Ethereum price rises on the frenzied interest in decentralized finance

- Ethereum price shaking free of the February high over the last two weeks.

- Non-fungible-tokens (NFTs) popularity translates into a tonne of potential for ETH investors.

- “Alt-season” puts ETH at the apex of the cryptocurrency market capitalization.

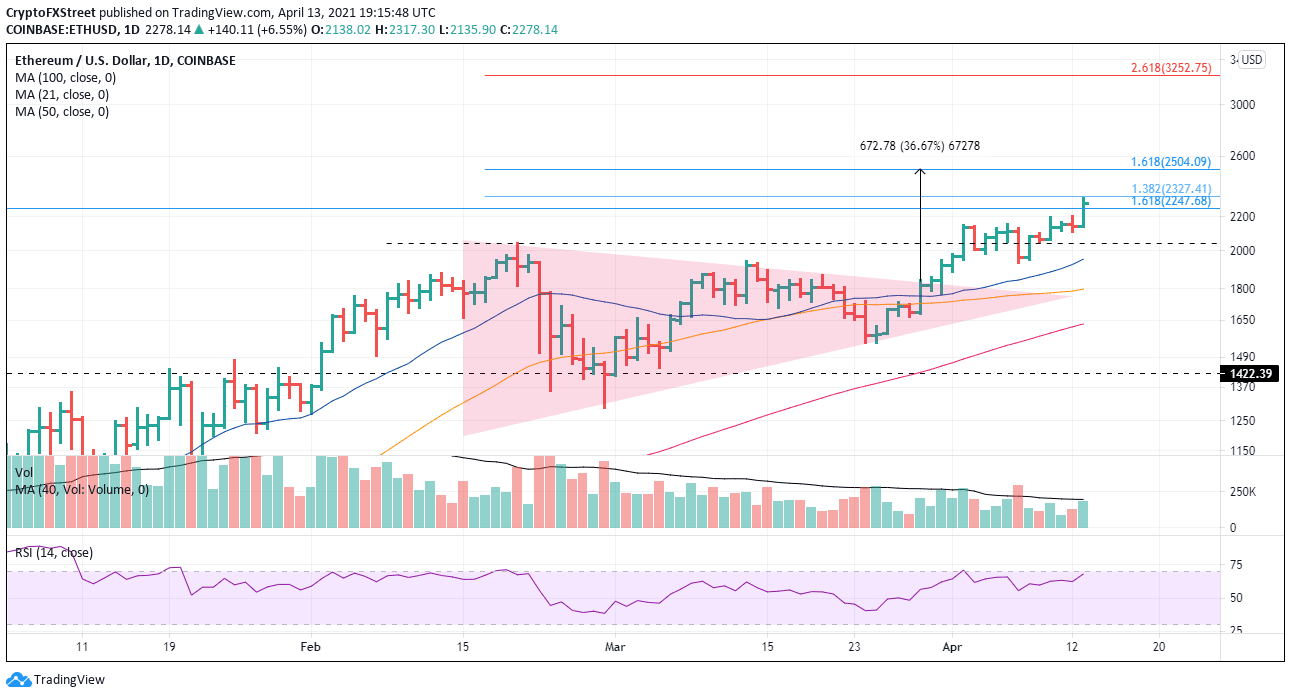

Ethereum price is up for the third consecutive week and crushed the 161.8% Fibonacci retracement of the 2018 bear market at $2,248 today. The outlook remains bullish for ETH, with the next resistance emerging at $2,500.

Ethereum price advance still not commanding heavy buying

Sometimes rallies take time to attract heavy buying, but it bears watching as the rally continues to unfold. The lack of interest will hurt the odds of ETH breaking through significant tactical levels in the days and weeks ahead.

As mentioned above, ETH should close today above the 161.8% extension of the 2018 bear market at $2,248, and it also came close to hitting the 138.2% extension of the February correction at $2,327 on an intra-day basis. The following important target for the advance is the alignment of the 161.8% extension of the February correction at $2,504 and the symmetrical triangle’s measured move target of $2,507.

If heavy buying emerges, speculators should consider the 261.8% extension level of the February correction at $3,253 as a possible price outcome in the coming weeks.

ETH/USD daily chart

In technical analysis circles, it is common to hear that resistance becomes support, and the February high at $2,041 is where the discussion of support begins for ETH. The next layer of support is the 50-day simple moving average (SMA) at $1,800, followed by the 100-day SMA at $1,633.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.