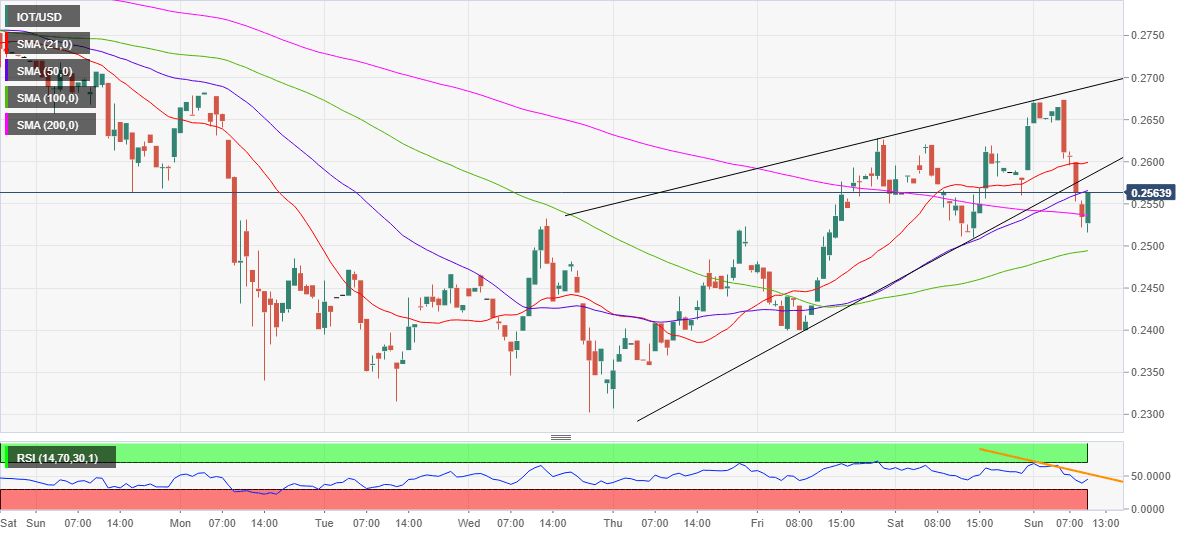

IOTA Price Forecast: IOT/USD sold-off amid rising wedge breakdown, bearish RSI divergence

- IOT/USD slides as technical set up turns in favor of bears.

- Sellers target 100-HMA support amid bearish RSI.

- 21-HMA to limit the recovery attempts in IOTA.

IOTA (IOT/USD) stalls the sharp sell-off to 0.2515, as the bears take a breather before the next push lower.

As observed on the hourly chart, the coin came under fresh selling pressure from near 0.2670 region after a death cross got confirmed early Sunday. The bearish crossover appeared after the 200-HMA pierced the 50-HMA from above.

Also, the price-Relative Strength Index (RSI) bearish divergence added credence to the downside.

The sell-off gathered traction after the bears took out the 21-hourly Simple Moving Average (HMA) support, then at 0.2598.

Subsequently, the downside pressure intensified, validating a rising wedge breakdown below the rising trendline support at 0.2575. Further south, the price penetrated through the critical 50 and 200-HMA.

At the moment, the price has recaptured the 200-HMA at 0.2536, now flirting with the 50-HMA at 0.2569 on the road to recovery.

The tepid bounce can be attributed to the upturn in the hourly RSI, currently at 45.29. The next upside resistance is seen at the pattern support now resistance at 0.2580.

The bearish bias remains intact so long as the spot holds below the 21-HMA.

To the downside, the daily low could be retested should the sellers regain control, below which the floors open up towards the 100-HMA at 0.2494 en route the pattern target of 0.2302.

IOT/USD: Hourly chart

IOT/USD: Additional levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.