Lido Dao price favors a 30% uptick, with LDO to print $3 on the quote board

- Lido Dao sees bulls pushing price action higher.

- LDO is breaking a crucial, pivotal level that will unlock more gains in the coming days.

- Expect to see a razor-blade sharp rally towards $3.

Lido Dao (LDO) price is enjoying a domino effect in tailwinds that originated after the tech earnings from Alphabet on Tuesday, after the closing bell. With advertising revenue still growing, markets are starting to second-guess their fears of a possible recession. The equity tailwind has spun over into the major cryptocurrencies, with Bitcoin surpassing $30,000 and dragging along altcoins with it.

Lido Dao price to break key pivotal level

Lido Dao price is surging higher as a positive equity tailwind is playing into cryptocurrencies and alt currencies as well. The tailwind emerged late on Tuesday night after the closing bell as Alphabet earnings revealed that companies are not cutting back on their advertisement spending. When a recession is nearby, companies start cutting costs, with advertisement spending often being the first and biggest on the chopping block.

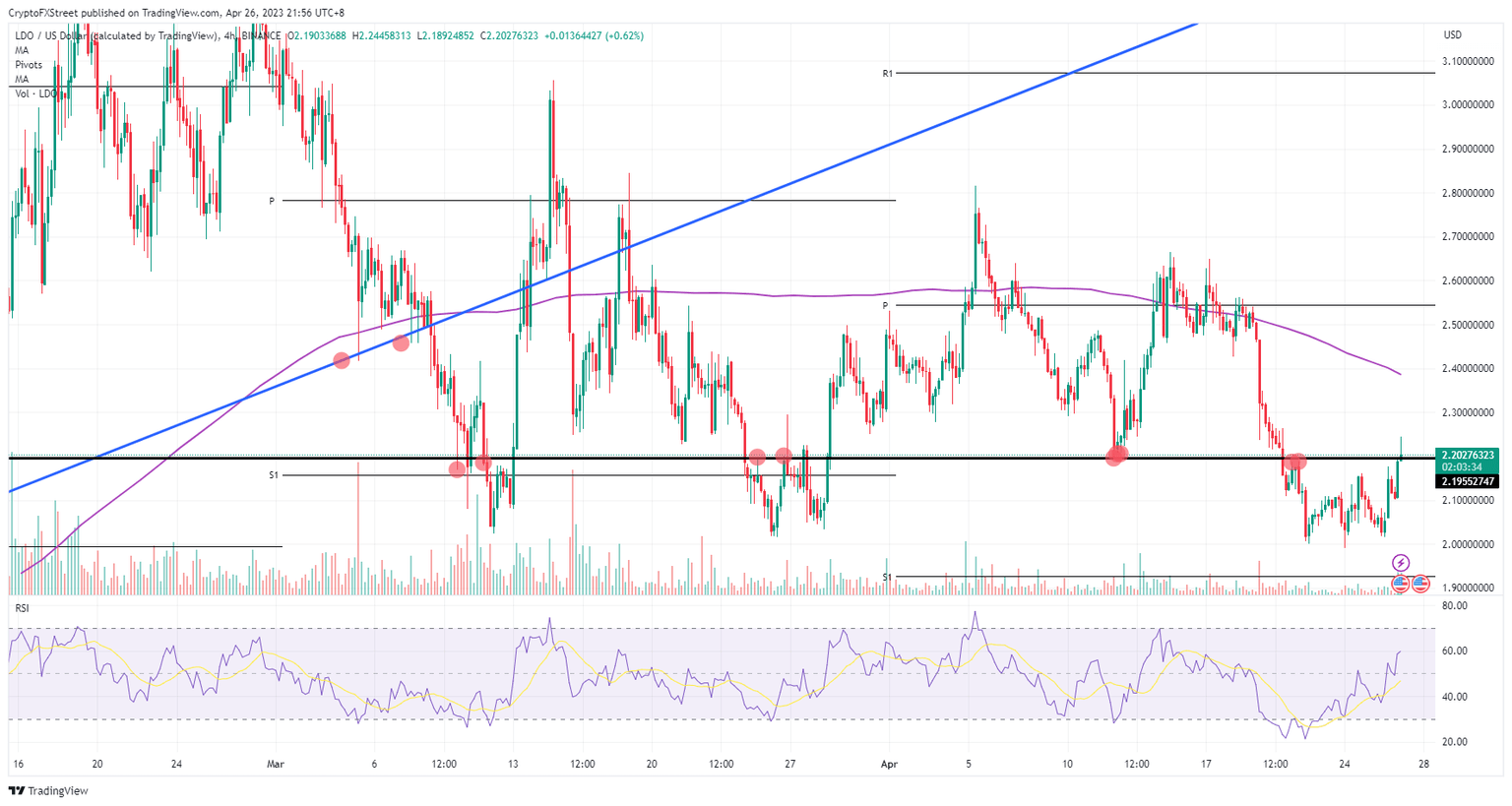

LDO has been breaking above $2.20 almost simultaneously as Bitcoin price was breaking above $30,000. Expect to see continuation into next week with $2.40 as the first and only hurdle nearby at the 55-day SMA. Once that is out of the way, expect a clear-cut one-way rally towards $3.00, printing a new high for April and possibly March.

LDO/USD 4H-chart

A bigger risk to the downside would be if bulls are unable to hold the $2.20 pivotal level and retreat below it. That would point to too much profit-taking and would weaken the rally substantially. Expect to see a drop lower, with a test at $2.00 and a possible break towards $1.92 at the monthly S1, to then find some support after selling off 12%.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.