These three altcoins are ripe for a short-term rally after FTX collapse

- Crypto markets are in turmoil after FTX, one of the largest crypto exchanges collapsed.

- As a result, all FTX-related tokens, like SOL, FTT, SRM, MAPS, etc., are tanking without a stop.

- Traders, however, can focus on altcoins like dYdX, PERP and CAKE that are showing strength.

The aftermath of FTX’s collapse is something that the crypto industry is still dealing with, but a few altcoins seem to be making noise. These altcoins are showing strength amid a sea of red, suggesting a shift in investor sentiment and capital rotation.

dYdX price explodes and here’s what to expect

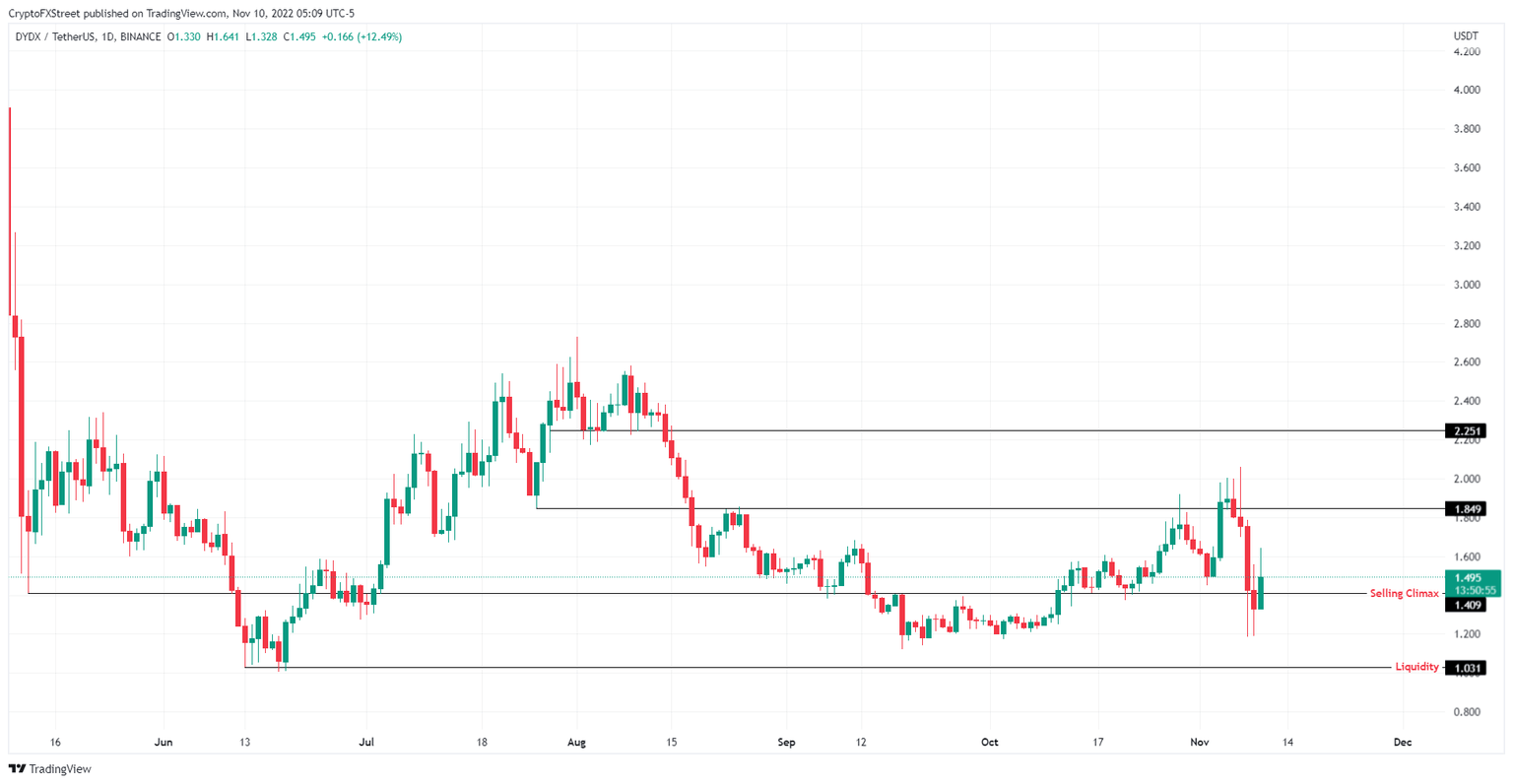

dYdX price shed roughly 42% due to the selling frenzy over the last week, resulting in a steep correction. However, the chart attached below shows that an influx of buyers stepped up at $1.41, resulting in a quick reversal and a 23% upswing. Although the daily candlestick is yet to close, the next level of interest, if this buying pressure continues to build up, is $1.85.

The reason why the dYdX price saw a sudden boost could be the recent collapse of another centralized exchange (CEX). As a result, investors may have rotated their capital to decentralized exchanges (DEX), which is the theme in the market right now.

In addition to dYdX, other DEX tokens are also seeing a similar narrative-based play. A resurgence in buying pressure that flips $1.85 could see the altcoin revisit the $2.25 hurdle, raking in a total gain of 52% from the current position.

dYdXUSDT 1-day chart

While things are looking up for this category of tokens, the narrative is at the mercy of Bitcoin price. A continuation of BTC’s downtrend could see dYdX price break its immediate support level at $1.41. This development will invalidate the bullish thesis and potentially trigger a correction to $1.03.

Perpetual token price could revert to mean

Perpetual token or PERP price seems to have taken a brutal hit as it dropped 55% and is currently hovering below the selling climax formed on June 18 at $0.50. However, since setting up a local bottom at $0.309, the altcoin has rallied 12% and is currently eyeing a retest of $0.50.

Interestingly, the midpoint of its 55% crash coincides with this level, making it a confluence and high probability zone to book profits. In total, this move would constitute a 39% upswing from the current position.

However, investors can play it a little risky and instead enter longs on a retest of the 62% or 70.5% retracement levels at $0.544 and $0.576 levels, respectively.

PERPUSDT 1-day chart

Regardless of the bullish outlook, a breakdown of the range low at $0.309 will invalidate this optimistic scenario and potentially trigger a correction to the negative 27% retracement level at $0.20.

CAKE price remains resilient

CAKE price saw a 33% drop due to the FTX exchange’s collapse, and this makes PancakeSwap’s native token one of the least affected in the market. Considering that Binance played a pivotal role in FTX’s collapse, this Binance Chain token’s performance seems obvious.

Going forward, investors need to pay close attention to CAKE and other Binance Chain ecosystem tokens, which have a higher chance of rallying.

As for CAKE price, the immediate hurdle at $4.35 is the first barrier that will be tagged after an 8% upswing. Flipping this blockade into a foothold will open the path for bulls to reach a buying climax at $5.14. This move would bring the total gain from 8% to 28% and would completely undo the FTX-induced crash.

CAKEUSDT 1-day chart

On the other hand, if CAKE price fails to climb higher but instead slices through the selling climax at $3.28, it would invalidate the bullish thesis and trigger a correction to $2.84.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.