IOTA Price Analysis: IOT on the cusp of remarkable bull run

- IOTA is in the initial phase of a recovery targeting the medium-term resistance at $0.30.

- Various technical indexes and chart patterns have reinforced the bullish outlook.

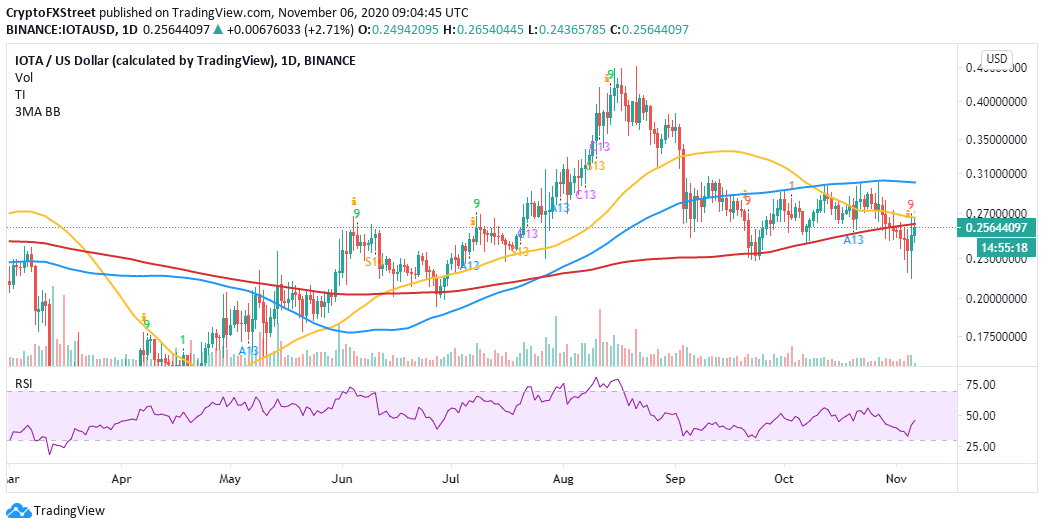

IOTA is nurturing an uptrend from a recently established support at $0.23. Before the anchor, the token was rejected from the crucial resistance at $0.3. Bullish efforts to keep it above the support at $0.26 went down the drain as bears swung into action, taking control over the price. However, recovery appears to be brewing amid rising buying pressure.

IOTA fights to break critical resistance

At the time of writing, the $709 million crypto asset is changing hands at $0.254. Immediately on the upside, the 200 Simple Moving Average in the daily timeframe caps price movement. This hurdle must come down to allow buyers to shift the focus back to $0.30.

A buy signal was recently presented by the TD Sequential indicator in the form of a red nine candlestick, giving credibility to the bullish outlook. If buy orders increase on account of this signal, IOTA is likely to attract enough volume to support recovery to $0.3, as highlighted by the 50-day SMA.

The Relative Strength Index also reinforces the bulls' presence in the market after bouncing off the oversold region. A spike above the midline would show that buying pressure has intensified. On the other hand, buy orders could rise as the fear of missing out (FOMO) creeps into the market, pulling IOTA to higher levels.

IOT/USD daily chart

A descending wedge pattern was recently formed in the same daily time frame. The chart pattern is created by connecting a series of lower lows and their respective highs using two converging trendlines.

Descending wedges usually lead to price reversal, as the downtrend loses momentum. The ongoing bullish price action is supported by a new breakout above the wedge, which added weight to the bullish narrative.

IOT/USD daily chart

A zoomed out 12-hour chart also reinforces the anticipated bull run with the formation of a double-bottom pattern. The pattern prints a picture of an asset's initial drop in price, recovery and another dive to the same level. Finally, a significant rebound is usually expected from the support, as illustrated on the chart.

IOT/USD 12-hour chart

It is worth mentioning that the bullish outlook will be sabotaged if IOTA does not close above the 200-day SMA. A rejection at the moving average might revisit the primary support at $0.225. If bears regain control over the price, declines to $0.20 may come into the picture.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637402528666083143.png&w=1536&q=95)

-637402530035868234.png&w=1536&q=95)