- Charlie Lee confirmed the negotiations saying, “We are exploring it.”

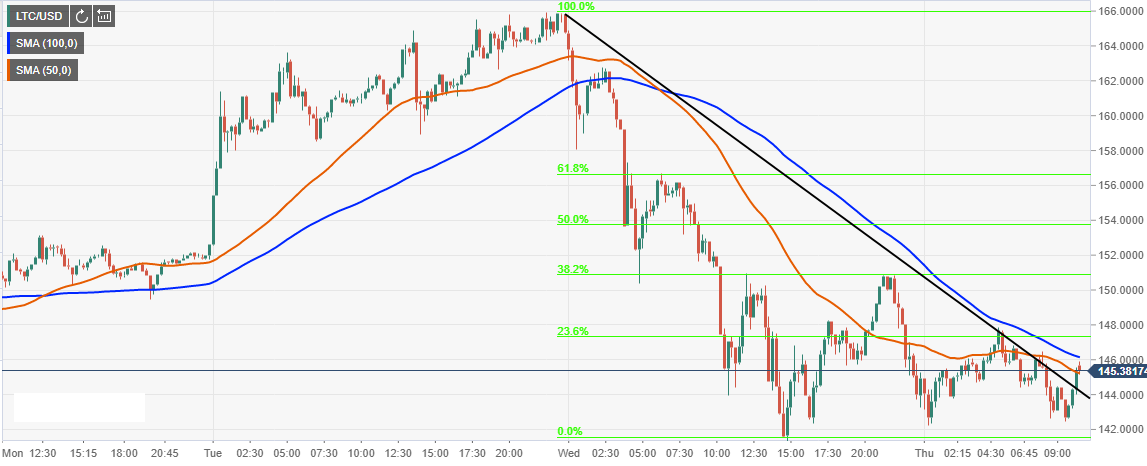

- Litecoin price facing resistance at the 100 SMA, on the downside $142 will support the price.

Like many other coins and altcoins in the crypto market, Litecoin price is correcting lower with over 5% decline in the last 24 hours. Litecoin price explored new levels in April reaching highs of $165 before the sellers set in to force lower consolidations. LTC/USD even traded below the support level at $142 during the trading session on Wednesday. The price bounced back and now is comfortably trading above the support on 15’ intraday chart.

Litecoin CEO, Charlie Lee and the CEO of TokenPay, Derek Capo, recently had a discussion on Twitter that hinted that the two firms would be exploring the idea of acquiring a banking solution. They are looking into a bank in Germany that will enable government education as well as work with regulators, digital asset debit cards among others. Through a message to a crypto news website, Finance Magnets, Litecoin’s CEO confirmed that negotiations were underway, he said “we’re exploring it,” but the matter remains behind closed doors.

A message from (Derek Capo) the discussion on Twitter between the two CEOs goes:

“They [sic] key to making this all work is ecosystems, partnerships and constant communication with regulators,” Capo continued “Buying a bank in Germany gets us a seat at regulator table, key to educating governments. As for $LTC we can add to our bank, debit card, gift cards etc.”

Litecoin price technical analysis

Litecoin price has broken above the key bullish trend line on the chart, while the moving averages gap is narrowing to show that the bulls are holding ground. The 100 SMA is offering immediate resistance at $146 while the 23.6% Fib retracement level with the last swing high of $165 and a low of $147.7 will prevent upside gains approximately at $150 level. The immediate support for LTC/USD is at $142 while $140 is the next support.

LTC/USD 15’ chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Coinbase lists WIF perpetual futures contract as it unveils plans for Aevo, Ethena, and Etherfi

Dogwifhat perpetual futures began trading on Coinbase International Exchange and Coinbase Advanced on Thursday. However, the futures contract failed to trigger a rally for the popular meme coin.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Ethereum cancels rally expectations as Consensys sues SEC over ETH security status

Ethereum (ETH) appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the Securities & Exchange Commission (SEC) and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US Federal Bureau of Investigations (FBI) has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission (SEC) is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?