AI crypto coins rally ahead of ChatGPT creator OpenAI plans to announce Google search competitor on Monday

- ChatGPT creator OpenAI will reveal Google search competitor on Monday.

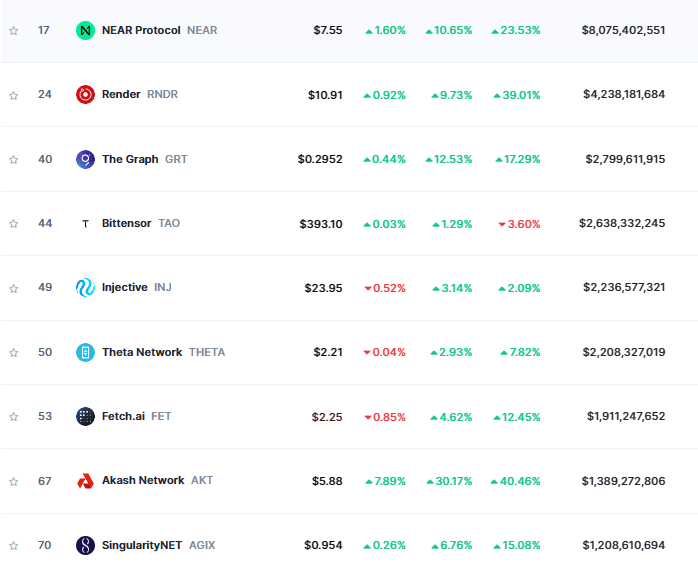

- NEAR, RNDR, GRT, AKT, and WLD tokens are rallying; the sector’s market capitalization rose nearly 8% to $38.9 billion.

- Continued tailwinds from an NVIDIA report also continue to drive crypto AI tokens, with some posting double-digit gains.

Barely before the hype around NVIDIA stock gain is over, AI crypto tokens have another bullish catalyst coming their way, which could provide more tailwinds to drive the price of the sector’s tokens.

Also Read: Crypto AI tokens post near double-digit gains amidst launches from NVIDIA, OpenAI and Amazon

OpenAI to reveal Google search competitor

OpenAI, the company behind ChatGPT is set to announce a new market competitor against Google on Monday, May 13, Reuters reports, citing sources close the matter.

— Andrew Curran (@AndrewCurran_) May 9, 2024

Based on the report, the new search engine tool will be an artificial intelligence-powered search product, which will raise the stakes in market rivalry with Google. Notably, the date of the announcement is not fixed.

Bloomberg has reported that the new search engine tool being an extension of ChatGPT, adding that it will make it possible for ChatGPT to pull in direct information from the Web and include citations.

OpenAI forays into this space backed by Microsoft, to become an industry peer for Alphabet’s Google and the well-funded AI search startup, Perplexity.

On May 14, Google's annual I/O conference is set to commence, with the search king expected to debut several AI-related products.

AI crypto coins could continue to rally ahead of eventful week

Amid hype about bullish news and key innovations in the AI sector, Near Protocol (NEAR), Render (RNDR), The Graph (GRT), The Akash Network (AKT), and Worldcoin (WLD), among other AI crypto coins, are rallying, with some posting double-digit gains.

AI crypto coins

The sector’s market capitalization is already up by nearly 8% to $38.97 billion, outperforming the meme coin sector, which is up 5% to $52.51 billion.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.