Jupiter Price Forecast: JUP remains firm despite market correction

- Jupiter’s price extends its gains on Tuesday after rallying nearly 7% the previous day.

- The recent JUP buyback and 3 billion token burn announcement were revealed in its Catstanbul event.

- On-chain metrics also paint a bullish picture as JUP’s open interest, trading volume and TVL are rising.

Jupiter’s (JUP) price extends its gains, trading around $1.23 and rallying nearly 10% on Tuesday after a 7% rise the previous day. The recent JUP buyback and 3 billion token burn announcement was revealed in its Catstanbul event, further supporting JUP’s bullish outlook. Moreover, its on-chain metrics also paint a bullish picture as JUP’s open interest, trading volume, and Total Value Locked (TVL) are rising.

Jupiter burns 3 billion native tokens and announces buyback plans

Jupiter announced in its “Catstanbul” event on Saturday and Sunday that supported its recent price rally. During this event, a series of announcements were made as follows:

- 50% of all protocol fees are set to buy tokens from the open market, with the tokens being moved to a “long-term litterbox,” a long-term reserve.

- Three billion of Jupiter’s native tokens were burned.

- Jupiter launched their omnichain expansion plans.

- Jupiter’s founder set a vote to give away more than $280 million of his own JUP.

All these announcements could increase attention on the platform and attract new users and liquidity to the Jupiter ecosystem in the long run, leading to its bullish outlook.

Catstanbul by @JupiterExchange was basically Breakpoint v0

— ashen (@solashenone) January 27, 2025

- 3B $JUP was destroyed

- @weremeow set a vote to give away $280M+ of his own JUP

- Jupiter launched their omnichain expansion plans

- 50% JUP buyback was revealed

we also burned a cat. pic.twitter.com/Ayk5aEHKV3

Jupiter display strong on-chain metrics

Jupiter’s on-chain metrics further support its bullish outlook. According to Coinglass’s data, the futures Open Interest (OI) in JUP at exchanges rose from $173.91 million on Friday to $336.58 million on Monday, the highest level since its launch. An increasing OI represents new or additional money entering the market and new buying, which suggests a rally ahead in the Jupiter price.

Jupiter Open Interest chart. Source: Coinglass

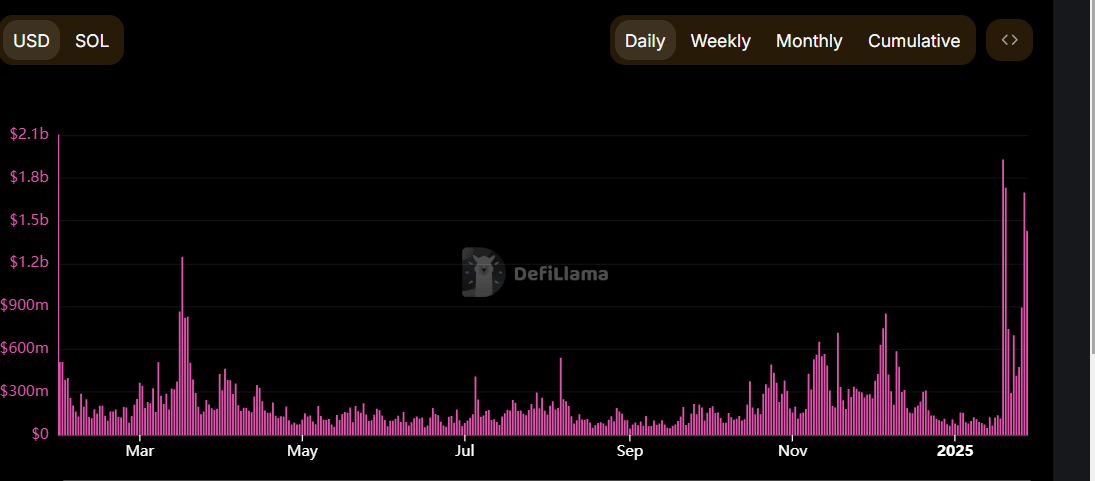

Another aspect bolstering the platform’s bullish outlook is a recent surge in traders interest and liquidity in the JUP chain. DefiLlama’s data shows that the JUP chain’s trading volume rose from $415.02 million on Friday to $1.69 billion on Monday.

JUP trading volume chart. Source: DefiLlama

Moreover, crypto intelligence tracker DefiLlama, shows that Jupiter’s TVL has been constantly rising and reached a new all-time high of $2.92 billion on Thursday.

This increase in TVL indicates growing activity and interest within the Jupiter ecosystem. It suggests that more users deposit or utilize assets within JUP-based protocols, adding credence to the bullish outlook.

Jupiter TVL chart. Source: DefiLlama

Jupiter technical outlook: JUP bulls aim for $1.4 mark

Jupiter's price found support, bounced off the 50-day Exponential Moving Average (EMA) level at $0.94, and rallied 6.68% on Monday. At the time of writing on Tuesday, it continues to trade higher, breaking above its weekly resistance at $1.17.

If JUP continues its upward momentum, it could extend the rally to retest its December 5 high of $1.44.

The daily chart’s Relative Strength Index (RSI) reads 67, indicating bullish momentum. However, traders should remain cautious as it reaches overbought levels and the chances of a correction or a pullback increase. Another probable scenario is that the RSI remains above overbought levels, and JUP continues to rally.

JUP/USDT daily chart

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.