Litecoin price could hit $100 on LTC halving in six weeks

- Litecoin’s block rewards will slash from 12.5 LTC to 6.25 LTC after the third halving event.

- But Litecoin price continues to hover under $80, at the mercy of Bitcoin’s volatility.

- A recovery above the $85.45 hurdle could induce a rally that shoots past the $100 psychological level and tags $105.79.

Litecoin will undergo the third halving event on August 2, 2023, which will reduce the block rewards from 12.5 to 6.25 LTC. But all the prophecies and forecasts about LTC price have failed to manifest due to Bitcoin’s volatility and uncertain moves from the United States’ regulatory bodies.

Read more: Litecoin price gears for a rally as LTC market cap hits $6 billion

Litecoin’s third halving event

As mentioned above, Litecoin’s halving event is an upgrade to the blockchain that occurs once every four years or after 840,000 blocks have been minted. This event will reduce the miners’ block rewards in half.

So far, Litecoin has undergone two halving events in 2015 and 2019, with the third one set to take place around August 2, 2023, or after 24,646 blocks.

Litecoin Halving Countdown

Why is halving important?

When the asset’s rewards are slashed in half, it has two effects - making the asset scarcer, and if the demand remains the same or increases, it will cause the underlying asset’s price to shoot up violently.

In a nutshell, it is a way of inducing a negative supply shock.

The typical behavior from crypto traders is to front-run the event in anticipation of a rally. If enough investors come to a similar conclusion, the network effects catalyze a pre-halving bull run. The same effect is seen in Bitcoin and Litecoin prices weeks or months before the halving period.

Many investors expected something similar for Litecoin ahead of the third halving event, but bulls were a no-show. With roughly six weeks before the next halving, investors need to pay close attention to Litecoin price action, which hints at an upcoming rally.

Read more: Failed Litecoin halving prophecy

Is Litecoin price ready to explode?

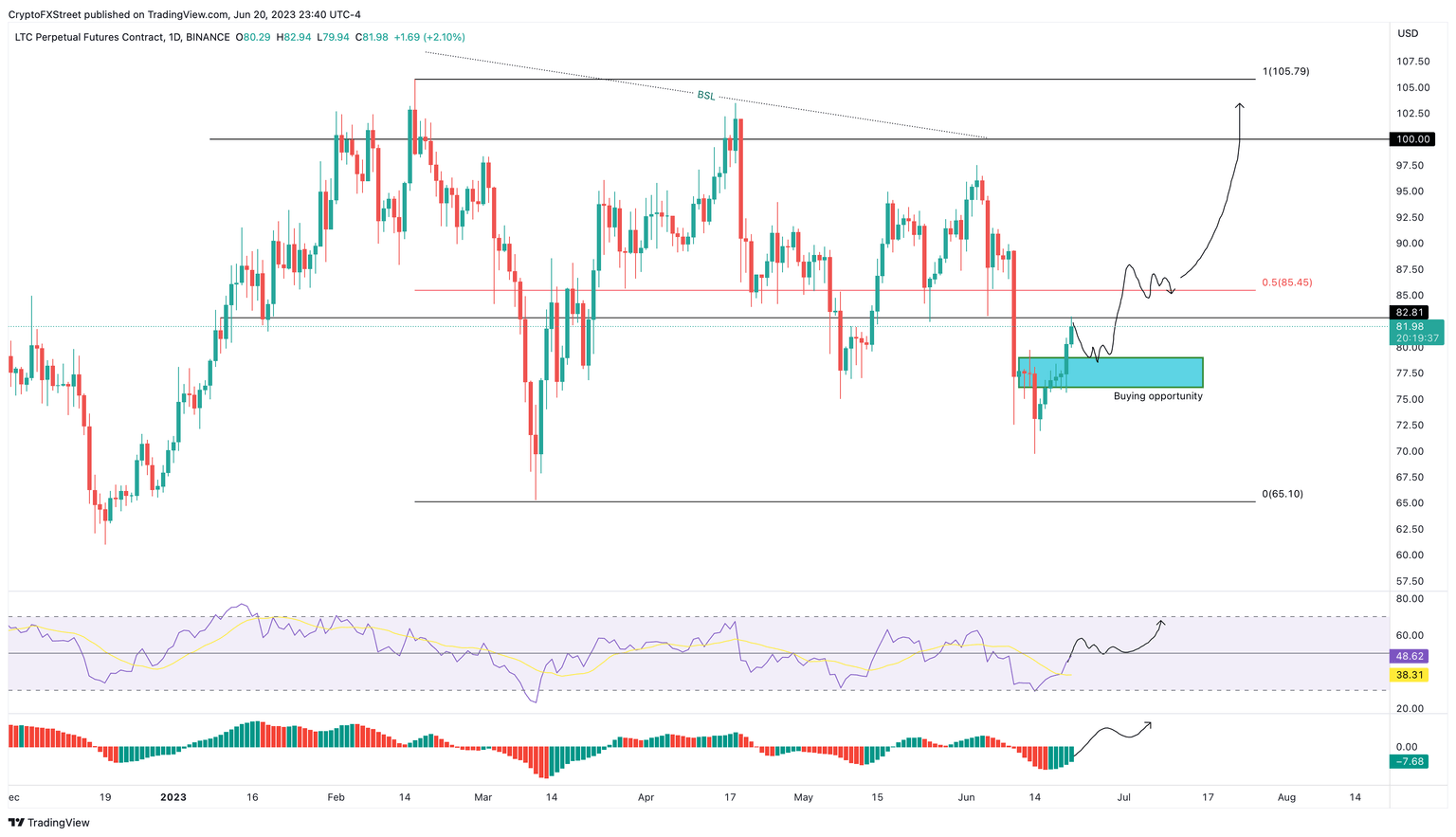

Litecoin price, on the daily chart, is currently retesting the $82.81 hurdle after a 12% rally in the last five days. While traders might be feeling FOMO, they should not pull the trigger now. Market participants can expect a minor recovery into the $78.97 to $76.15 support zone.

A bounce from this area followed by a successful recovery above the $82.81 and $85.45 resistance levels is key for LTC bulls to trigger a recovery rally.

Doing so could propel Litecoin price to tag the $100 psychological level and retest the range high at $105.79.

Monitoring the Relative Strength Index (RSI) and Awesome Oscillator (AO) for a recovery above their mean levels signals a buying opportunity.

LTC/USDT 1-day chart

While the bullish outlook is highly risky, investors need to wait for rejection at the $82.81 or $85.45 hurdles. A breakdown of $76.15 on the daily timeframe will invalidate the bullish thesis for LTC and potentially trigger a steep correction to retest the range low at $65.10.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.