Is Altcoin season here?

- On-chain data shows the Altcoin Season Index has more room for growth.

- Upcoming US Presidential elections could fuel a parabolic move for altcoins.

- A crypto analyst projects the similarity of the 2017 and 2021 alt seasons with the ongoing cycle.

Altcoin season is when cryptocurrencies other than Bitcoin see substantial price increases. On-chain data indicate that the Altcoin Season Index has further potential for growth. With the upcoming US Presidential elections and insights from crypto analyst Moustache, the current cycle could echo the altcoin seasons of 2017 and 2021, possibly leading to a parabolic move for altcoins.

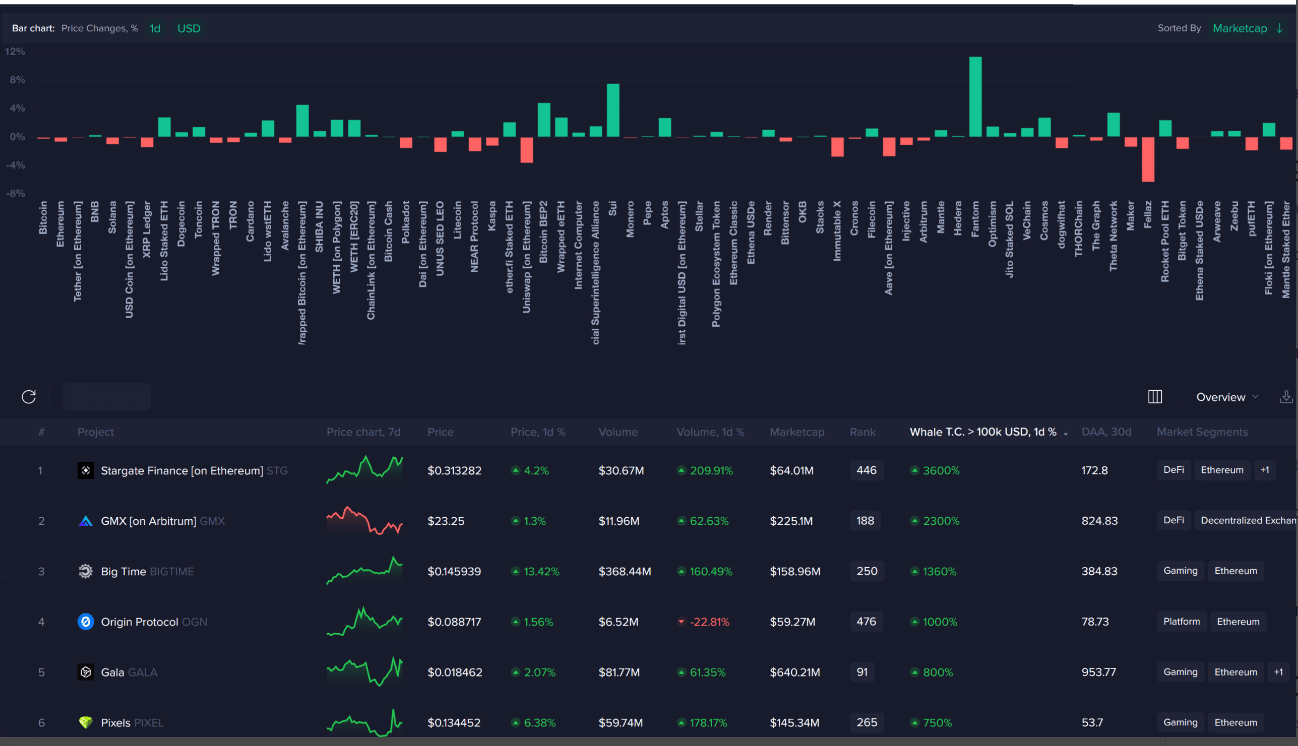

Furthermore, Santiment data shows that the price of Bitcoin and most altcoins rose following Wednesday's 50 basis point rate cut by the US Federal Reserve (Fed).

On-chain metrics show too early for Altseason

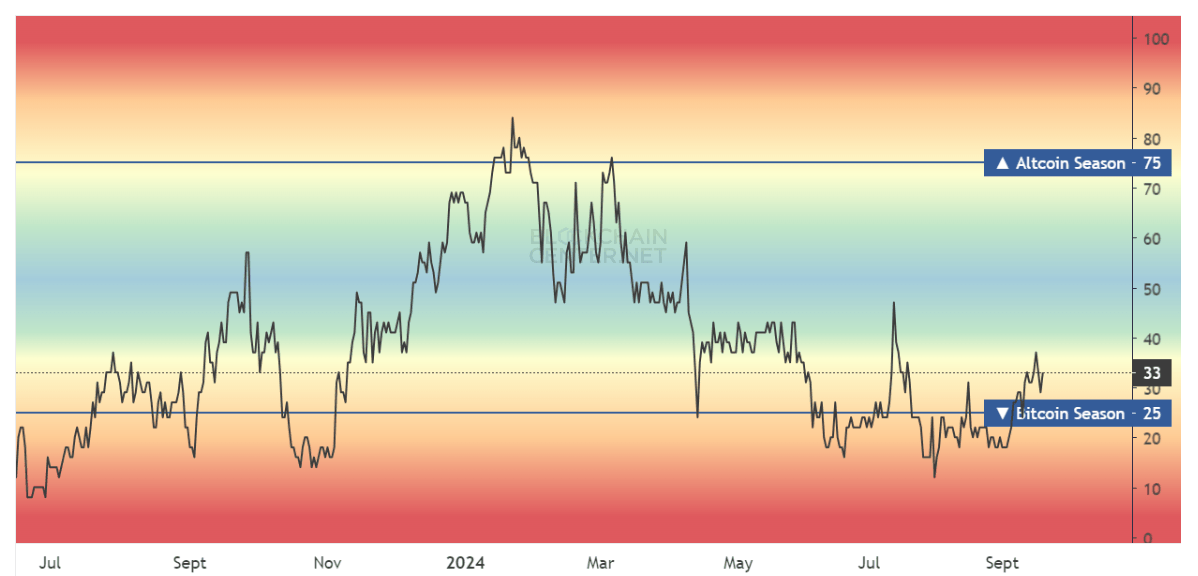

Blockchaincenter.net’s Altcoin Season index chart shows whether it is Altcoin season or Bitcoin season. If the index is below 25, it suggests that Bitcoin performs well compared to altcoins (money flows into Bitcoin from altcoins). However, if the index is above 75, it suggests that altcoins perform better than Bitcoin (money flows into altcoins from Bitcoin).

The index stands at 33, indicating that altcoins have more room for growth. Investors still prefer to invest their money in Bitcoin or hold it rather than transferring it to altcoins.

Altcoin Season index chart

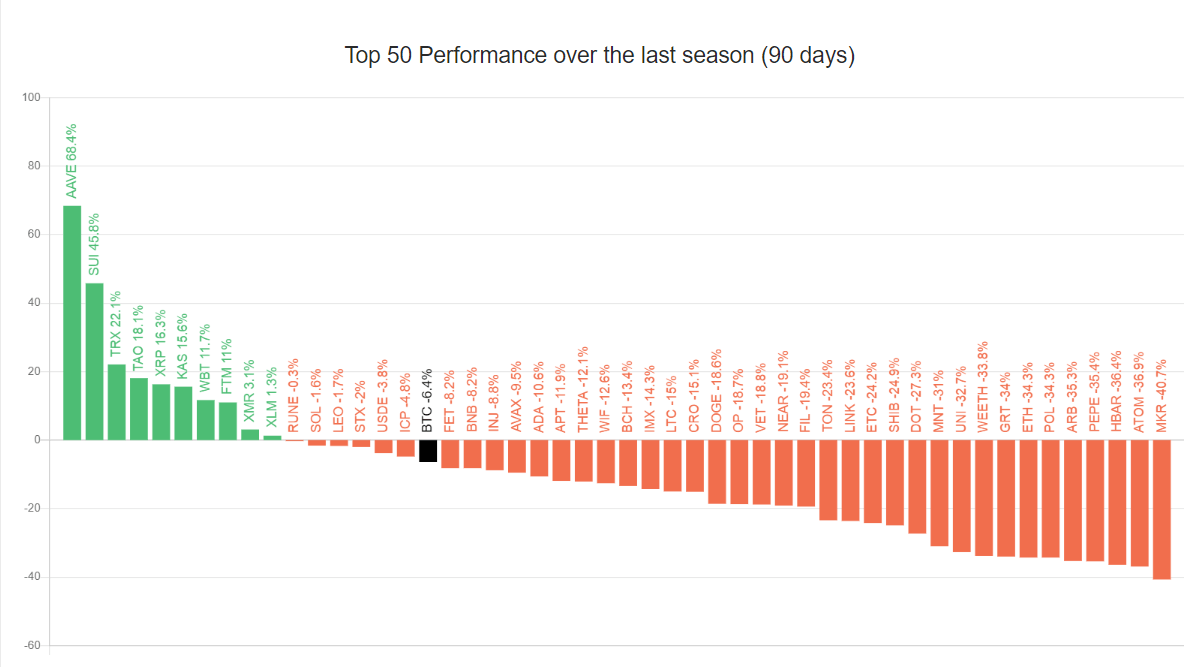

The Top 50 performance analysis over the last 90 days shows that a few altcoins like AAVE, SUI, and TRX have risen above 20%. However, most other top altcoins are still under the woods. This shows more room for growth, and the altcoin season is yet to come.

Top 50 Performance chart

Upcoming US elections

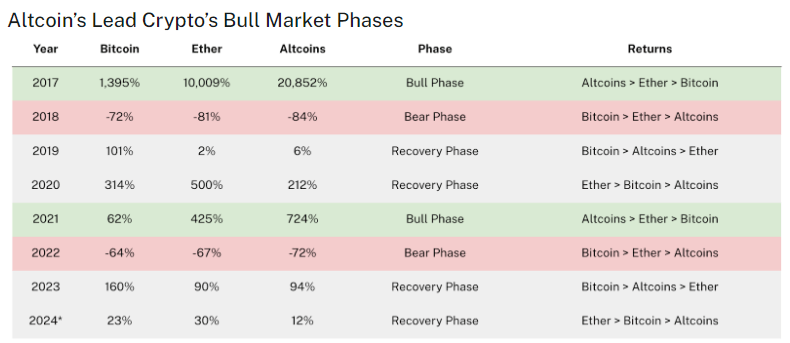

Crypto assets generally follow a four-year cycle:

- A bull phase around a year.

- A significant bear market lasts for a year.

- A two-year recovery phase.

The chart below shows that the 2022 bear phase followed the 2021 bull phase.

Crypto cycles chart

The recovery phase of the crypto market cycle started in 2023 and could last till 2024, which often coincides with “altseason,” where altcoins (everything except Bitcoin) experience significant surges in price.

This year, the timing aligns with Bitcoin’s fourth halving in April and the US Federal Reserve interest rate cut of 50 basis points (bps) in September, which is generally positive for risky assets like cryptocurrencies.

Moreover, the upcoming US Presidential elections will be held in November. Unlike the previous elections, the candidates in this election are not side-viewing cryptocurrency. They are discussing cryptocurrencies in their campaigns and possibly fueling a parabolic move in the crypto market.

Technical Analysis of Altcoin

Moustache, a crypto analyst, posted on Twitter, “We’re all not bullish enough. Cycles repeat themselves.”

Historically, the 2017 altcoin chart shows two curves before the parabolic move to the upside, and currently, the altcoin chart projects a similar move, which could lead to a sharp rise in 2025.

#Altcoins

— ⓗ (@el_crypto_prof) September 17, 2024

We're all not bullish enough.

Cycles repeat themselves.

2017-2021-2024/2025. pic.twitter.com/puQzHFYxrt

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.