Here’s why XLM price is likely to rally 40% soon

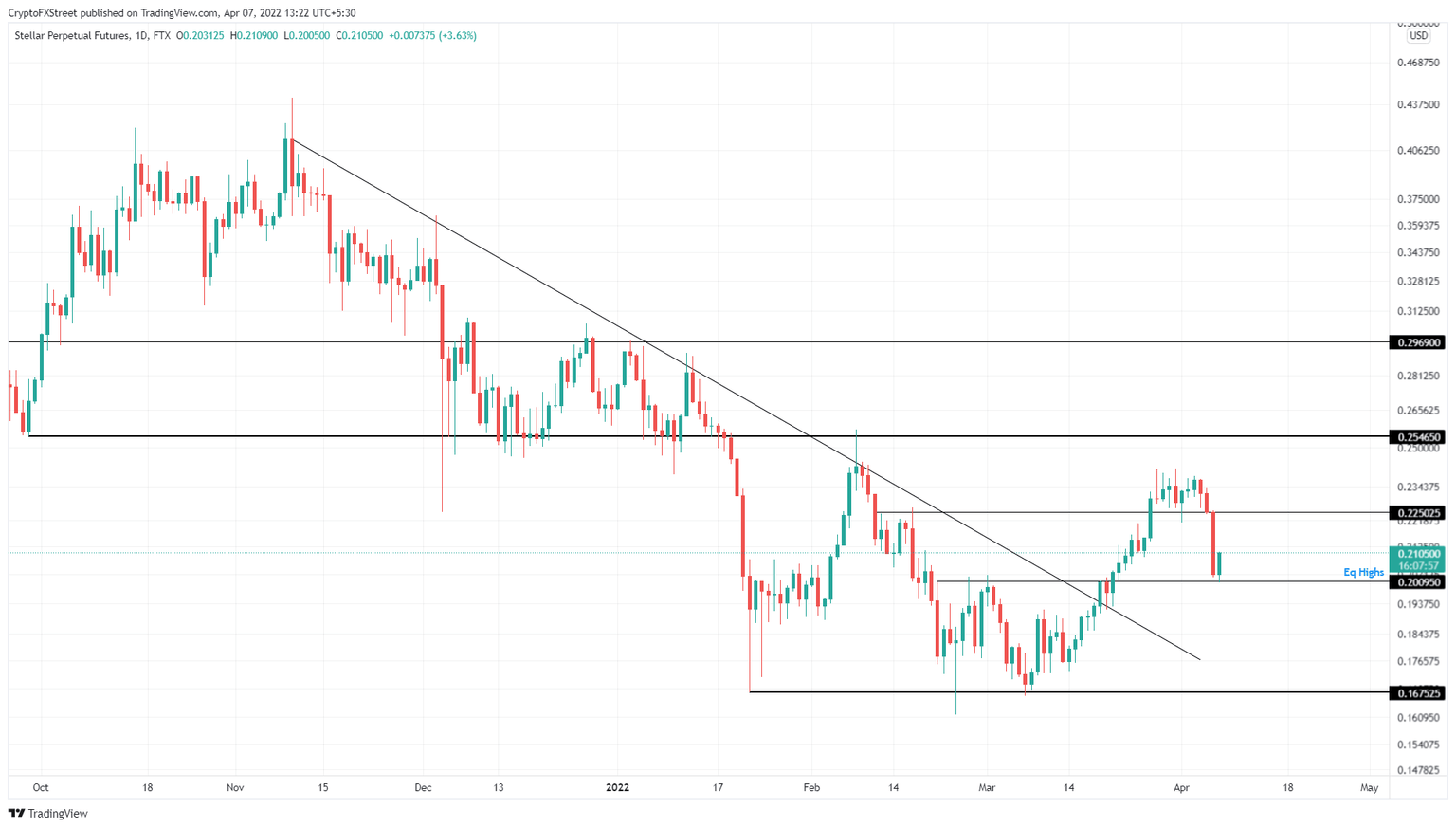

- XLM price shows signs of recovery as it bounces off the $0.200 support level.

- Investors can expect the emerging rally to propel Stellar by 40% to $0.30.

- A daily candlestick close below $0.167 will invalidate the bullish thesis.

XLM price is exuding bullishness after the recent flash crash. Since this momentum is emerging around a support level, investors can expect Stellar to trigger a rally.

XLM price prepares for another launch

XLM price rallied 44% after tagging the $0.167 support level for the third time on March 8. This massive uptrend set up a swing high at $0.24, but due to the recent bearishness for Bitcoin, the remittance token dropped 16% in market value.

However, the sell-off was handled perfectly by the buyers at the $0.20 support level. As a result, XLM price has already surged by 3.6% and is showing signs that this move will continue. Investors can expect the resulting uptrend to retest the $0.254 resistance level.

This move would constitute a 21% ascent. If buyers stick together and flip this hurdle into a support level, the rally could extend to the next barrier at $0.296, bringing the total gain to 40%.

XLM/USDT 1-day chart

After the recent uptick from the $0.20 support level, the outlook for XLM price is bullish without doubt. However, if the big crypto takes a U-turn, Stellar will more than comply and follow suit.

Under these circumstances, a daily candlestick close below $0.167 will create a lower low and invalidate the bullish thesis for XLM price. In such a case, Stellar could revisit the $0.144 support level, where buyers could step back in and give the uptrend another go.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.