Dogecoin retakes meme coin throne as Shiba Inu, Pepe mania fades

- Dogecoin trade volume exceeded that of other meme coins for the first time in two months.

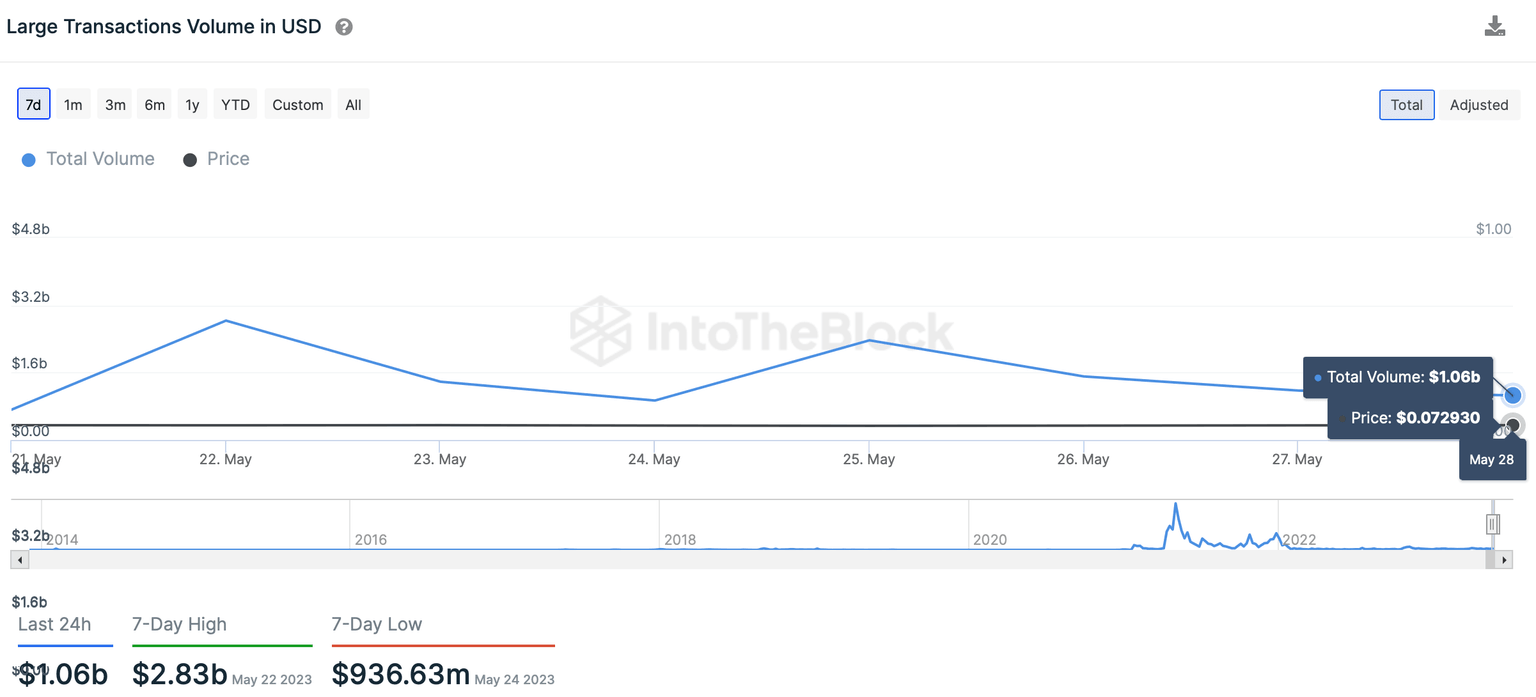

- Dogecoin network registered $1.6 billion in large volume transactions on May 28 as its price increased.

- Crypto analyst sets $1 bullish target for DOGE amidst long-term consolidation of the meme coin.

Dogecoin (DOGE), a leading meme coin in the crypto ecosystem, has seen a spike in activity from large wallet investors, popularly known as whales. The uptick in activity and recent price increases has placed Dogecoin as the biggest meme coin by market capitalization for the first time in around two months, regaining a leading position after Shiba Inu and PEPE took the center stage for most of April and May.

Whale activity pushed large transaction volume to $1.06 billion on May 28, fueling a bullish sentiment among DOGE holders. While Shiba Inu and PEPE emerged as key competitors for Dogecoin in April and May, the two tokens have registered a decline in on-chain activity.

Also read: Elon Musk warns traders against “betting the farm” on his favorite cryptocurrency Dogecoin

Around 40% of DOGE wallets turn profitable

Trade volume is considered a key on-chain metric to assess the utility and dominance of a cryptocurrency. Dogecoin’s trade volume climbed to $231.95 million in the past 24-hour period, leaving competitors Shiba Inu and PEPE behind. Shiba Inu’s trade volume for the same period is half that of DOGE at around $113 million, while PEPE is at $98.29 million, according to data from CoinGecko

Dogecoin’s dominance in terms of trade volume is driven by activity from whales. Large wallet addresses holding DOGE in their portfolio have consistently added more tokens to their holdings since April 3, according to data from crypto intelligence tracker Santiment.

%2520%5B12.11.15%2C%252029%2520May%2C%25202023%5D-638209434082094857.png&w=1536&q=95)

Dogecoin accumulation by whales

Whales across three different segments, holding between 1,000 to 1,000,000 Dogecoin, have gradually increased their purchases of the meme coin since April 3. The metric fuels a bullish thesis for the Shiba-Inu-themed asset.

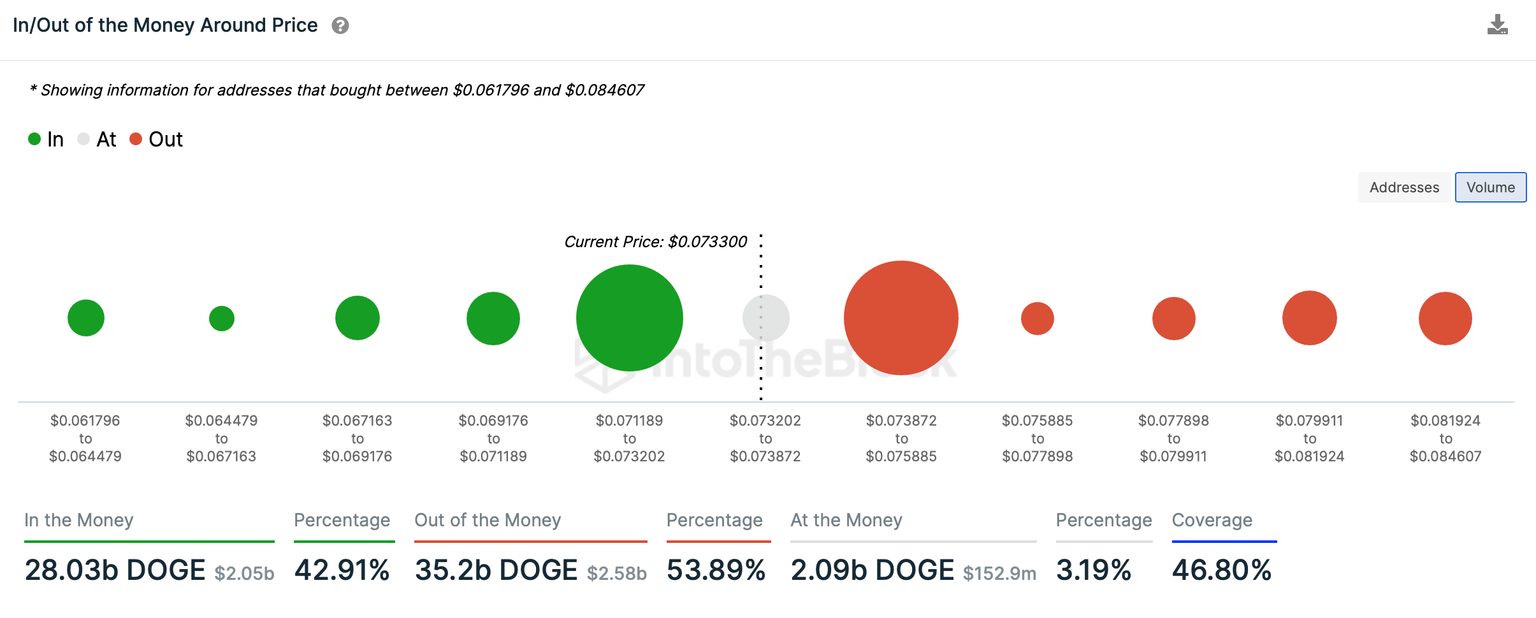

According to statistics from IntoTheBlock, at $0.0733 (DOGE price at the time of writing), more than 42% of wallet addresses holding Dogecoin are profitable. Still, 53.89% wallet addresses are “out of the money,” meaning they are sitting on unrealized losses.

42.91% DOGE wallets are profitable at the current price of $0.0733

Could Dogecoin price reach $1?

Large transactions in Dogecoin (USD)

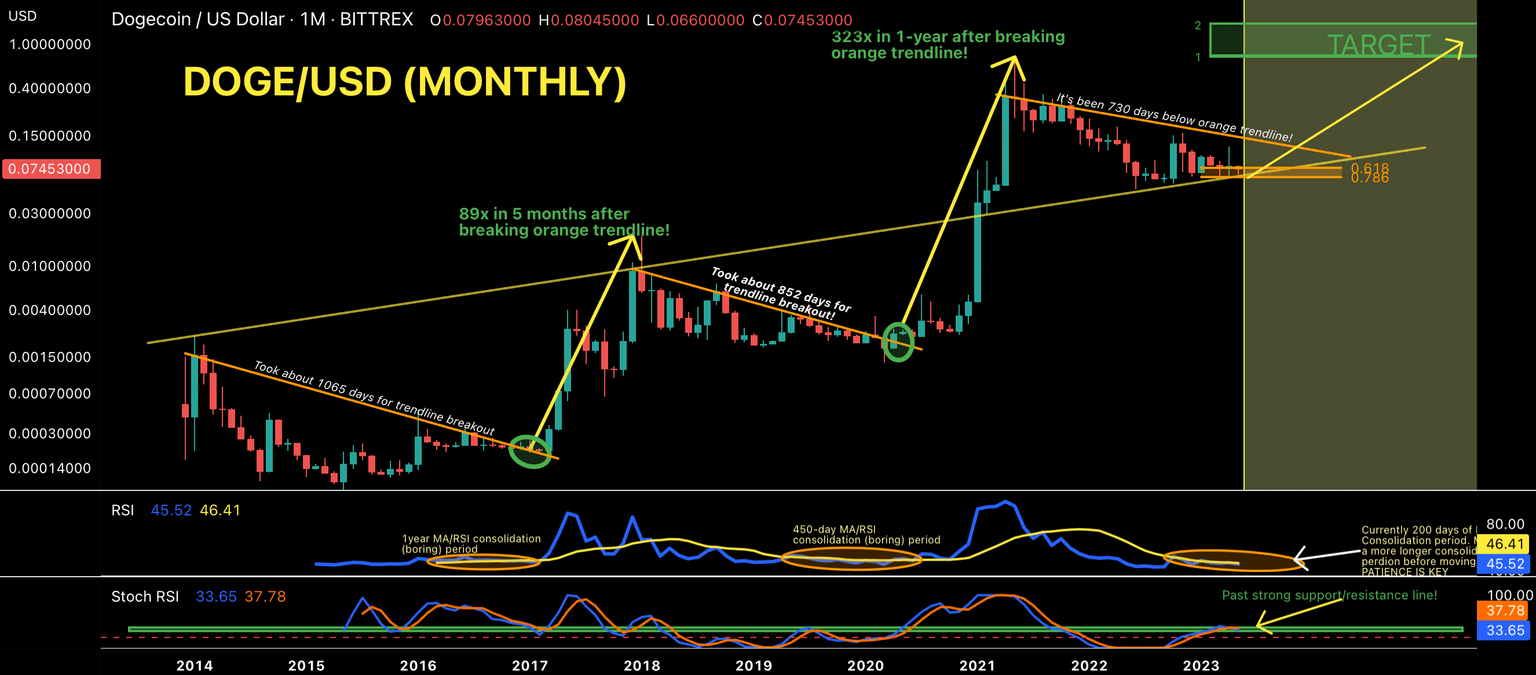

The accumulation by whales, a spike in activity and large volume transactions have fueled a bullish thesis for Dogecoin price. Crypto expert and analyst @Jaydee_757 set a target of $1 for DOGE, in what he describes as an upcoming bull run.

The expert argues that long-term consolidation precedes a rally in the meme coin. DOGE price spent over 730 days below the orange trendline in the chart below, so the analyst said that a decisive breakout above the trendline is close.

DOGE/USD one-month price chart

In the event of a breakout, DOGE price is likely to break into the target zone between $0.7718 and $1.5000.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.