The Fed does not want to induce a recession but is there any choice?

- FOMC hikes 75 basis points to a 1.75% upper target.

- Fed funds expected to be 3.4% at year end, up from 1.9%.

- Retail sales drop 0.3% in May, missing the 0.2% forecast.

- Atlanta Fed Q2 GDP estimate falls from 0.9% to 0%.

“There is no sign I can see of a broader slowdown in the economy…We are not trying to induce a recession,” Federal Reserve Chair Jerome Powell.

Federal Reserve Chair Jerome Powell put a brave face on the bank’s largest rate increase in 28 years, the third in as many meetings. “It does appear the US economy is strong and well positioned to withstand higher interest rates.” Markets took the unexpected acceleration in rate hikes in stride but the US economy is showing signs of inflation fatigue despite the Fed's positive assertion.

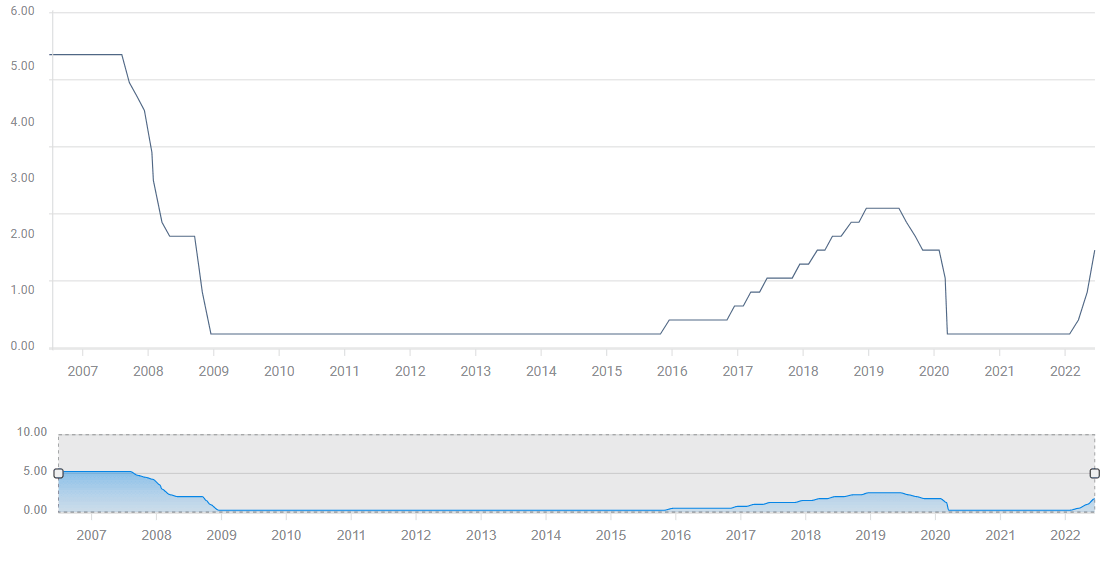

Fed funds rate

Today’s 75 basis point hike to 1.75% was prompted by an 8.6% reading in May’s annual Consumer Price Index (CPI).

That unexpected acceleration above the March high of 8.5% led the Fed to take the unusual step of changing its rate outlook during its two-week media blackout before the Federal Open Market Committee Meeting (FOMC). An anonymous and assumed Fed source informed the Wall Street Journal, whose article on Monday alerted markets that the rate prescription had changed from 0.5%.

The Fed also issued its updated economic and rate projections, the second of four each year.

The year-end estimate for the fed funds rate rose to 3.4% from 1.9% in March, implying a doubling from its current level. Economic growth in 2022 dropped to 1.7% from 2.8%, PCE inflation rose to 5.2% from 4.3% and core to 4.3% from 4.1%. Inflation is still expected to decline in 2023 to 2.6% for headline and 2.7% for core, barely changed from the March projections.

There were no changes to the balance sheet reduction program that began this month with a $47.5 billion roll-off of maturing securities.

Markets

After some initial uncertainty markets responded to the Fed’s rate increase with relief that it was not a more drastic 100 basis points.

Equities rebounded from initial losses to post substantial gains. The Dow added 1.0%, 303.70 points to 30,668.53 and the S&P 500 rose 1.46%, 54.51 points to 3,789.99. The NASDAQ jumped 2.50%, 270.81 points after a long string of losses to 11,099.16.

Treasury yields retreated with the 10-year losing 8.4 points to 3.311% and the 2-year dropping 6.2 points to 3.217%.

The dollar also lost ground after early gains, falling small amounts in all major pairs on the reversing credit yields.

Inflation, consumers and the Fed

The Fed has consistently underestimated inflation. Chair Powell and other officials insisted for most of last year that price increases were transitory, as CPI climbed from 1.4% in January to 5.4% in June and 7.0% in December. The April drop to 8.3% was taken as a sign that prices had begun to decline. The reverse to 8.6% in May was clearly a shock to the policymakers.

Consumers were probably not surprised. It seems that 16 months of rising inflation may be all the family budget can tolerate.

Retail Sales dipped 0.3% in May instead of rising 0.2%. The Control Group category that mimics the consumption component of GDP was flat, well below its 0.5% forecast.

Consumer discontent was reflected in the June Michigan Consumer Sentiment Index, released last Friday, which skidded to 50.2, its lowest reading in the more than 50 year series history.

Michigan Consumer Sentiment

In response to a number of recent economic statistics including the sales numbers, the Atlanta Fed GDPNow second quarter estimate dropped from 0.9% to 0%. First quarter GDP was -1.5%.

Conclusion

The Federal Reserve is facing an economic situation that has forced it to make the most unpalatable choice there is for a central banker. Growth or inflation.

Inflation is devastating for consumers, and especially painful when necessities, food, energy and shelter are rising even faster than overall prices. Families first turn to savings but that cannot last and soon households begin to cut back on spending. Once that begins, and May’s drop was ominous though hardly conclusive, the odds of a recession rise sharply.

The Fed has promised to thwart inflation running at its highest pace in four decades, even though rate increases work through slowing economic growth and job creation. Policy makers could not give inflation a pass to preserve jobs even if they wanted to, because price increases force consumers to curtail spending, eventually reducing economic growth whether the Fed raises rates or not.

Having let inflation escape its control, Fed governors have no leeway for action. Either they risk a recession now with rate increases or inflation will deliver one in a few months anyway.

Mr. Powell managed to reassure markets, which are his main audience, but his words will do little to buoy spirits across the country. Americans will make their own decisions. Unless there is a swift and dramatic improvement in inflation, the window for a soft-landing has probably already closed.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.