Here’s how Vitalik Buterin’s privacy solution could be a game changer for Ethereum and privacy coins

- Vitalik Buterin recently made a blog post detailing the importance of privacy solutions on the Ethereum network.

- Buterin seeks to potentially anonymize peer-to-peer transactions, NFT transfers and Ethereum Name Service registrations, protecting users.

- The US government's sanction of Tornado Cash and European Union’s skepticism on privacy coins shows the need for anonymizing crypto transactions.

Ethereum co-founder Vitalik Buterin recently shared a blog post on a privacy enhancing solution for the Ether blockchain and its users. Buterin’s recommendation is in line with the need for anonymizing solutions at a time when the US Government and the European Union has toughened its stance on privacy enhancing coins and apps like Tornado Cash.

Also read: Here’s how Ethereum whales predict massive gains in meme coin Shiba Inu

Vitalik Buterin proposes anonymity in Ethereum network-based P2P transactions, NFT transfers

Vitalik Buterin, a Russian-Canadian computer programmer and the co-founder of the Ethereum Network has stressed the importance of privacy solutions on the blockchain, particularly in the form of stealth addresses in a new blog post.

Buterin believes that stealth addresses could potentially anonymize peer-to-peer transactions, non fungible token (NFT) transfers, and Ethereum Name Service (ENS) registrations, helping protect users.

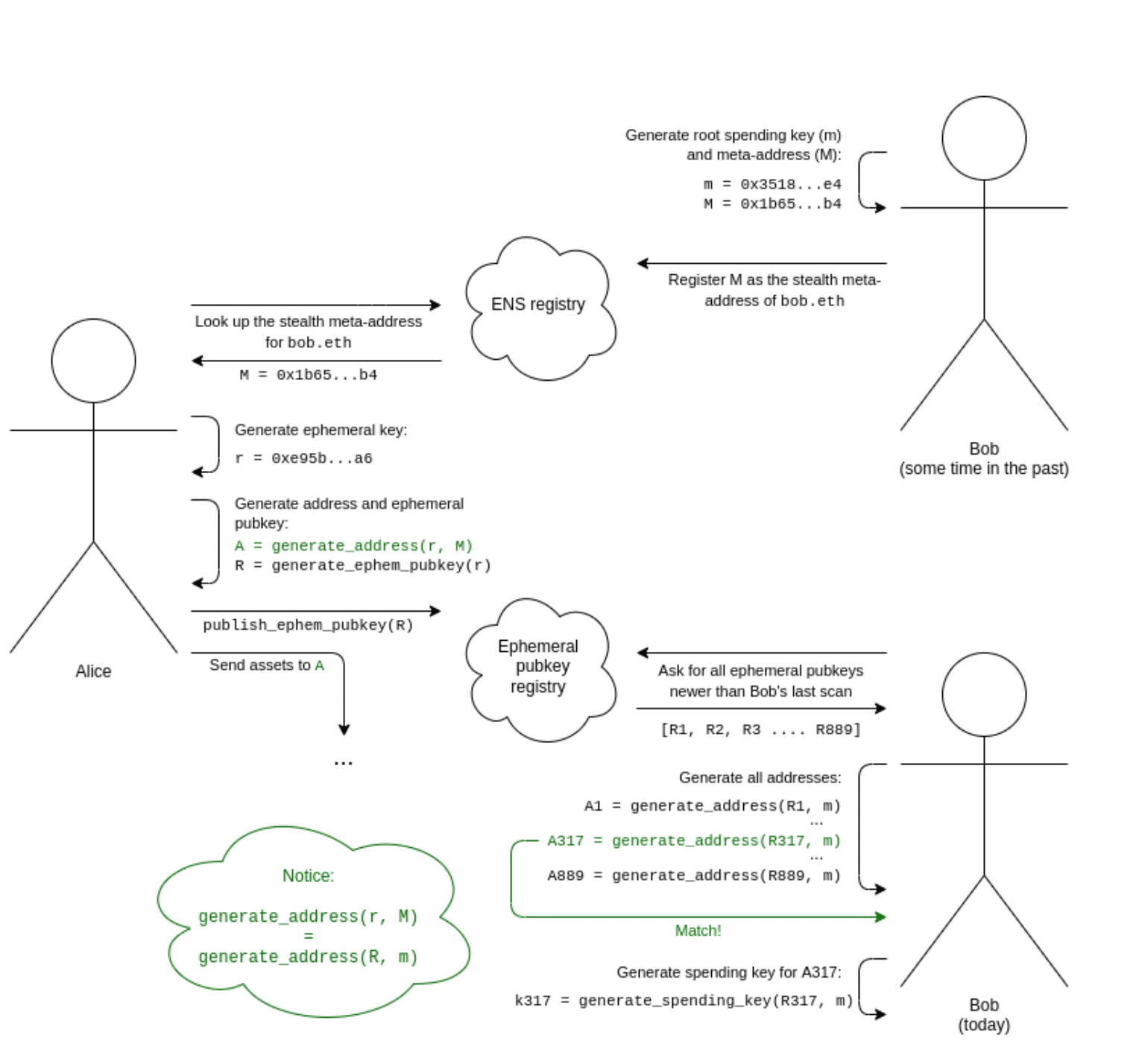

The Ethereum co-founder proposed the idea of a “spending key” that generates a stealth meta-address. This address can then be passed on to the sender, who uses a cryptographic computation to generate a stealth address belonging to the receiver. With this system, a new stealth address is generated for each new transaction, creating privacy for the sender and receiver.

Workflow of the stealth address scheme

Buterin believes that stealth addresses could be implemented fairly quickly, and would be a significant boost to user privacy on Ethereum. However, there are some longer-term usability concerns, such as social recovery issues, which could be solved with more advanced zero-knowledge proof technology.

The introduction of stealth addresses could act as a catalyst for Ethereum, as it could increase the privacy of users on the network. This could drive demand for the altcoin, fueling a bullish narrative among ETH holders. As more traders join the Ethereum network due to its improved privacy features, demand for the altcoin increases.

Furthermore, stealth addresses could help Ethereum to better compete with popular privacy coins such as ZCash and Monero. These coins have grown in popularity due to their privacy features, and the introduction of stealth addresses could make Ethereum a lucrative alternative, driving users from these projects to the ETH network.

Governments are skeptical on privacy enhancing coins, with EU considering a ban

The US government recently sanctioned Tornado Cash, an open source, non-custodial, fully decentralized cryptocurrency tumbler. This project offers a service that mixes potentially identifiable or "tainted" cryptocurrency funds with others, so as to obscure the trail back to the fund's original source. Thus offering privacy to its users.

Czech officials proposed a ban on privacy coins in the European Union in November. Since privacy coins like Monero prevent snooping into blockchain activity, the ban is intended to mirror one on anonymous instruments such as bearer shares and anonymous accounts, included in the original bill proposal.

In conclusion, Vitalik Buterin’s proposal for stealth addresses could be a major game-changer for Ethereum. Not only will it help to increase the privacy of users, but it could make Ethereum more competitive with other privacy coins.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.