ApeCoin, AAVE and Lido Dao witness surge in whale activity, here’s what this means for price

- ApeCoin, AAVE and Lido Dao have noted a flurry of big whale transactions over the past ninety days.

- Analysts combed through the transactions to identify altcoins with whale accumulation and declining exchange balances.

- AAVE and Lido Dao’s LDO prices have bullish potential based on large wallet investor activity and declining exchange reserves.

Large wallet investors increased their activity in altcoins over the past ninety days. During this time, the “alt season” narrative that stands for capital rotation from Bitcoin to altcoins gained relevance and large wallet investors continued their accumulation of several alternative cryptocurrencies.

Also read: Ethereum Shapella upgrade is successful, debate ensues on whether ETH is a security

ApeCoin, AAVE and Lido Dao note spike in whale activity

Analysts at crypto intelligence tracker Santiment noted a spike in activity of large wallet investors, in several altcoin projects. Monitoring top transactions in altcoins, experts noted a flurry of whale activity over the past three months.

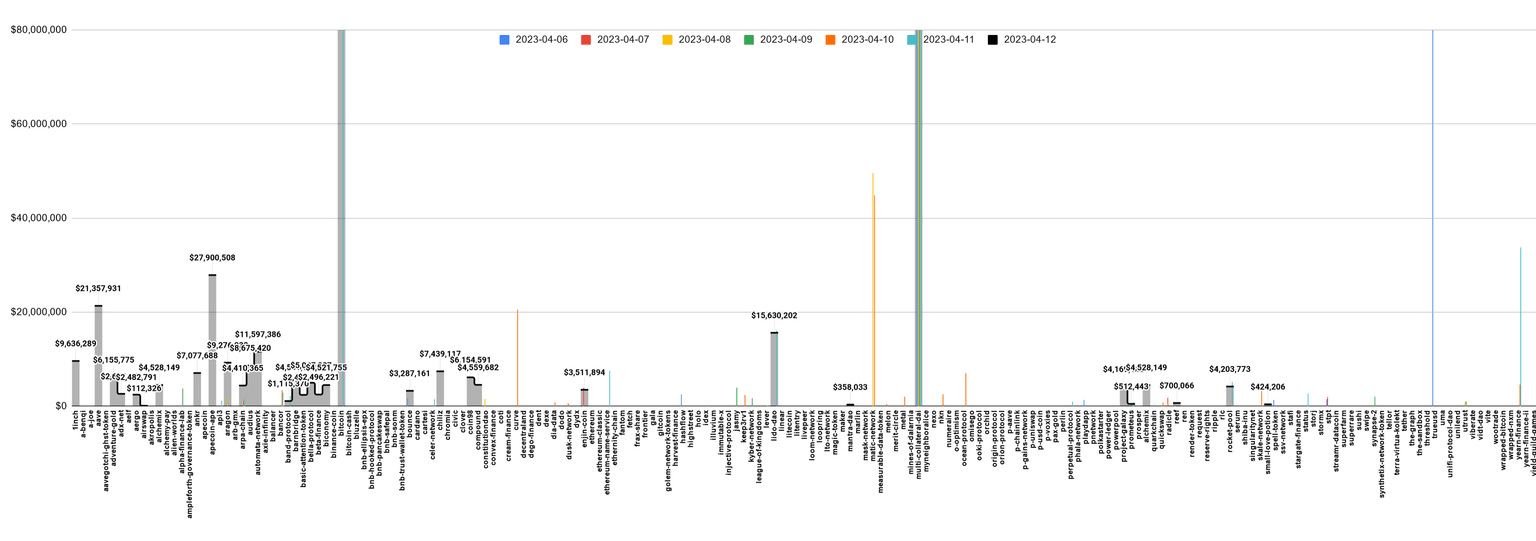

The black bars on the Top Transactions model below indicate the USD amount transferred.

Top Transactions Model

As seen in the chart above, ApeCoin (APE), AAVE and Lido Dao (LDO) in this order recorded relatively high USD volume transferred by whales. In the case of different altcoins whale transactions signify accumulation, transfer of tokens to or off exchanges and so on.

ApeCoin witnessed $27.9 million worth of whale transactions, these constituted of exchange to exchange address transfers. In AAVE, exchange balances declined as tokens were moved off exchanges in transactions worth $21.4 million.

Similarly, in LDO, $15.6 million worth of the token was exchanged between non-exchange addresses by whales, while exchange balances declined. Therefore, in the case of AAVE and LDO, it fuels a bullish thesis.

The bullish case for AAVE and LDO

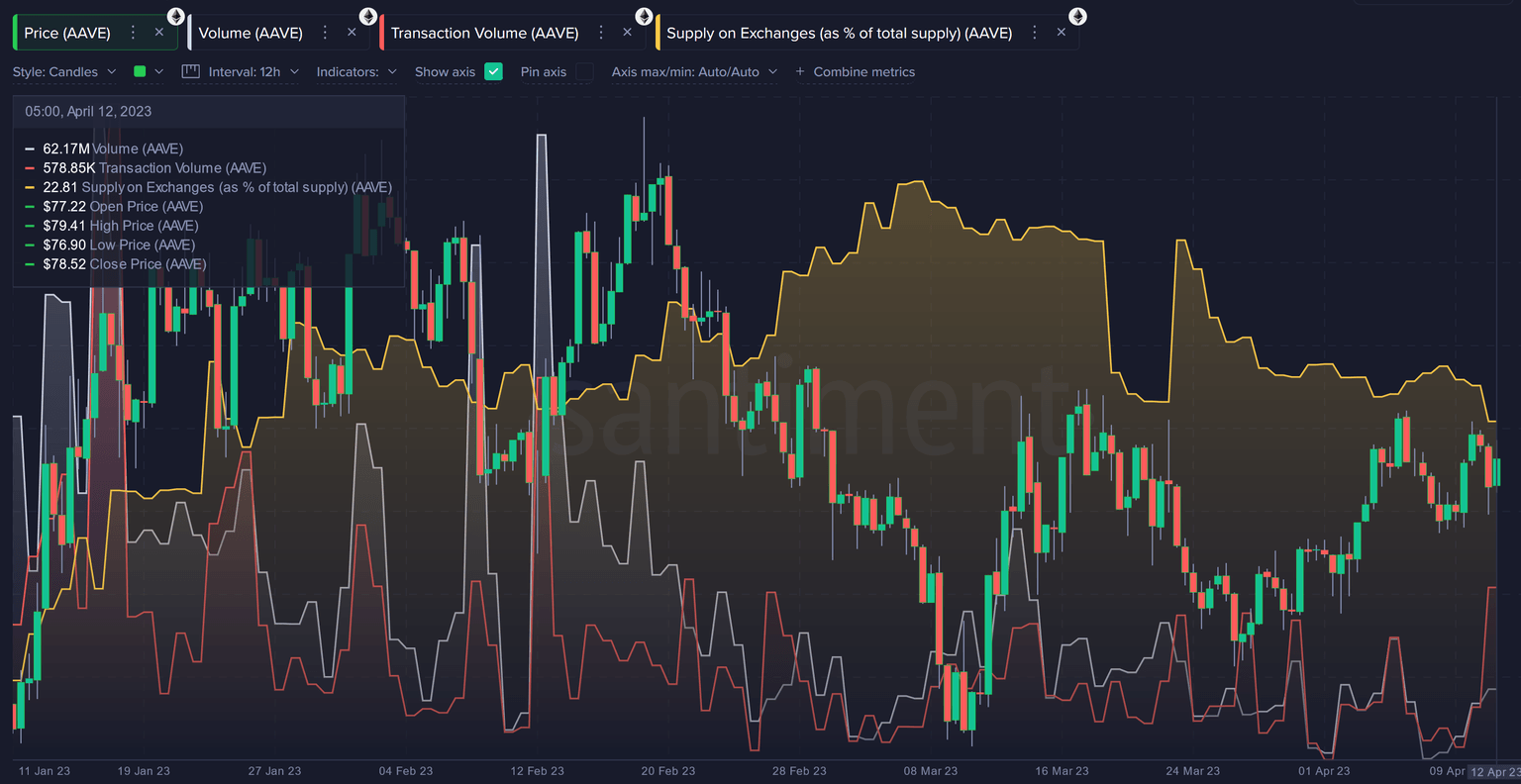

AAVE recorded the highest transaction volume in five weeks, today, Thursday, April 13. The supply on exchanges declined while whales made their transfers and this is considered a bullish sign for AAVE.

AAVE transaction volume and supply on exchanges

AAVE price yielded 9% gains for holders over the past two weeks and the DeFi token is in an uptrend. Based on the on-chain metric and whale activity, AAVE is poised for further gains. CryptoFaibik, a technical analyst, notes that AAVE is on the verge of breaking out of the upper trendline of a descending parallel channel, this is typically considered bullish for an asset.

A clean break above the upper trendline could send AAVE to its bullish target of $199, according to Faibik’s analysis.

AAVE/USDT 3D price chart

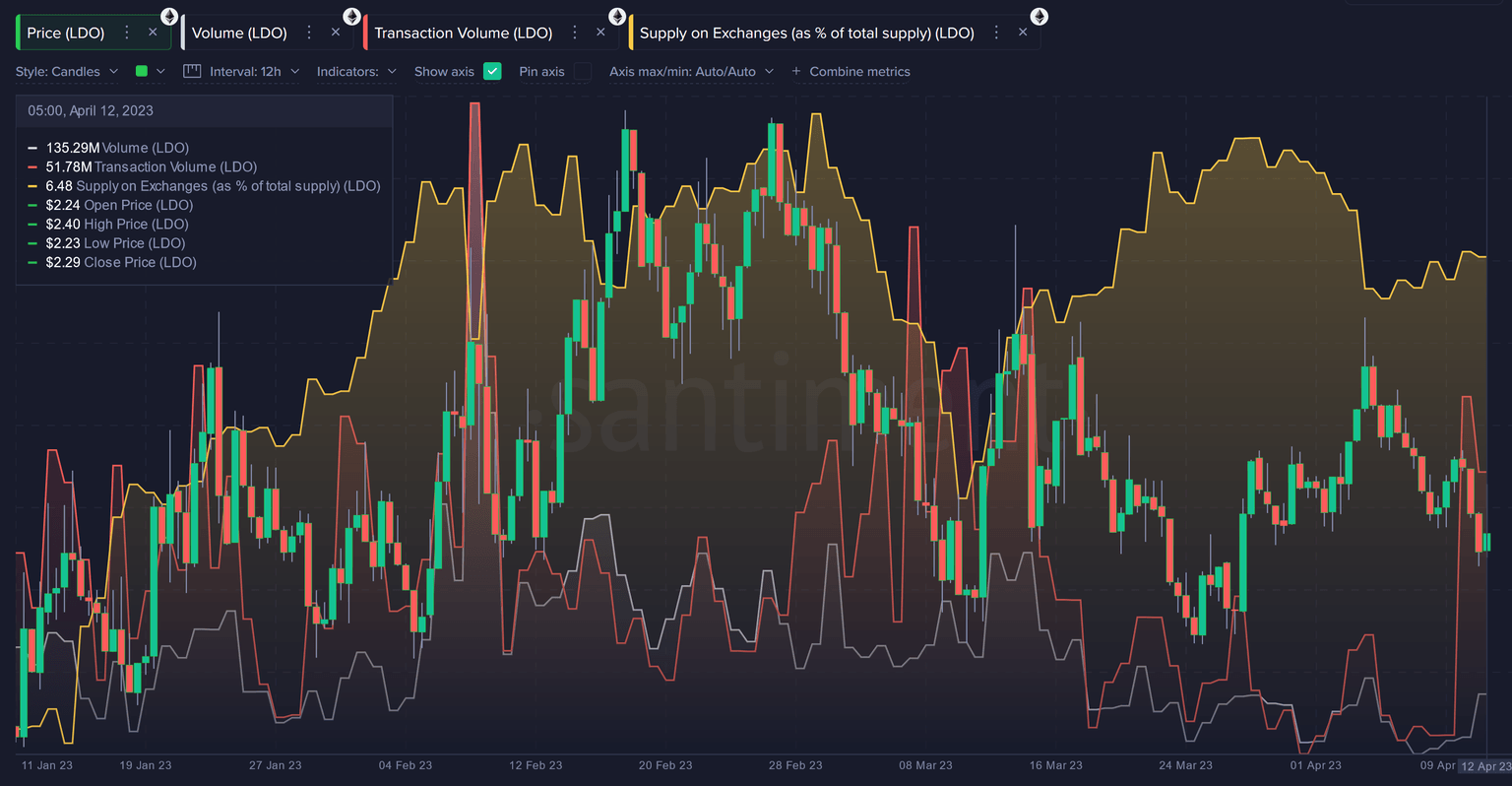

LDO’s supply on exchanges has climbed since Wednesday, however its important to note that the increase is modest and analysts do not consider it a cause for concern. LDO transaction volume hit a four-week high on Wednesday and the token’s price is up 6% since the successful completion of Ethereum’s Shapella upgrade.

LDO supply on exchanges and transaction volume

LDO is one of the Liquid Staking protocol tokens that gained relevance with the “Liquid Staking” narrative ahead of the Shapella upgrade. Analysts evaluated the LDO price chart and commented that Ethereum’s recent uptrend could drive the Liquid Staking protocol’s token higher.

LDO/USDT price chart

CryptoJelleNL, a technical expert, has set a target range of $3.1 to $3.3 for LDO, as seen in the chart above.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.