Litecoin price rises by 10% in a day, aiming potential profits worth $2 billion

- Litecoin price has gained nearly 10% in the last 24 hours to trade at $88.

- The altcoin is attempting to turn the 12.42 million bought between $82 and $94 into profits.

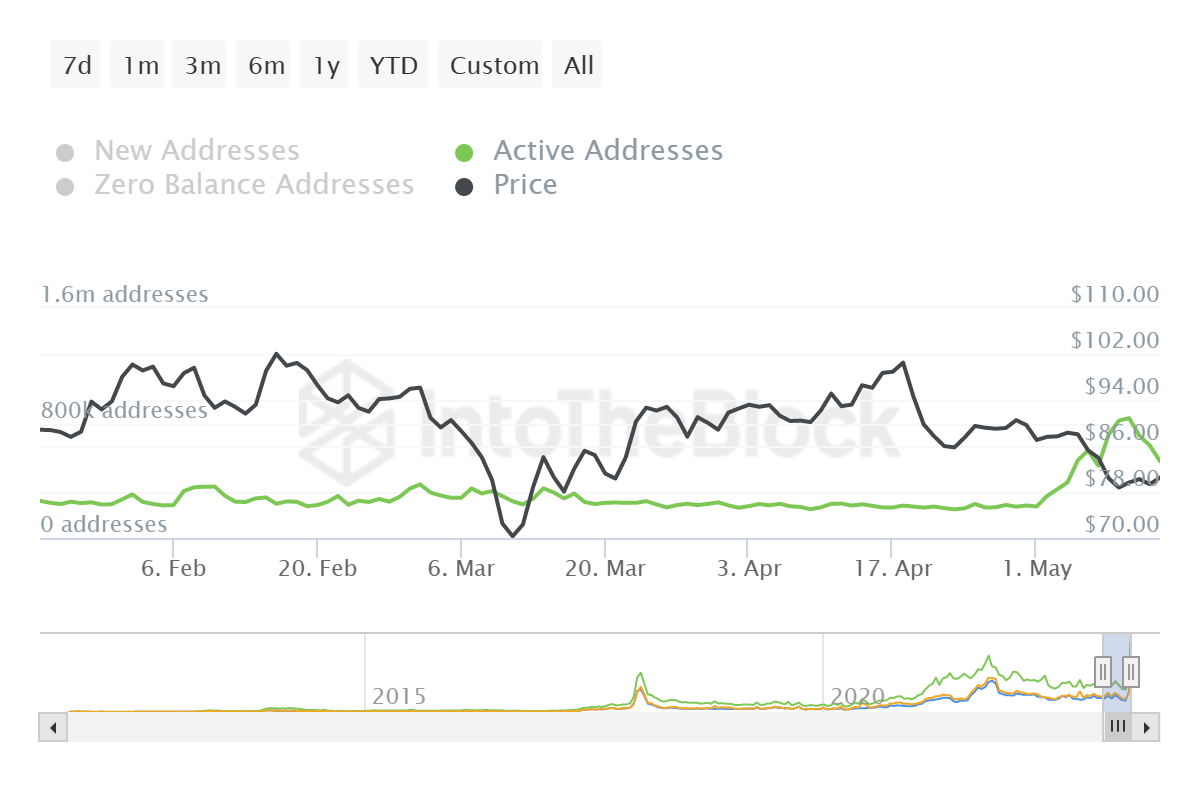

- The LTC20 token hype had active addresses touching the peak of 830,000, which have since reduced by 36% in four days.

Litecoin price is seeing some decent recovery despite the leader of the cryptocurrencies, Bitcoin, observing a slow rise over the few trading session. This recovery holds the potential to bring about significant profits to the network, however, broader market cues might act as a hurdle.

Litecoin price rise barrier

Litecoin price does not particularly face any bearish development at the moment, but until the broader market cues turn largely positive, recovery might be a while.

This is because the Gold to Litecoin's Silver, Bitcoin, is still struggling around the $27,300 mark. Until the leader cryptocurrency climbs back to $30,000, the rest of the altcoins will note some resistance in charting green candlesticks.

In such a case, it could result in almost 12.42 million LTC hanging in the uncertainty of profits. Following the 9.5% rally noted in the last 24 hours, Litecoin price can be seen exchanging hands at $88.

This increase led to the $1.88 billion demand wall being breached, which includes the 12.42 million LTC bought between $82 and $94.

Litecoin GIOM

For this supply to become profitable again, Litecoin price would need to note another 7.47% rally to $94, which may not sound like a tough job. However, the bullishness that has been pushing the price up is slowly disappearing.

LTC/USD 1-day chart

The recent launch of LTC20, an experimental non-fungible token (NFT) standard, created hype across the network, grabbing the investors' attention. Consequently, the addresses conducting transactions on the chain shot up significantly, peaking at 830,000. But in the last five days, these active addresses have come down by 36% to just 534,000.

Litecoin active addresses

As LTC holders' participation continues to decline, the bullish force driving the price uptrend will also diminish. This will lead to either slower recovery or sideways movement for the altcoin. Thus, the 1.23 million addresses holding 12.42 million LTC could fall and return to the state of facing unrealized losses.

On the other hand, breaching $94 could initiate a stronger bullish momentum. Until then, traders are advised to remain cautious in either making a long or short call.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.