Ethereum Price Prediction: ETH presents buy signal, targeting $2,500

- Ethereum price was held by the $2,000 support level after a steep correction.

- As long as this demand barrier holds, ETH could rebound to $2,500.

- The Tom DeMark Sequential indicator adds credence to the bullish outlook.

Ethereum price seems primed for a bullish impulse after a particular technical indicator presented a buy signal on the 12-hour chart.

Ethereum price poised to rebound

Ethereum price has been in a downtrend since the beginning of June, shedding nearly 30% in market value. The second-largest cryptocurrency by market capitalization dropped from a high of $2,900 to recently hit a low of $2,040.

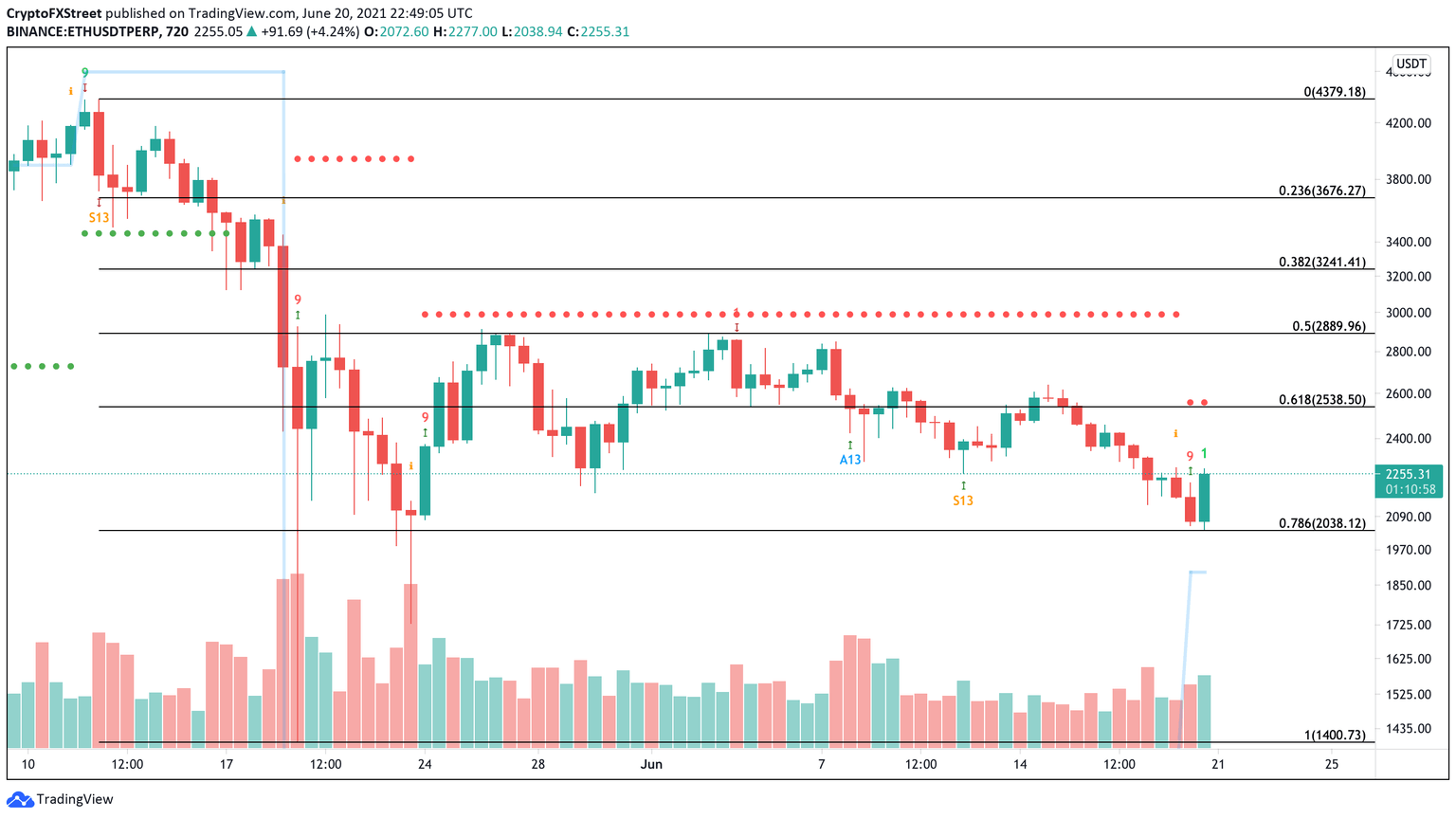

Despite the significant losses incurred over the past three weeks, Ethereum price looks primed to rebound. The Tom DeMark (TD) Sequential indicator presented a buy signal on the 12-hour chart after ETH tested the 78.6% Fibonacci retracement level.

The bullish formation developed in the form of a green nine candlestick, which is indicative of a one to four 12-hour candlestick upswing. A spike in buying pressure around the current price levels could see Ethereum price rise toward the 61.8% Fibonacci retracement level at $2,540.

ETH/USDt 12-hour chart

Even though the odds seem to favor the bulls, Ethereum price must remain trading above $2,040 to validate the bullish outlook. Failing to hold above this critical support level might spell trouble for the bulls.

A 12-hour candlestick close below the $2,040 support may result in a retest of May 23 or May 19’s low. These interest areas sit at $1,730 and $1,400, respectively.

Author

FXStreet Team

FXStreet