Litecoin Price Forecast: Weak buyer momentum delivers LTC in the hands of bears

- Litecoin price is bearish amid waning halving-related hype and negative sentiment in the wider market.

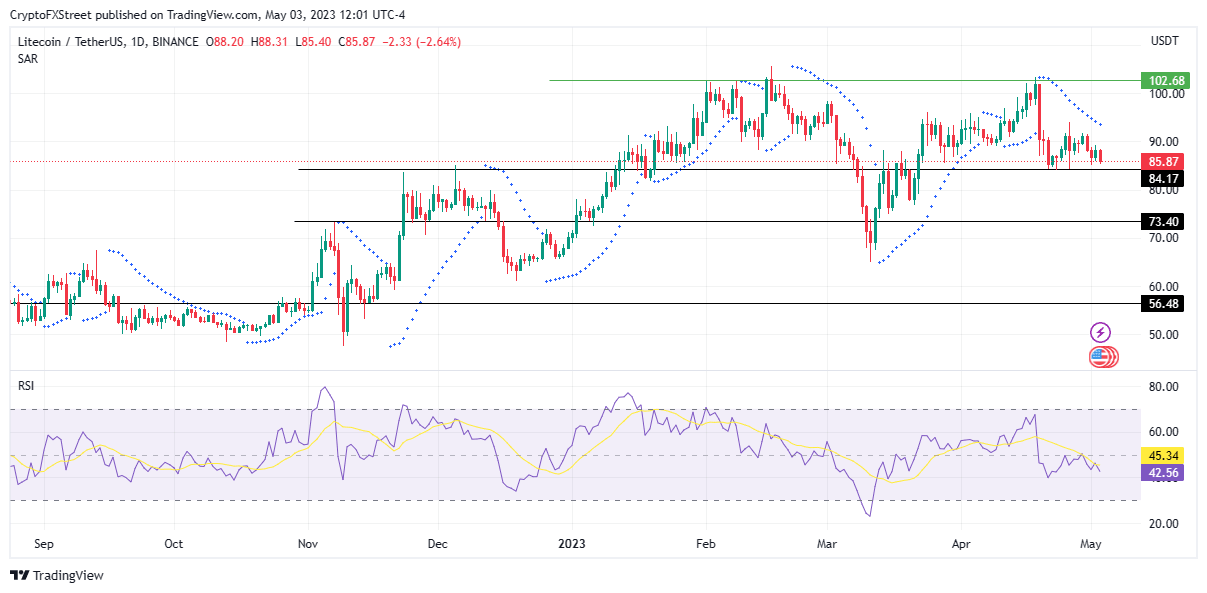

- LTC could shed 15% to $73.40 if the bulls fail to defend the $84.17 support level.

- The bearish thesis will be invalidated upon a decisive daily candlestick close above $102.68.

Litecoin (LTC) price indicates a bearish dominance, an outcome majorly attributed to weak buying pressure from investors and a general bearish sentiment across the wider cryptocurrency market. The Litecoin ecosystem has witnessed significant developments since the year started. As of press time, there are less than 100 days to the third halving that would reduce the block rewards. This could typically boost the LTC price.

Further, BIT Mining Limited also revealed a new mining infrastructure dedicated to Litecoin. This, coupled with the halving, could serve LTC miners very well. Nevertheless, the Litecoin price has been plunging, with miners selling many coins.

Litecoin price suffers growing negative pressure

Litecoin price is on a southbound move, but the support at $84.17 appears to be standing strong, having stood for two consecutive weeks. Breakout efforts by the bulls proved premature, requiring more momentum to sustain. As a result, the bears have taken over and the odds are in their favor based on the general outlook.

If seller momentum continues, the price could break below the critical support at $84.17. Below this level, the cliff could see LTC lose 15% to tag the $73.40 support level.

The Relative Strength Index (RSI) position at 43 below the mean line supports the bearish outlook. The southbound move of this trend-following indicator hinted at a continued downtrend. Further, the Parabolic SAR indicator was still negative after flipping bearish and moving above the price since April 19. This also favors the downside.

Notably, the Parabolic SAR is the dotted lines on the one-day chart below for the LTC/USDT trading pair. Whenever it appears below the current price of the asset, it is interpreted as a bullish signal. Conversely, if it is positioned above the asset’s current price, it is deemed to be a bearish signal.

LTC/USDT 1-Day Chart

Conversely, if sidelined investors choose to buy LTC at current low market value, Litecoin price could reverse. In such a case, the northbound move could see the decentralized peer-to-peer (P2P) token flip above the Parabolic SAR and target the area above the psychological $100.00.

In such a case, Litecoin price could tag the $102.68 resistance level, denoting a 20% upswing.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.