Eyes on Ethereum Classic price as ETC prints green candle

- Ethereum Classic price reclaims the ground above $20.00 after ricocheting from an overarching drop to $17.77.

- FTX exchange is likely on its own after Binance backed out of a deal to acquire it.

- Ethereum Classic price must close the day above resistance at $22.00 to validate bullish outlook, avoid further falls.

Ethereum Classic price is gradually finding its way back to the surface after falling victim to the FTX-triggered selloff. Rumors of insolvency sparked panic among investors as they rushed to withdraw funds from the embattled cryptocurrency exchange owned by Sam Bankman-Fried (SBF).

FTX in disarray, Binance backs out of acquisition deal

In addition to suspending withdrawals, FTX has stopped new sign-ups, a move hinting at much deeper problems. Crypto enthusiasts and investors have already started counting losses amid vivid signs of FTX’s ultimate end.

Mike Novogratz, the CEO of Galaxy Digital, a company that focuses on providing crypto services, reckoned when he appeared on CNBC on Thursday that he is doubtful he will recover up to $77 million linked to FTX.

Although Binance had hinted at fully acquiring FTX to protect investors, the exchange backed out on Wednesday, saying, “the issues are beyond our control or ability to help.”

Meanwhile, in the most recent update (seen by Reuters) over the fate of FTX, SBF says that he intends to raise funds over the next week to do right by customers and explore the possibility of acquiring “new investors.”

Despite the efforts being made to save FTX, the damage that occurred in the past few days will be faced for a long time, like in the case of the Terra (LUNA) crash in May. For now, eyes are fixated on the Ethereum Classic price’s ability to sustain an uptrend above $20.00.

Ethereum Classic price paints a bullish picture

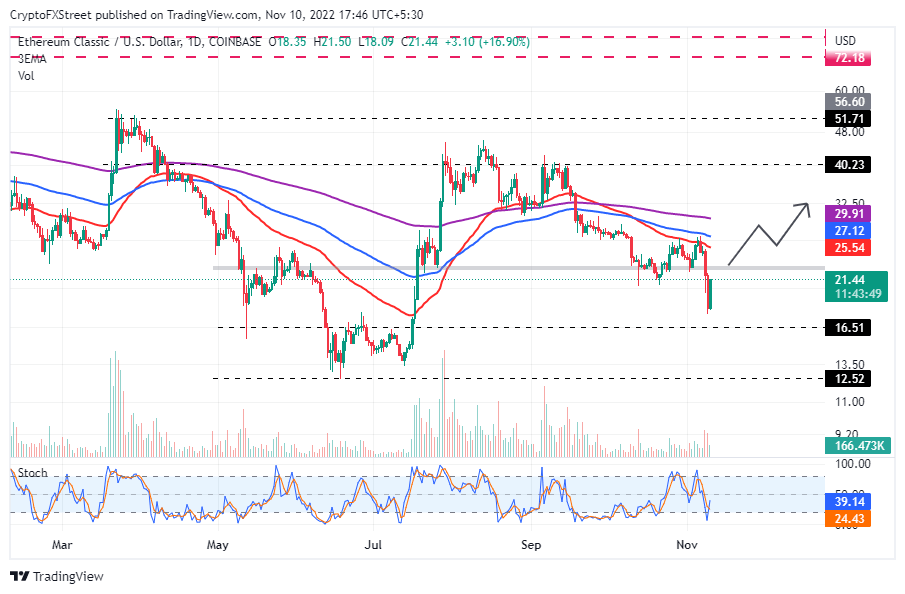

Ethereum Classic price dodders at $21.10 at the time of writing. The price rebounded from support at $17.77 as the entire crypto market waded through the murky waters gushing out of FTX’s woes.

A bullish candle is underway and might close above resistance at $22.00. Traders might view this move as a dramatic rise in price to counter the sharp freefall ETC has endured this week.

ETCUSD daily chart

The Stochastic oscillator’s return into the neutral area affirms that Ethereum Classic buyers are slowly gaining control of the trend. A break above $22.00, coupled with the Stochastics’ movement above the midline and probably into the overbought region, will add credence to the bullish outlook in Ethereum Classic price.

Traders must, from now on, tread cautiously, keeping in mind that ETC is trading below all the applied moving averages – the 50 Exponential Moving Average (EMA) (in red), the 100-day EMA (in blue) and the 200-day EMA (in purple) included. Short positions will immediately turn profitable if Ethereum Classic price fails to close the day above $22.00 or slides below the critical $20.00 level.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren