Is Binance’s failure to acquire FTX a blessing for the larger crypto market?

- Binance announced on November 10 that the deal had been called off, citing corporate due diligence.

- FTX’s CEO Sam Bankman-Fried told his employees that Binance failed to inform them before making this move.

- The purchase not going through prevented a possible Mt.Gox repeat in the future.

Binance is already one of the biggest cryptocurrency exchanges in the world, but it was on the verge of becoming a far more powerful entity had the FTX acquisition deal gone through.

Binance-FTX no more

A short-lived dream came to an end on Thursday after Binance announced that the exchange would no longer pursue the acquisition of FTX. The exchange cited corporate due diligence, reports regarding mishandled customer funds and alleged US agency investigations as the reasons for not going forward.

Binance stated that the existing issues are beyond their ability to help, adding,

“Every time a major player in an industry fails, retail consumers will suffer. We have seen over the last several years that the crypto ecosystem is becoming more resilient and we believe in time that outliers that misuse user funds will be weeded out by the free market.”

However, FTX’s CEO Sam Bankman-Fried (SBF) was just as surprised as the rest of the market since he wasn’t informed beforehand either. As per Reuters, SBF told his employees that Binance made their statement to the media first and not to them but that he will keep fighting still and look into other options.

Apparently, SBF has been attempting to pull FTX out of the liquidity crunch by requesting its investors and other players in the industry for emergency funds. The exchange currently needs about $8 billion in order to cover the withdrawals conducted by users in the last three days.

OKX Director of Financial Markets, Lennix Lai, also noted a similar request, said that FTX was urgently seeking $2 to $4 billion in cash and that the exchange had over $7 billion in liabilities.

While Binance’s CEO Changpeng Zhao (CZ) did say that the last few days were not part of their “master plan”, the deal going through would not have been particularly great either.

In the spirit of transparency, might as well share the actual note, sent to all Binance team globally a few hours ago.https://t.co/IUNkPcLC8T pic.twitter.com/XGlIJB7EV5

— CZ Binance (@cz_binance) November 9, 2022

Binance’s crypto share is reminiscent of Mt. Gox

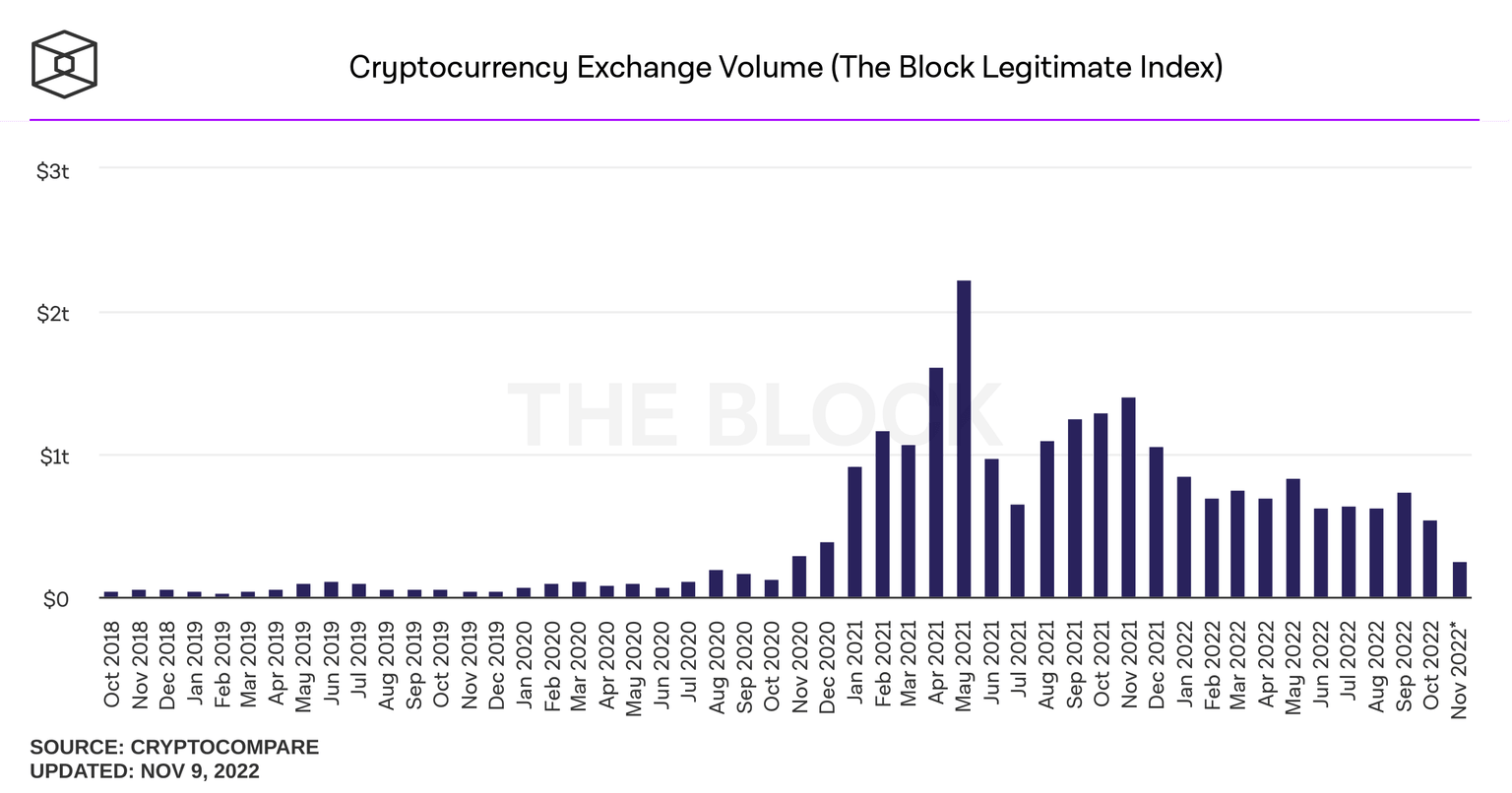

Binance, as of last month, was responsible for over $390 billion worth of transactions out of the $543 billion noted across all exchanges. This shows that the exchange already had a 71.8% dominance in the crypto market. If its acquisition of FTX were a success, Binance would be a force to be reckoned with, not to mention the wider implications in case of a collapse.

Crypto exchange’s monthly transaction volume

Thus, with one single entity handling roughly 80% of the market’s transactions, the situation would be oddly reminiscent of Mt. Gox’s downfall in 2014. However, this time around, the aftermath would be disastrous, considering the sheer size of the crypto market.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.