Ethereum Price Prediction: Whales-led volatility aims to separate traders from investors

- Ethereum price rose by 33% during the final days of October.

-

The largest inflow of ETH tokens to exchanges since 2020 has been recently reported.

-

Invalidation of the bullish trend is a breach below $1,150.

Ethereum price is at a pivotal point. While the price action is undoubtedly bullish following October's last-minute rally, certain on-chain metrics show whales may be satisfied with their gains and seek to book profits. Key levels have been defined to determine the next possible move.

Ethereum price is set to get volatile

Ethereum price is on everyday traders' watchlist as the decentralized smart-contract token has recently witnessed immense volatility. During the final days of October, the ETH price rose by 33%. The bulls accomplished strong retaliation-like candlesticks that display a slight uptick in volume amidst the incline. The Relative Strength Index (RSI) bottomed out in supportive territory before the rally, and the price breached both the 8-day exponential and 21-day simple moving averages. At this point, the uptrend seems genuine, traders would be justified in joining the trend to reach higher targets in the future.

Ethereum price currently auctions at $1,561. While the technicals point north, investors should still be aware of certain on-chain metric factors that may influence the decentralized smart-contract token.

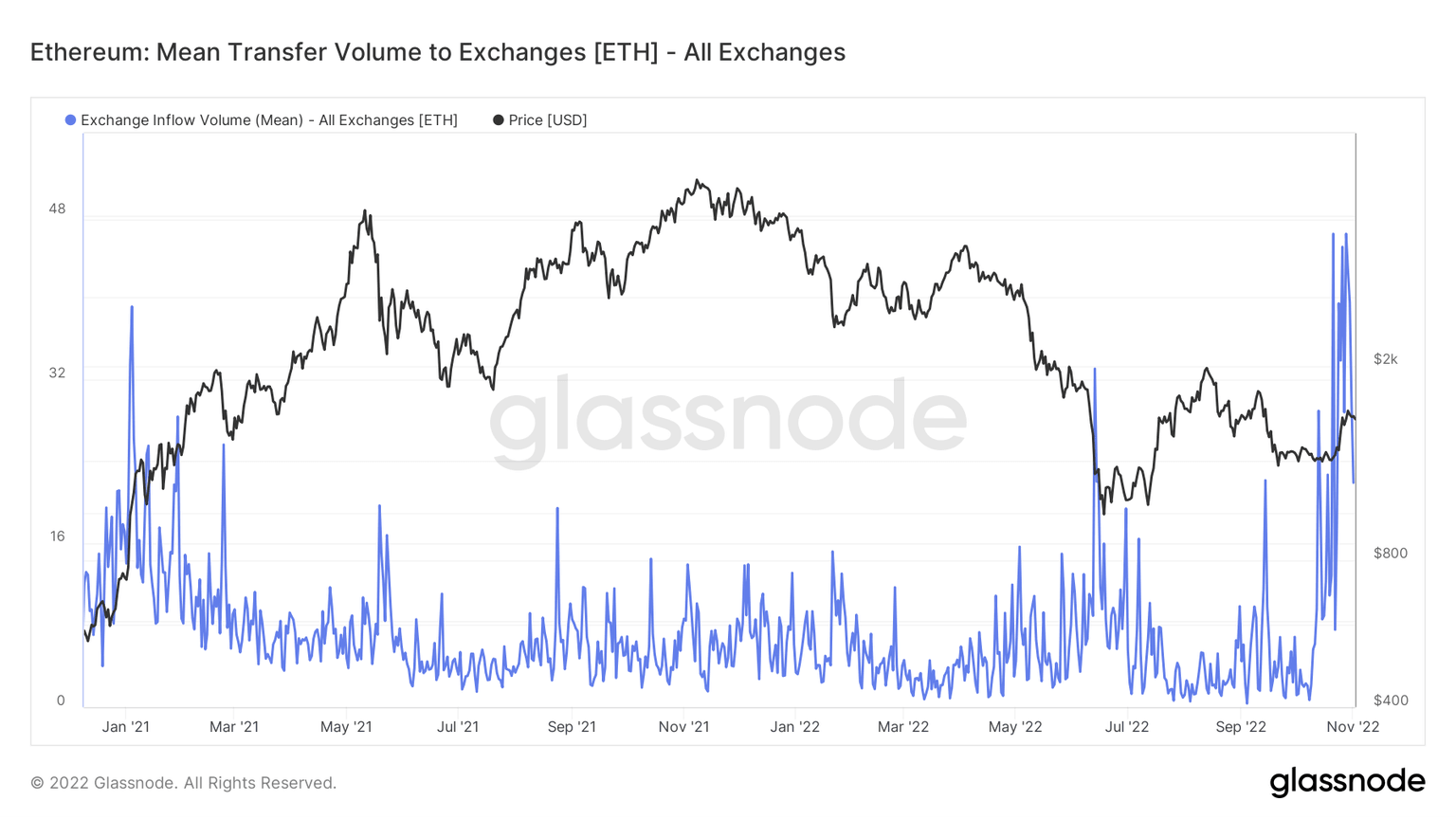

For instance, Glassnode’s Mean Exchange Inflow Indicator shows the largest influx of Ethereum tokens transferred to all exchanges since 2020. Based on historical evidence, an influx in transactions usually results in a healthy uptrend after weeks of psychological fakeouts and back-and-forth price action. One could argue that whales are sending tokens to the exchanges solely to dump the digital asset, but the indicator suggests that whales may be using a plethora of strategies to buy and sell at ideal prices while accumulating more ETH to their bottom line.

Glassnode’s Mean Transfer Volume to Exchanges Indicator

Due to the recent influx of tokens onboarded to exchanges, ETH prices could get very volatile in the weeks to come. Traders may want to apply healthier risk management during these times, while the HODL community may want to consider looking at prices less to avoid any psychological influence over their digital assets.

The health of the uptrend is still intact so long as the lows 20% below the current ETH price at $1,150 remain unbreached. If the bears produce a candle through these lows, the Ethereum price could re-route south to target the summer lows at $880. Such a move would result in a 40% decline from the current market value.

ETH USDT 3-Day Chart

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.