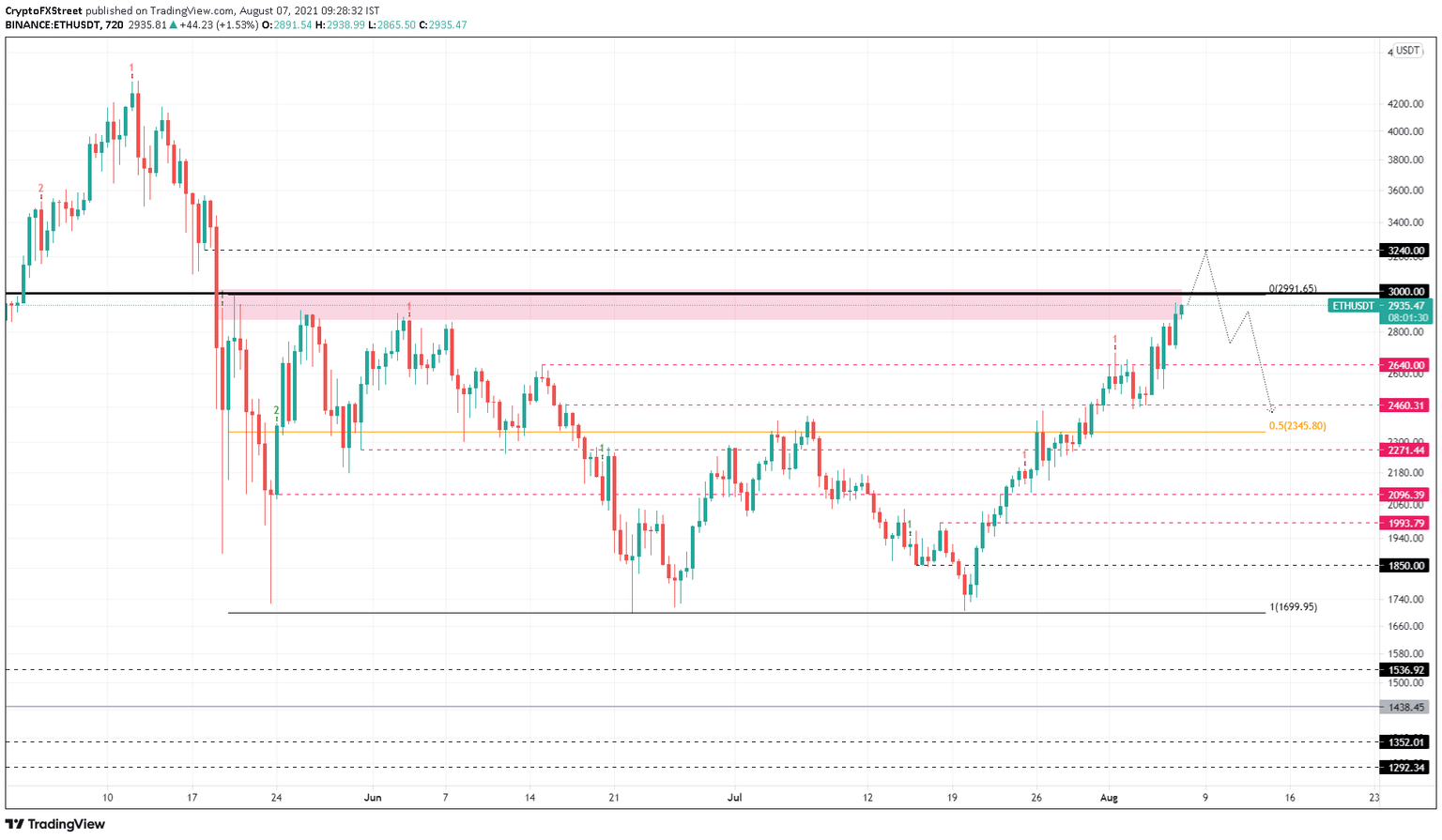

Ethereum Price Prediction: ETH eyes retest of $3,000 psychological level

- Ethereum price rally is looking to tag the $3,000 resistance level after 80 days.

- A successful flip of $3,240 might indicate the start of a new uptrend.

- If ETH fails to hold above $3,240, a pullback to $2,640 seems likely.

Ethereum price is at a crucial point in its uptrend as it approaches an essential supply barrier. The current position of ETH is vital since it will decide if the uptrend will continue or lead to a pullback.

Ethereum price faces a tough decision

Ethereum price continues to rise, continuing its rally that started on July 20. The impressive 72% upswing shows no signs of slowing as it approaches the range high at $2,991. Breaching this barrier will allow ETH to tag the $3,000 psychological level.

Such a development will lay out two possibilities, a continuation of the uptrend or a correction that allows the buyers to recuperate before the next leg up.

For this uptrend to continue, Ethereum price needs to slice through $3,000 and produce a decisive 12-hour candlestick close above $3,240. Such a move will flip the range high into a support level, allowing ETH bulls to retrace to it and restart a new uptrend.

However, if the uptrend fails to stay above $3,000 and flip $3,240, ETH will likely retrace to $2,640, a stable support barrier. This move will allow the bulls to gather steam for a new upswing.

ETH/USDT 12-hour chart

While things seem bullish for Ethereum price, the correction to $2,640 could turn fatal if the sellers shatter it. This development could push ETH down to the 50% Fibonacci retracement level at $2,345. A breakdown of the range’s mid-point will shift the favor toward bears and invalidate the bullish outlook.

In some cases, a surge in selling pressure might push ETH down to $2,271.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.