Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto markets turn green but need confirmation

- Bitcoin price faces a two-fold resistance zone after a 7.6% rally to $20,500.

- Ethereum price continues to consolidate between the $1,423 and $1,282 barriers.

- Ripple price produces a higher low at $0.437 as it eyes a retest of the $0.561 to $0.596 hurdle.

Bitcoin price has kick-started its first uptrend in October, and investors are happy to accept this move after weeks of choppy movement. In sympathy with Bitcoin, Ethereum and Ripple also triggered run-ups and are currently looking to continue their rallies.

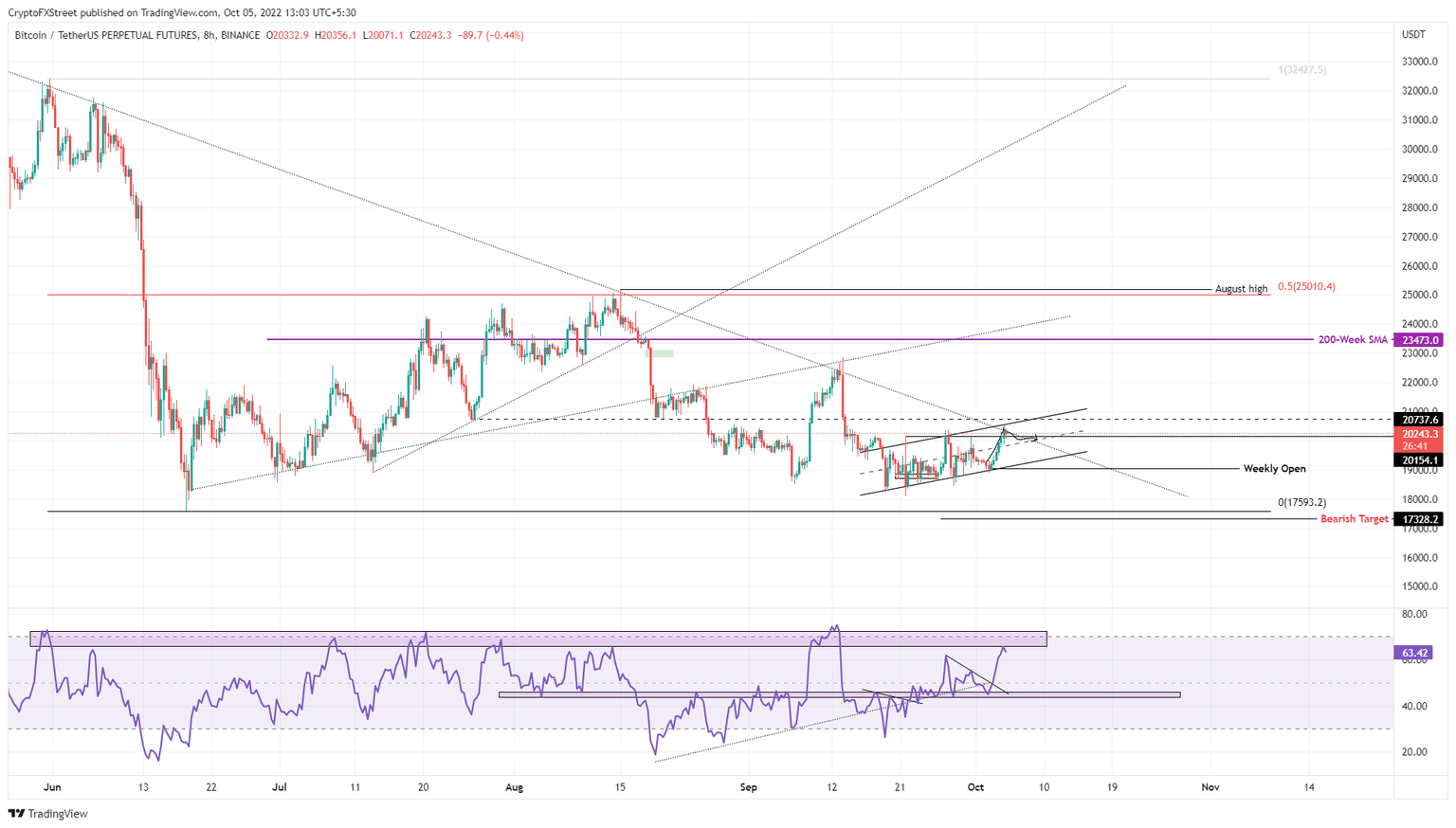

Bitcoin price plans its next step

Bitcoin price is currently facing resistance from the declining trend line connecting the swing highs since May 31, which has led to the top formation at $20,500. The second reason for forming this top can be seen in the Relative Strength Index (RSI), which has also approached a blockade.

Going forward, investors should prepare for a minor retracement to $19,800 before triggering the next leg-up for BTC, which could propel it to a significant hurdle at $20,737. A successful breakout could see Bitcoin price retest the $22,048 hurdle.

BTC/USD 8-hour chart

If Bitcoin price manages to flip the $20,737 hurdle, it will invalidate the bearish outlook, however, a failure to do so will denote weakness from buyers. This development could see BTC revisit and even breach $19,800.

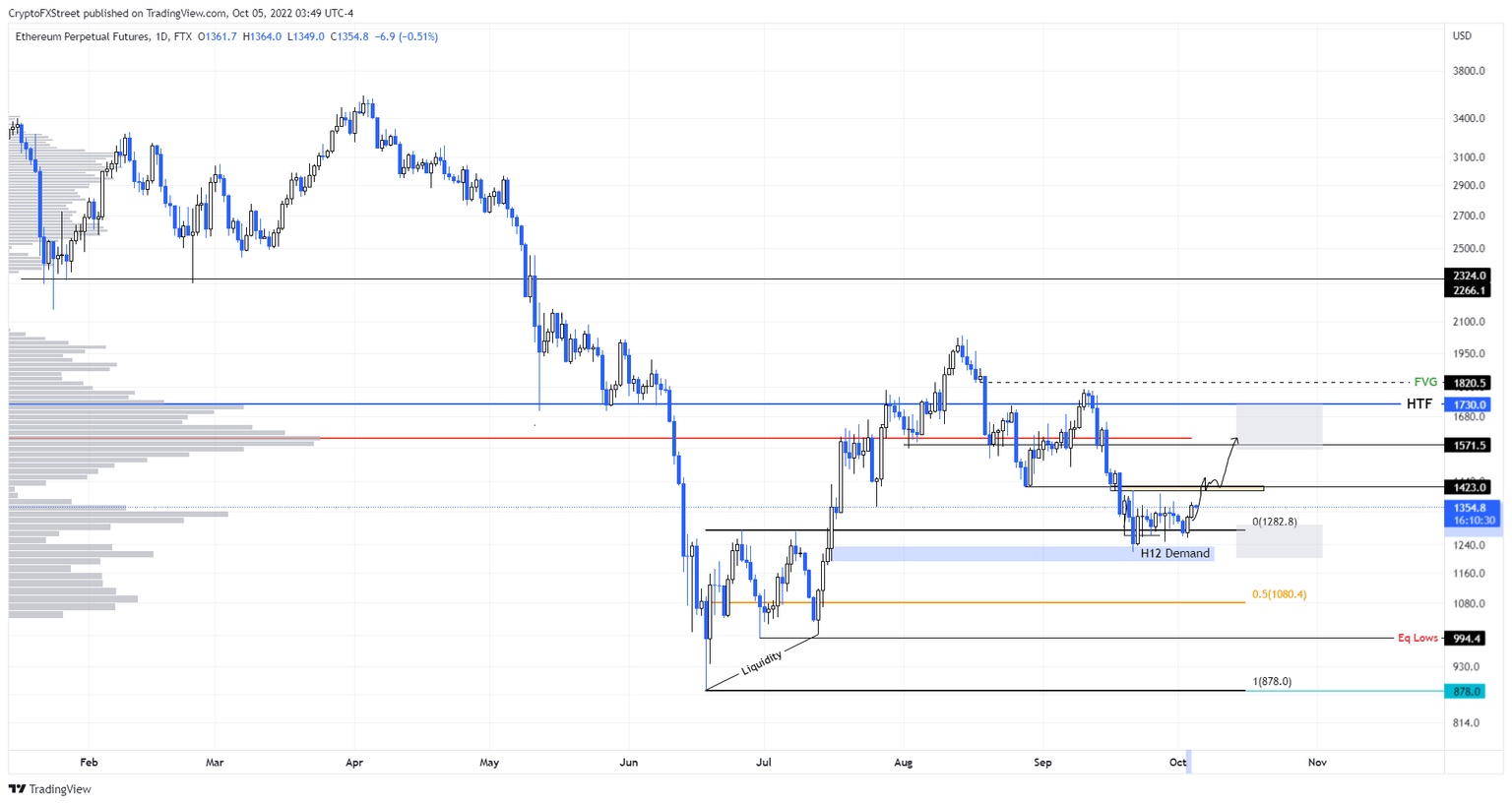

Ethereum price remains neutral

Ethereum price rallied 8.7% on October 4 but continues to ricochet between the $1,423 hurdle and the $1,280 support level. This range bound movement will change if market trend-setter Bitcoin price sees a volatile bullish move to $22,000 or higher.

In such a case, Ethereum price could flip the $1,423 hurdle and retest the $1,571 resistance level. If buying pressure builds up, investors should expect ETH to tag the $1,730 barrier.

ETH/USD 1-day chart

Regardless of the ongoing situation, if Ethereum price slices through the $1,200 psychological level, it will invalidate the bullish thesis and trigger a correction to $1,080.

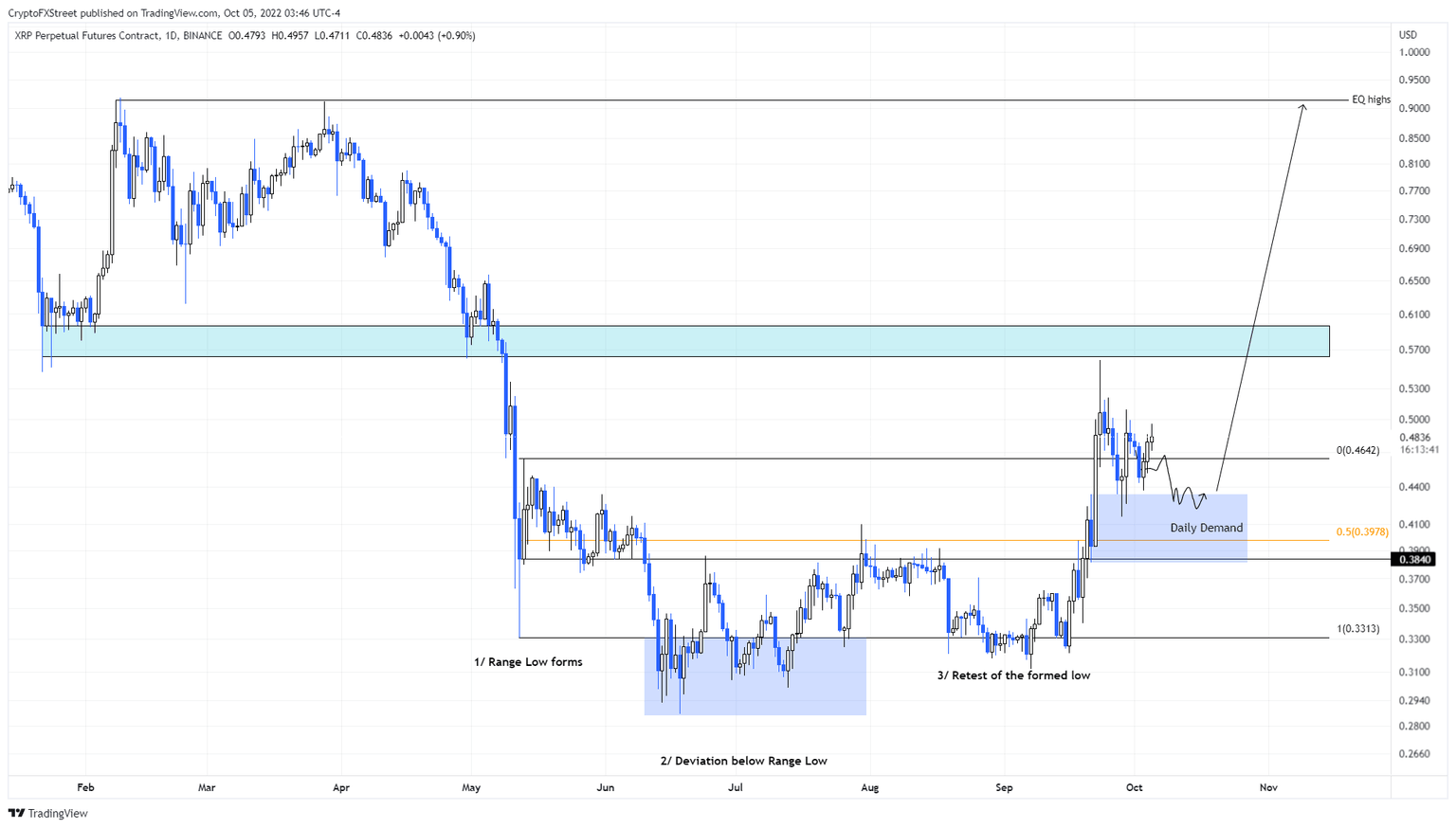

Ripple price ready to move higher

Ripple price bounced off the $0.381 to $0.433 demand zone on September 28 and rallied 19%. After forming a local top at $0.508, XRP price retraced again but formed a higher low at $0.437, denoting a bullish outlook.

If the momentum is strong, investors should see XRP price retest the $0.561 to $0.596 hurdle. This move would constitute a 17% ascent from the current position.

XRP/USD 1-day chart

On the other hand, if Ripple price fails to maintain the higher low at $0.437, it will indicate that the buyers are losing control. A failure to stay above the $0.381 level would invalidate the demand zone and the bullish thesis for XRP price.

Such a development could see the remittance token revisit the $0.360 intermediate support level to the downside.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.