Here’s the ideal scenario to buy Cardano’s ADA price

- Cardano price revisits $0.49 under relatively low volume.

- Being an early buyer is unwarranted despite recent increase in buying activity.

- A safe invalidation of the downtrend is a breach above $0.66.

Cardano price could begin heading north towards higher targets; being an early buyer is unwarranted for one reason.

Cardano price needs a safe entry

Cardano price is seeing choppy price action following Wednesday's bullish influx. Wednesday’s FOMC decision to hike interest rates 75 basis points induced a speculative frenzy prompting intraday traders to hold on to their accumulated long positions. The "buy the rumor, sell the news" event triggered a supply vs. demand blitzkrieg, leading to a 21% bull rally into a daily high of $0.53 in just a few short trading hours.

The Cardano price now trades at $0.49 as the bullish hype has simmered. The $0.50 level has been a critical level of interest for traders this month, so the breach of liquidity levels just below does provoke the idea that an uptrend rally will occur for the layer 2 token. Still, traders should approach ADA prices with a more conventional trading plan.

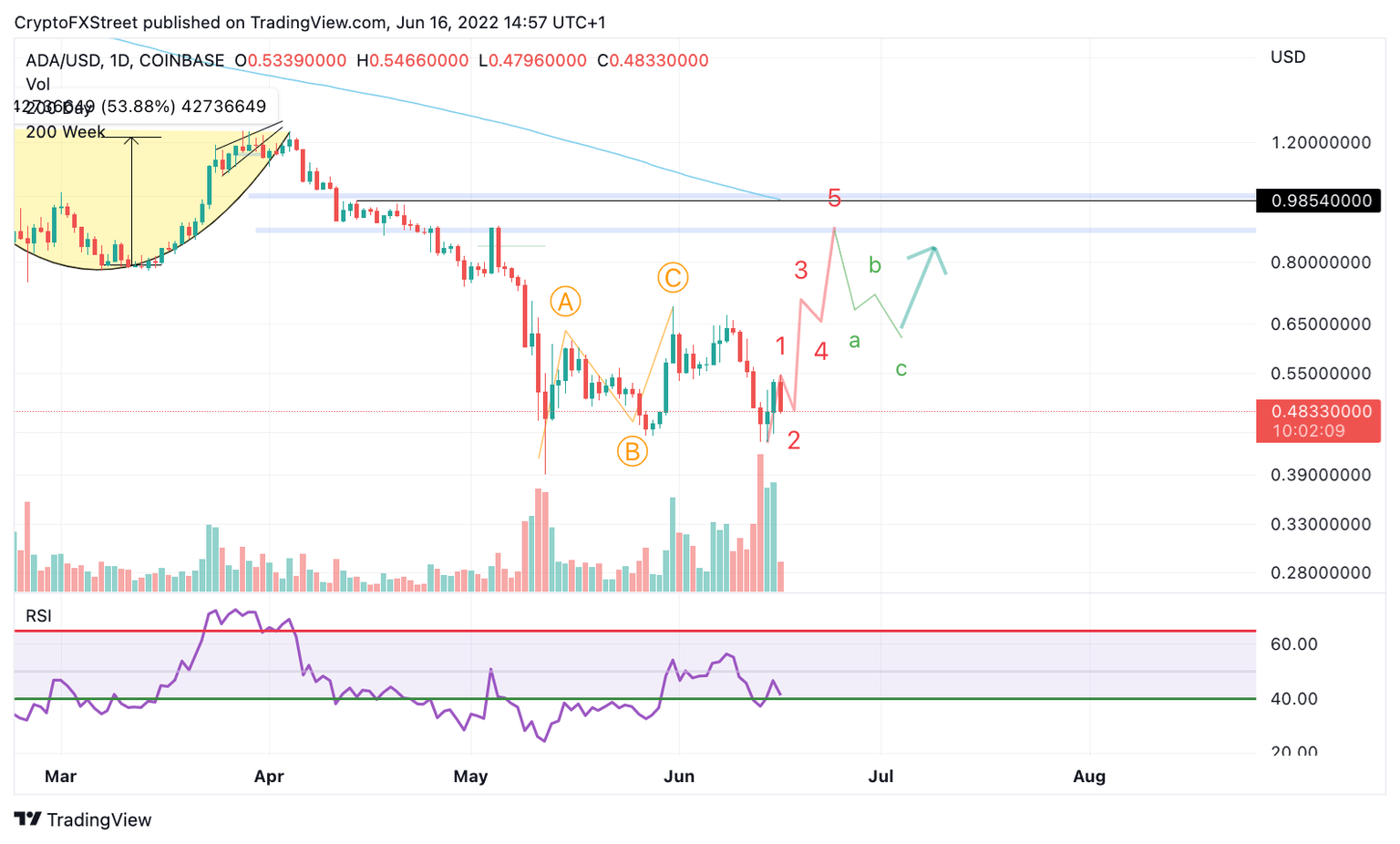

ADA/USDT 1-Day Chart

Cardano price has shown an influx of buyers since the $0.44 lows that occurred Monday, June 13. The bears’ attempts to lower prices comes with a considerable drop in volume, which is likely to confound a countertrend rally in the coming days. However, if the bears retest $0.44 in the short term, a true sell-off could occur at $0.20.

A conventional buying strategy is to allow the Cardano price to move higher before joining. Cardano price needs to breach the previous wave four at $0.66. After this occurs, a rally should ensue, possibly into $0.74 and higher. Next, a three-wave pullback should occur in lower areas of interest. A second breakout after the three-wave pullback will be crucial for investors to consider before buying the ADA price to make long-term gains. If this scenario occurs, the Cardano price would have the power to rally as high as $1.40, resulting in a 190% increase from the current Cardano price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.