Litecoin Price Forecast: LTC aims for a 15% upswing as bulls hold the upper hand

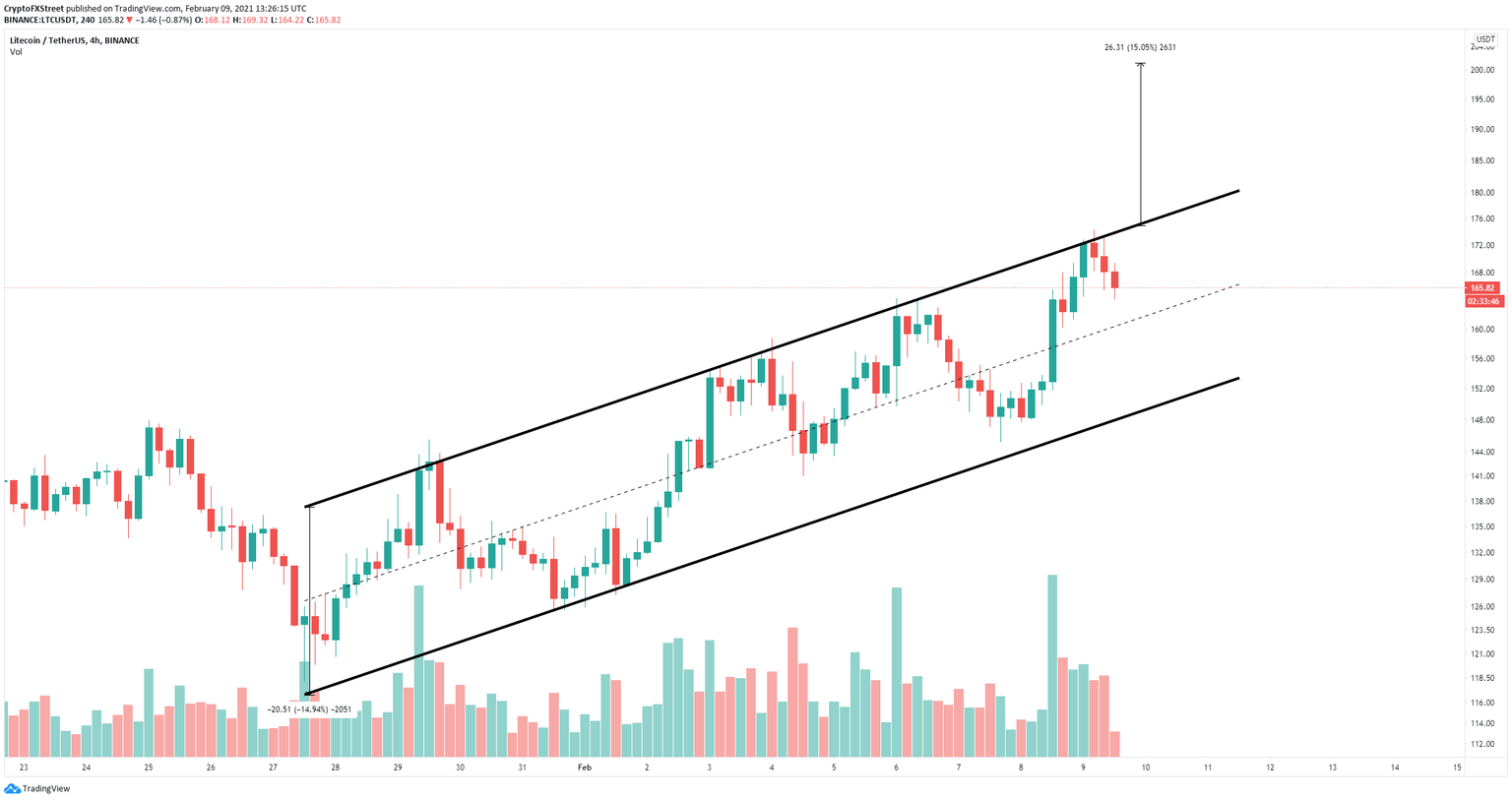

- Litecoin price is contained inside an ascending parallel channel on the 4-hour chart.

- The digital asset faces only one barrier ahead which could propel its price to $200.

- A notable number of whales have exited Litecoin, adding some selling pressure.

Litecoin has been trading in a steady and robust uptrend since the beginning of 2021. It is now facing one crucial resistance level at $175 before its final breakout towards the psychological level at $200.

Litecoin price can quickly jump to $200

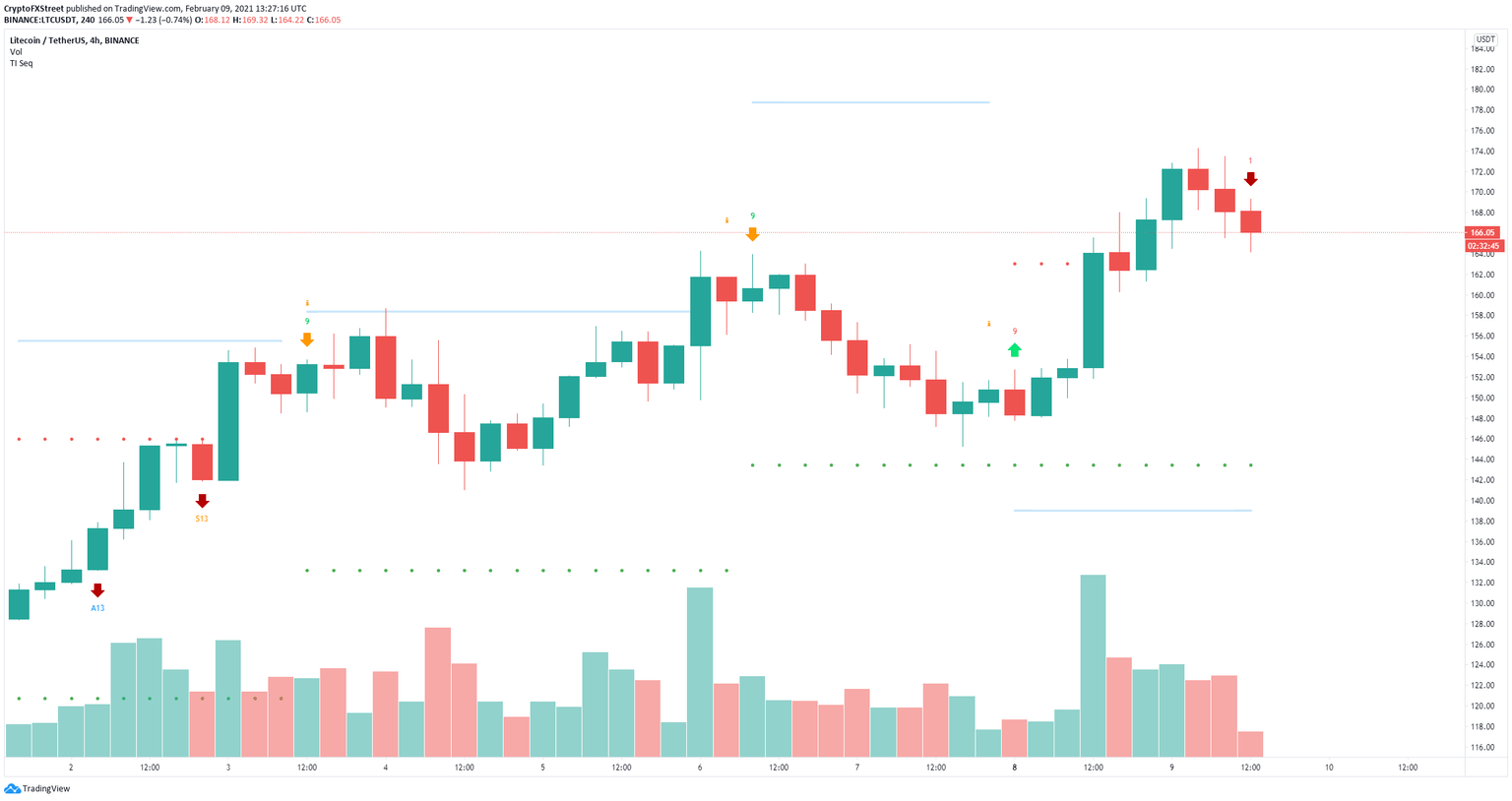

On the 4-hour chart, Litecoin is contained inside an ascending parallel channel. There is a strong support level below the current price at $162 from which LTC is looking for a rebound.

LTC/USD 4-hour chart

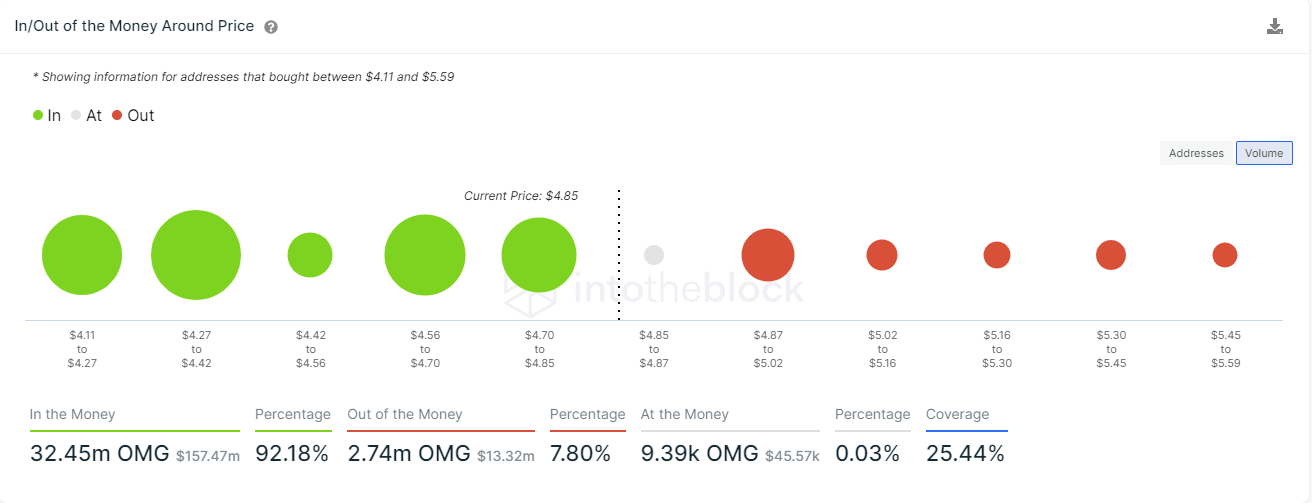

The In/Out of the Money Around Price (IOMAP) chart shows practically no resistance levels ahead. The most significant barrier is located between $171 and $176 which coincides with the upper resistance trendline of the parallel channel.

LTC IOMAP chart

A breakout above this point can easily drive Litecoin price towards $200 as the resistance ahead is weak. Additionally, the IOMAP model shows a lot of support below $160.

LTC Holders Distribution

However, the number of whales holding between 100,000 and 1,000,000 LTC coins ($16,600,000 and $166,000,000) has declined considerably in the past week by six, which indicates large investors have been taking profits expecting a correction.

LTC/USD 4-hour chart

On the 4-hour chart, the TD Sequential indicator has presented a sell signal which has been accurate in the past. Litecoin price could fall towards the middle trendline of the parallel channel at $160 and as low as $152 to retest the lower boundary.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B15.57.50%2C%252009%2520Feb%2C%25202021%5D-637484794768523645.png&w=1536&q=95)