Ethereum price sees its dreams of $1,400 shattered

- Ethereum price enters a dangerous technical setup as price action fails to make new highs for October.

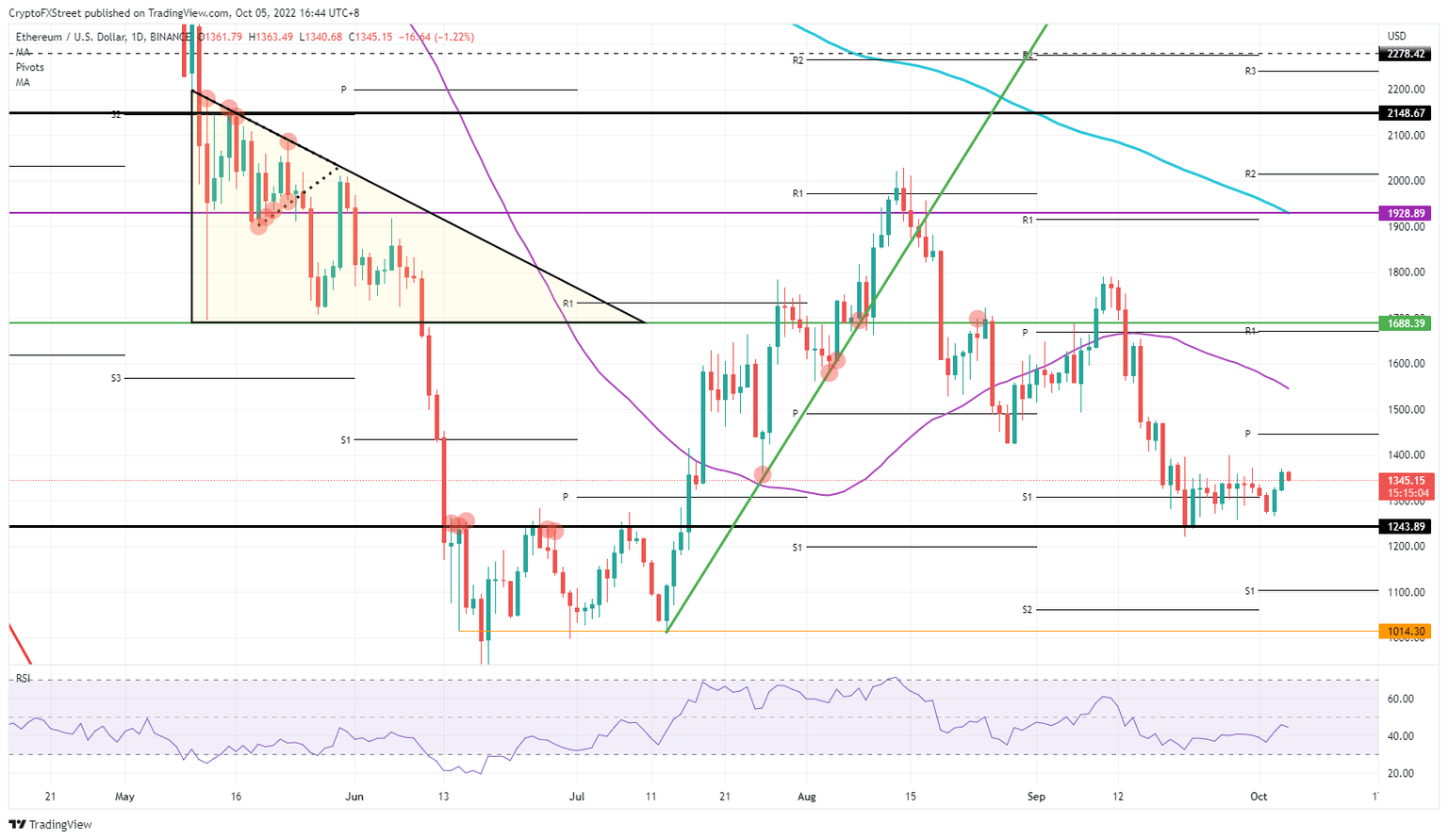

- ETH price is at risk of dropping back to $1,243 later this week.

- Expect to see pressure building on $1,243 with another leg lower towards $1,100.

Ethereum (ETH) price action has been printing some nice gains with 7% on the docket in just two trading days this week. This third trading day indicates a change in sentiment that could see bearish pressures mounting. There is a risk that all gains from this week will be lost, and no new highs for the month will be printed. Further, bears may have an opportunity to break back below $1,200 by the end of the week if dollar strength kicks in.

ETH price says goodbye to $1,400 forecast and instead welcomes in $1,200

Ethereum price takes a step back this morning with already -1% on the quote board as markets are rolling over in sentiment and seeing risk assets sold-off. The shift in sentiment comes from geopolitical tensions in Asia, where the US and South Korea have held joint exercises, including several missile attacks in response to North Korea after it launched a missile again on Tuesday. With the emergence of this new tail risk markets are worried that the US is poking the Chinese bear a bit too much.

ETH price thus slips 1% for now and looks set to drop back to $1,300. From there, it is not that far to hit $1,243 and challenge that level as bears rush into the price action to drive it into the ground. This is because Ethereum bulls cannot make new highs for the week, which could point to a false bounce off support at $1,243. If that level breaks, $1,100 comes into play with the monthly S1 support level as nearby support to underpin the price action.

ETH/USD Daily chart

On the other hand, it is quite normal that markets would take a small step back as a three-day-winning streak is quite exceptional unless a big positive catalyst comes into play. If so, and a more bullish catalyst comes into play, expect this to be a phase purely of profit taking, and a small step back before further advances in price action. If so, a rally could materialise and pick up speed again by Friday towards $1,400.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.