Galxe, Optimism and 1INCH set for volatility as $350 million token unlocks loom

- Galxe, Optimism and 1INCH have scheduled token unlocks this week totalling between 0.2% and 16% of their supply.

- Previous token unlocks where over 1% of supply was unlocked have turned out to be sell-the-news or pump and dump events.

- GAL, OP and 1INCH holders brace for volatility as token unlock draws closer.

Token unlocks are key events that result in volatility in asset prices. Galxe (GAL), Optimism (OP) and 1Inch Network (1INCH) tokens are scheduled for unlock this week, events that previously have hit prices when the unlocking amount of tokens exceeded 1% of the overall asset’s supply.

Tokens worth around $350 million in GAL, OP and 1INCH are set to enter the circulating supply, with the capacity to move asset prices in the short term.

Also read: Pro-XRP attorney predicts the altcoin’s rally to $2 ahead of SEC vs. Ripple verdict

GAL, OP and 1INCH token holders brace for unlock

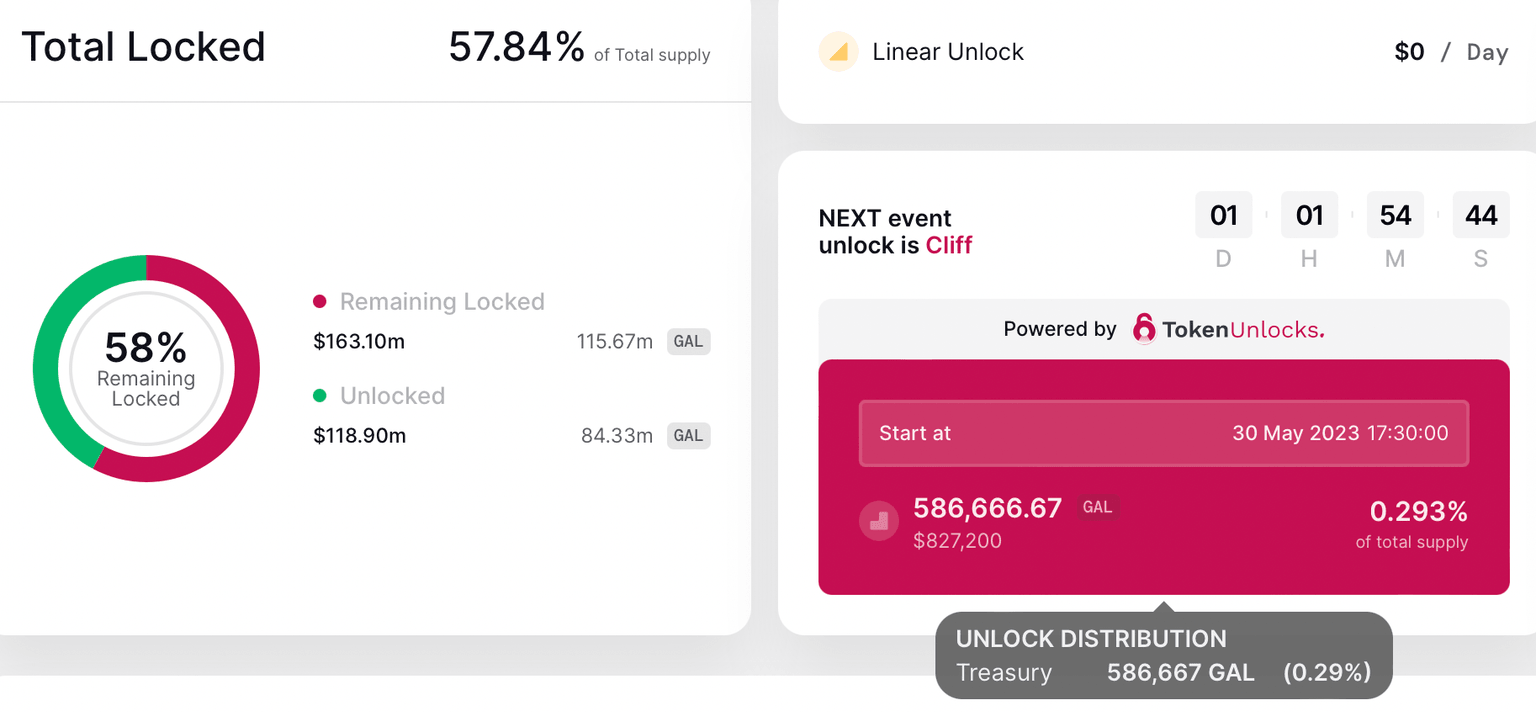

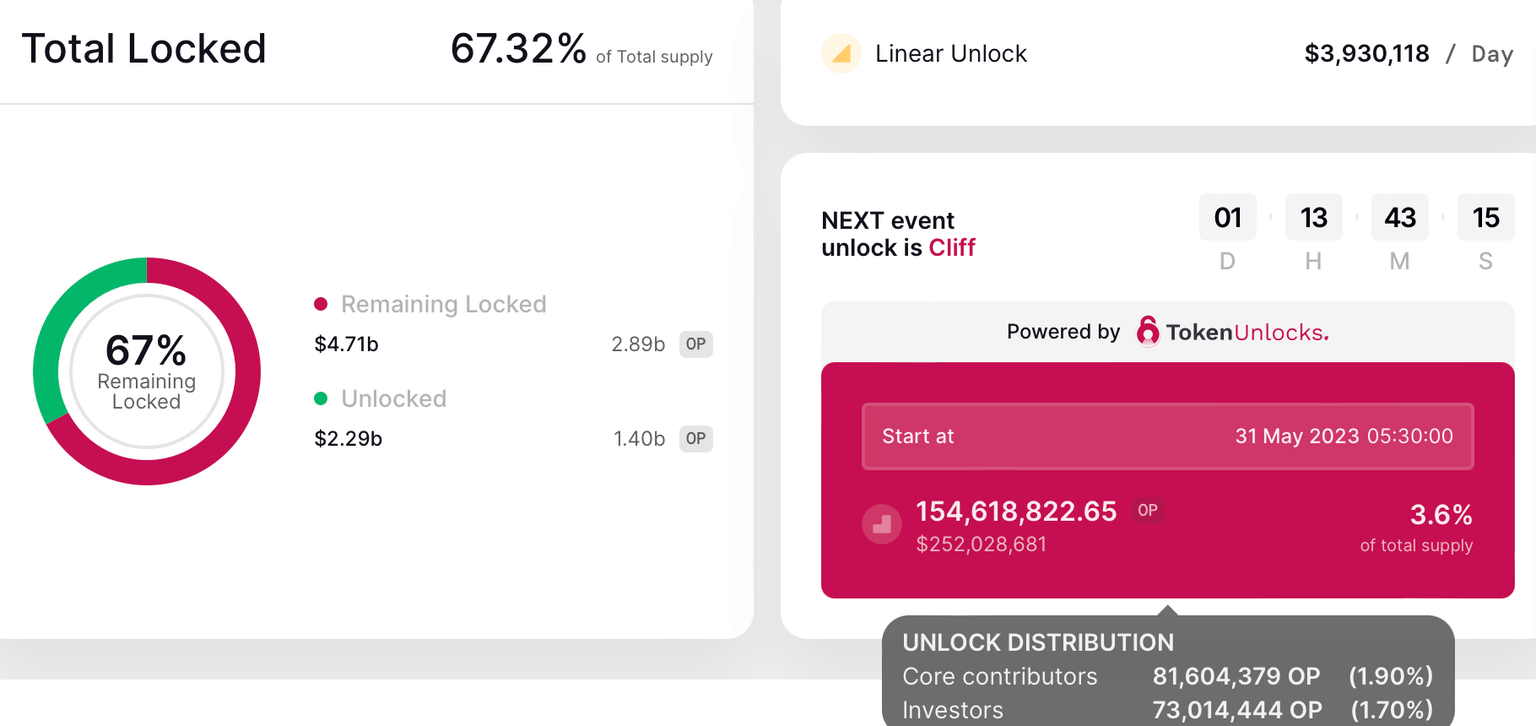

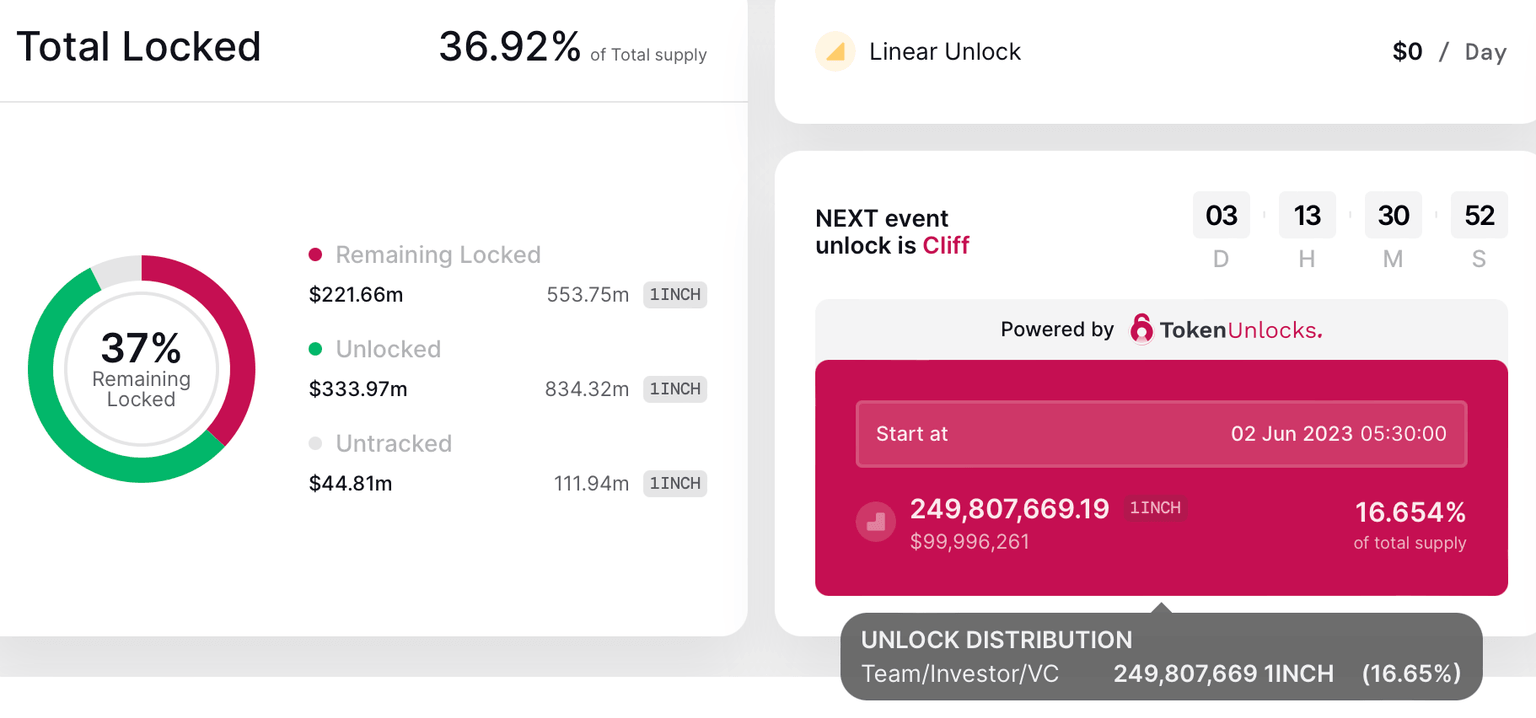

Based on data from TokenUnlocks.app, the following three token unlocks (Cliff) are scheduled this week: GAL on May 30, OP on May 31 and 1INCH on June 2.

Galxe is set to unlock 586,666.67 tokens worth $827,200, or 0.293% of the asset’s supply, on Tuesday. The unlocked tokens will be released to the project’s treasury. Based on data from Galxe’s community forum, there are currently nine community treasury signers that were elected by GAL holders.

GAL token unlock

GAL token unlock is less likely to usher volatility in Galxe prices for two reasons:

- Less than 1% of the token’s supply (0.293%) is being unlocked.

- Treasury unlocks are less likely to be associated with pump and dump in token prices.

Unlike GAL, Optimism is preparing for 3.6% of its supply to be unlocked on May 31, when 154,618,822.65 tokens worth $250,482,493 will be released. The unlocked tokens will be distributed among core contributors and investors. Core contributors of the project will receive 1.9%, while investors will get 1.7%, respectively.

The likelihood of a sell-off is higher in unlocks where investors receive tokens as they are more likely to offload their holdings. Moreover, 3.6% of OP token’s supply would enter circulation, increasing selling pressure on the asset. OP price has gained nearly 6% since Thursday, with the asset’s price climbing from $1.57 to $1.66.

OP token unlock

A rally in OP price ahead of the unlock is most likely associated with a “sell-the-news” event, where price rallies until the event but is followed by a sell-off and a correction after it.

1INCH holders should prepare for mass volatility

1INCH, the token of the decentralized aggregator of the same name, will unlock 249,807,669.19 1INCH worth $99,993,763, or 16.65% of the supply. The event lined up for June 2.

1INCH token unlock

The entire 16.65% of unlocked supply will be distributed to team members, investors or venture capital firms. When a relatively large percentage of an asset’s supply is being unlocked and distributed to investors, there is a higher probability of a sell-off.

1INCH price climbed 5%, from $0.38 to $0.40, between Thursday and the time of writing, according to data from CoinGecko. A consistent increase in 1INCH price in the days leading up to the unlock event will most likely be followed by a sell-off. 1INCH holders need to brace for volatility in the coming week as the asset’s price continues its upward trajectory.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.