Litecoin price is on its way to booking a 25% profit this week as bears retreat

- Litecoin price already gained 8% this week.

- LTC has bulls set to tear down the $90 psychological level.

- Once bulls can see their way through $92, a pop above $100 is in the cards.

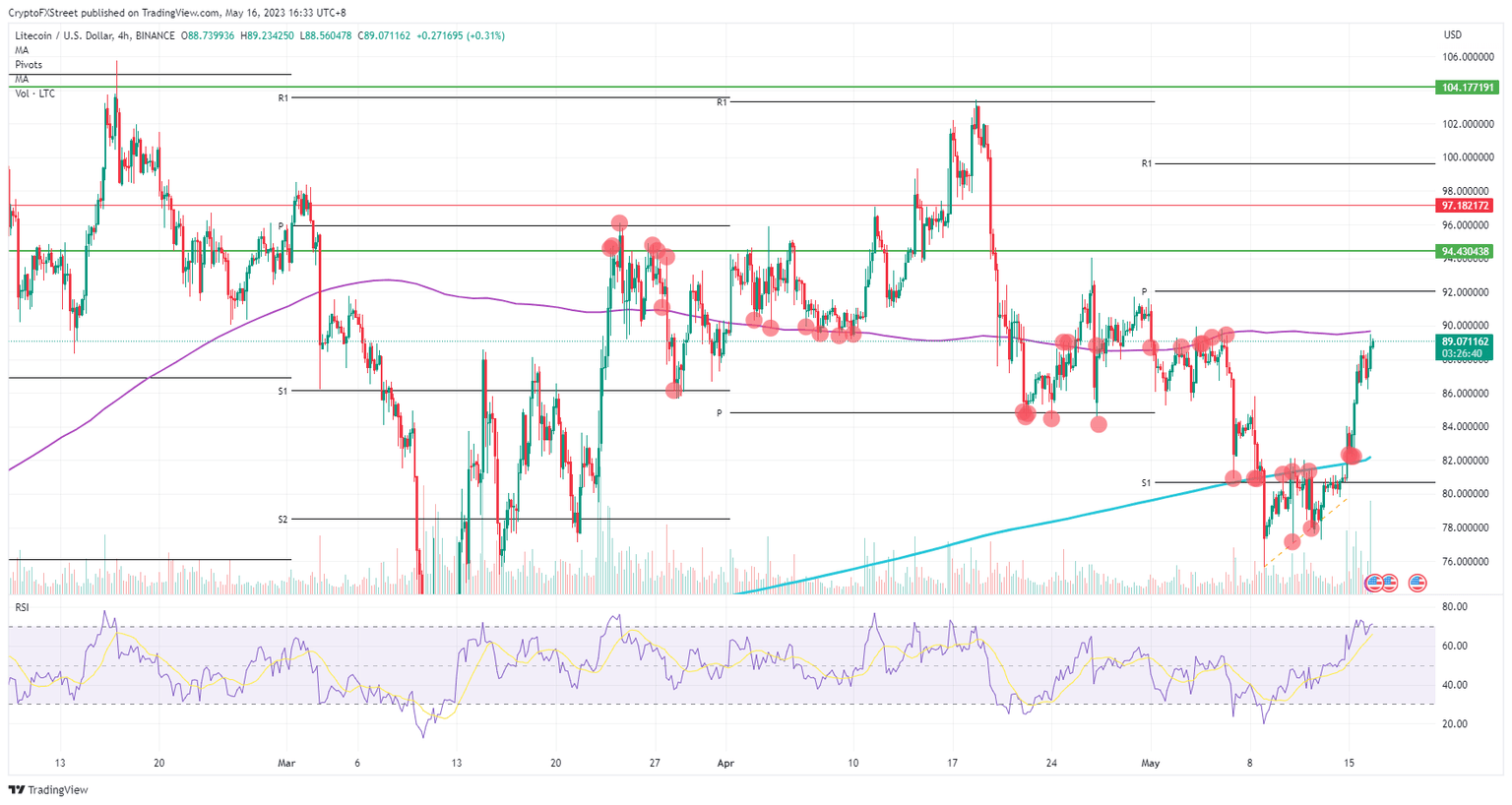

Litecoin (LTC) price is set to make a stellar move this week as bulls have been jumping into the price action since Monday. With heavy buying underway, bulls have already reached the first significant cap at $90 with the big psychological figure and the 55-day Simple Moving Average (SMA) at hand. When bulls can make their way through here, not much is in the way for it to extend all the way up to $104.

Litecoin price is about to hit a home run this week

Litecoin Price is seeing an enjoyable ball game unfold between bears and bulls, and the bulls are winning every inning so far. Several home runs were seen on Monday with LTC quickly reaching $90 and bound to break higher despite an overbought Relative Strength Index (RSI). Once that level is breached and the 55-day SMA turns into bullish support, more upside is in the cards for this week.

LTC has some minor elements to keep an eye on, however, with $94.43 and $97.18 as small pivot levels. The only high resistance level to be aware of is the monthly R1, just below $100. Look for the R1 being breached as confirmation. LTC price action should then head back to find support at that same R1 level and next head higher with the top level at $104. This trade would return a 25% profit for investors.

LTC/USD 4H-chart

Looking a little back backward on the chart, traders will have spotted that at the beginning of May the 55-day SMA was nearly impossible to close above. It made sense since the RSI was overbought as well, limiting any upside potential. Price action could start to fade and head back to $82 in a cooldown move with the RSI swing toward being oversold before heading higher again.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.