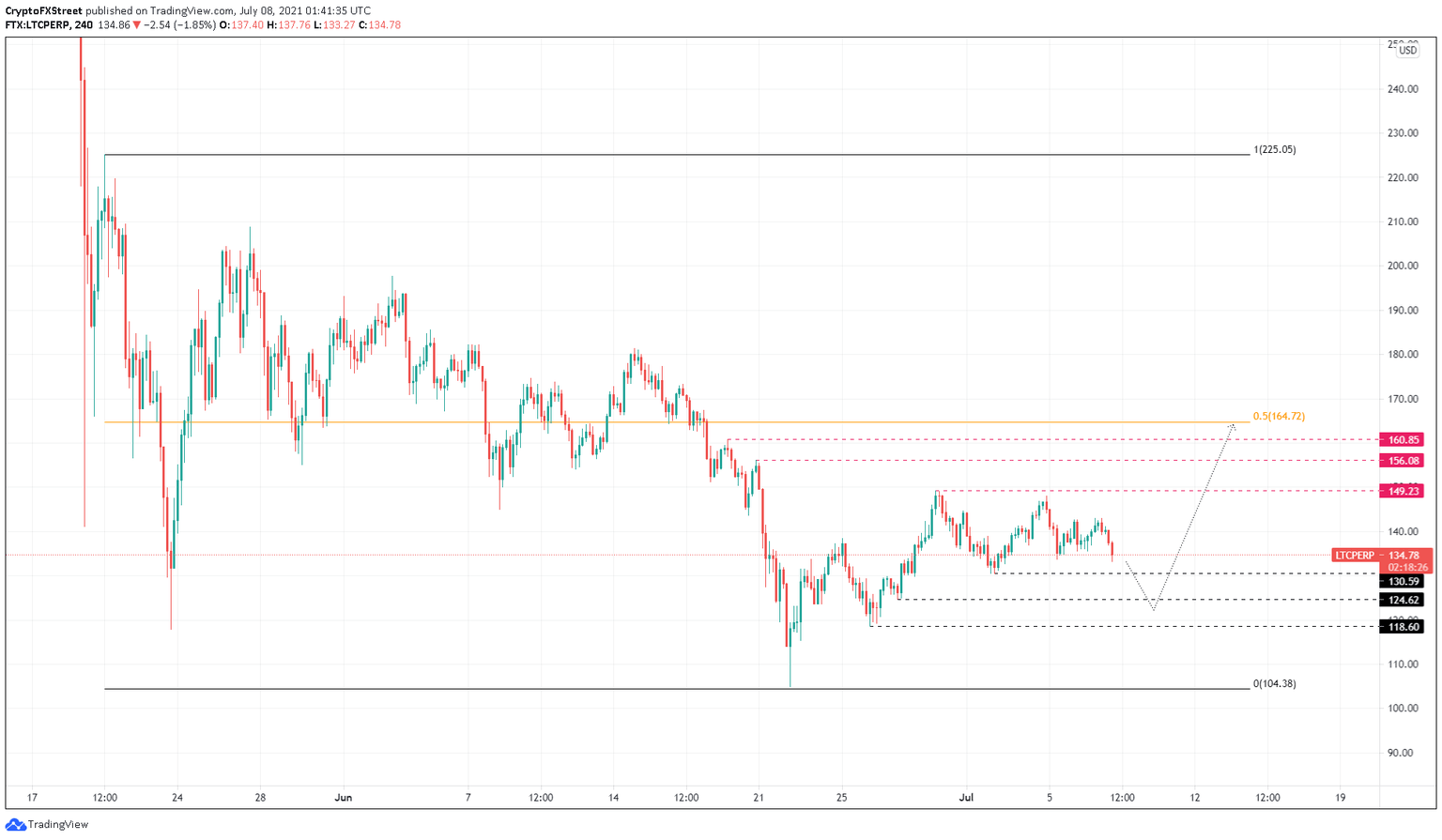

- Litecoin price is undergoing a pullback and might retest a crucial support barrier at $124.62.

- If the buyers make a comeback, investors can expect a full-blown rally to tag the range’s midpoint at $164.72.

- If LTC slices through $118.60 but fails to reclaim it, the bullish thesis will face invalidation.

Litecoin price is in a consolidation stage and does not show a clear directional bias. However, LTC is likely to continue its correction in the short term until it finds a stable support barrier.

Investors can expect a potential buying pressure at this point to propel LTC.

Litecoin price undecided on its destination

Litecoin price has been consolidating after setting up a local top at $149.02 on June 29. The ongoing correction is likely to create a lower high at $130.59. In some cases, the pullback will likely correct to $124.68, followed by $118.60.

Although uncertain, the buyers might make a comeback at $124.68 or $118.60.

Assuming the uptrend kick-starts at $124.68, the most likely upside target would be the range’s midpoint at $164.72, which constitutes a 30% ascent.

The reason for this optimism is Bitcoin and its market structure, which hints that a rally to the range high at $42,451 is around the corner. Hence, if BTC triggers such a climb, altcoins, including LTC, will follow suit and retest crucial levels.

However, for Litecoin price, the ascent might face a premature stop at $149.23, $156.08 or $160.85 resistance levels. Therefore, investors need to keep a close eye on these supply barriers.

LTC/USDT 4-hour chart

On the other hand, if Litecoin fails to hold above the support level at $118.60, it will indicate that the buying pressure was insufficient. While a sweep of this demand barrier is likely, a failure to produce a decisive 4-hour candlestick above it will invalidate the bullish thesis.

If this were to happen, LTC might slide 12% to retest the swing low at $104.80.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.