Ethereum Price Prediction: ETH eyes $3,000 as network activity explodes and scarcity grows

- Ethereum price has just hit a new all-time high at $1,475 and aims higher.

- Most on-chain metrics have turned bullish for ETH despite rising prices.

Ethereum has finally hit a clear new all-time high across all exchanges, and it’s currently under a healthy consolidation period. Over the past week, Ethereum’s dominance over the market increased from 13% to 17%, while Bitcoin lost close to five percentage points.

Ethereum price gears up for $3,000 as most indicators turn bullish

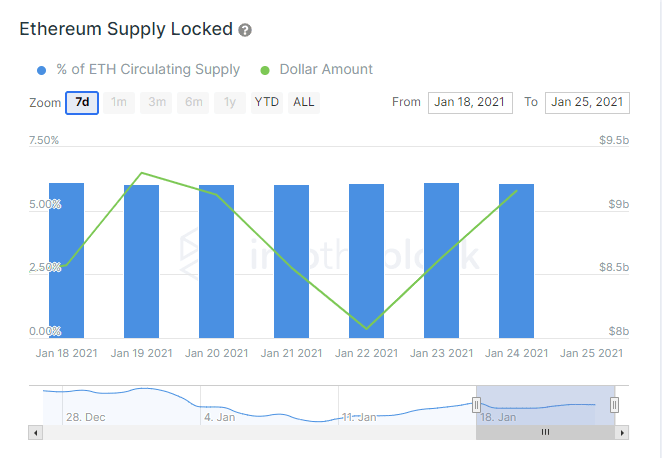

The Eth2 deposit contract continues to receive more Ethereum. At the time of writing, it holds around 2.83 million ETH worth over $4 billion at current prices. This is a significant number of Ethereum coins that are locked and cannot be sold.

ETH coins locked

In addition to the 2.83 million ETH locked inside Eth2, there are also 7 million ETH locked across DeFi protocols and projects, which means close to 10 million ETH are currently not truly in circulation, increasing its scarcity significantly, and therefore, bullish pressure.

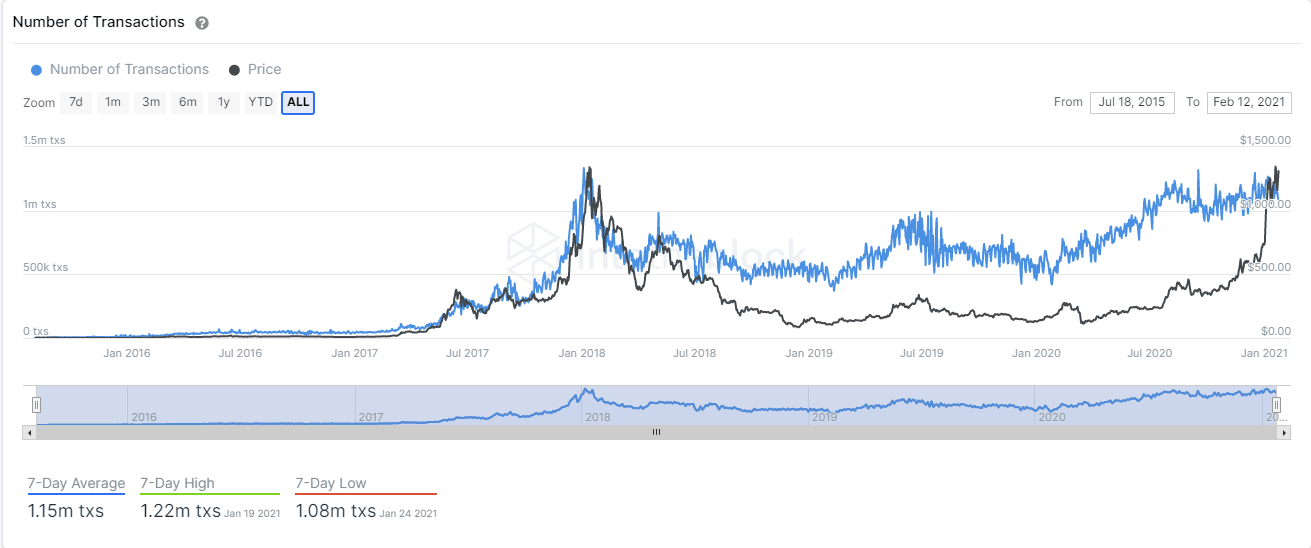

ETH Transactions chart

One of the main strengths of Ethereum during this run has been a massive increase in the number of transactions in the past several months. The digital asset has reached a 7-day average of 1.15 million transactions, which is almost higher than its peak of transactions in January 2018.

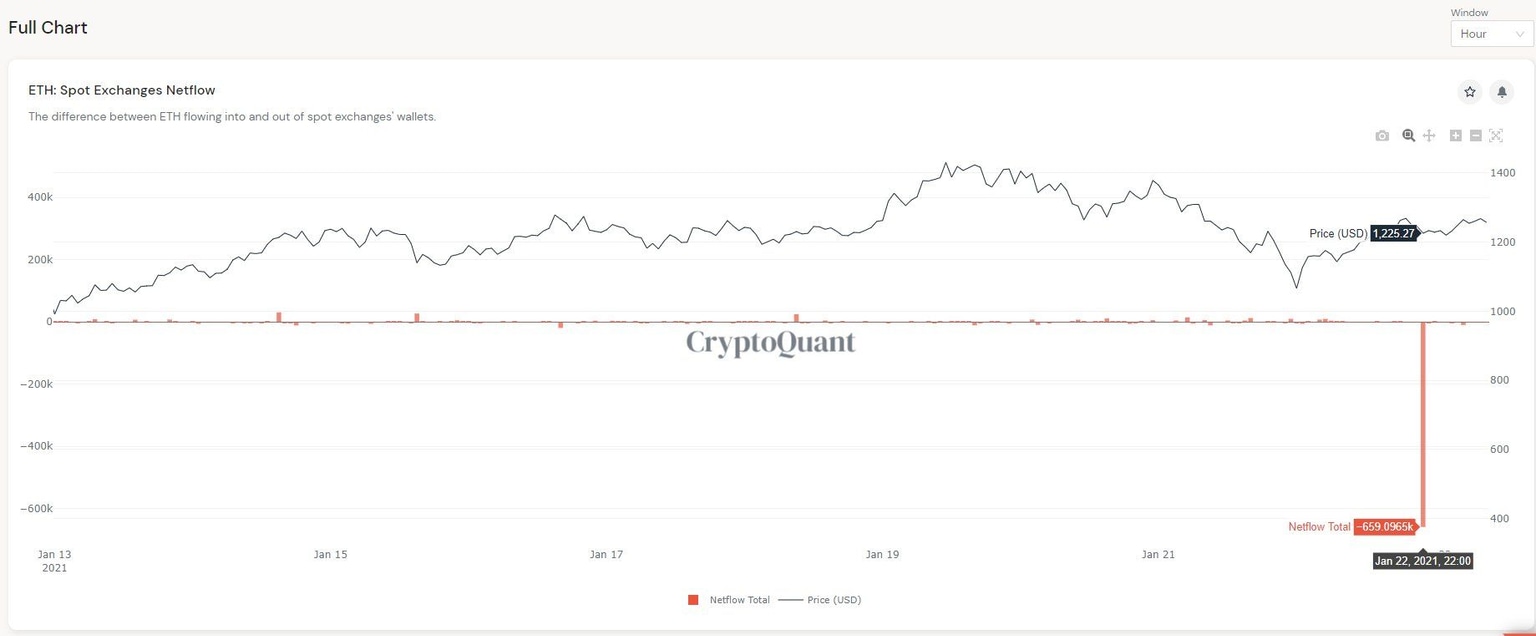

Ethereum exchange Netflow

On January 22, 2021, Ethereum saw a colossal spike in the number of coins withdrawn from exchanges. Around 659,000 ETH left exchanges in just a single hour, which is the largest amount ever and indicates traders and investors are not interested in selling the digital asset currently.

Ethereum supply on exchanges chart

Although this kind of spikes is not common, the total number of ETH inside exchanges has been declining since March 2020, from a high of 27% of Ethereum to only 20.8% currently, a notable decay. This is a key aspect that should allow Ethereum price to continue rising as demand quickly outpaces supply scarcity.

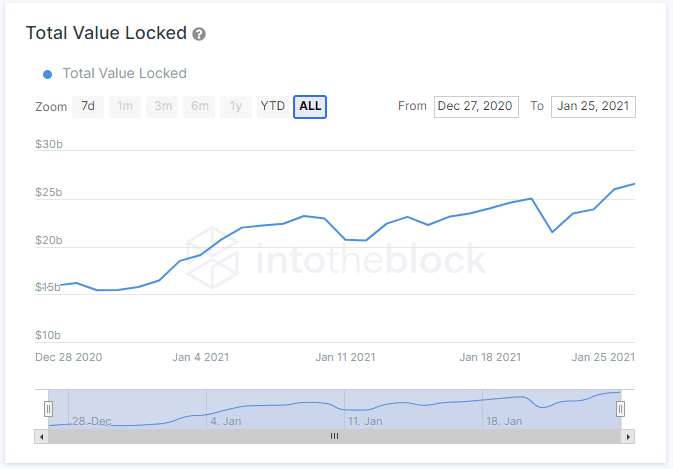

Total Value Locked chart

The DeFi industry has seen a tremendous surge of money in the past few weeks, from $15.4 billion on December 31, 2020, to a current all-time high of $26.5 billion. Considering that around 90% of all DeFi projects are built on Ethereum, this metric shows how fast the ecosystem is growing, and it’s undoubtedly bullish for ETH.

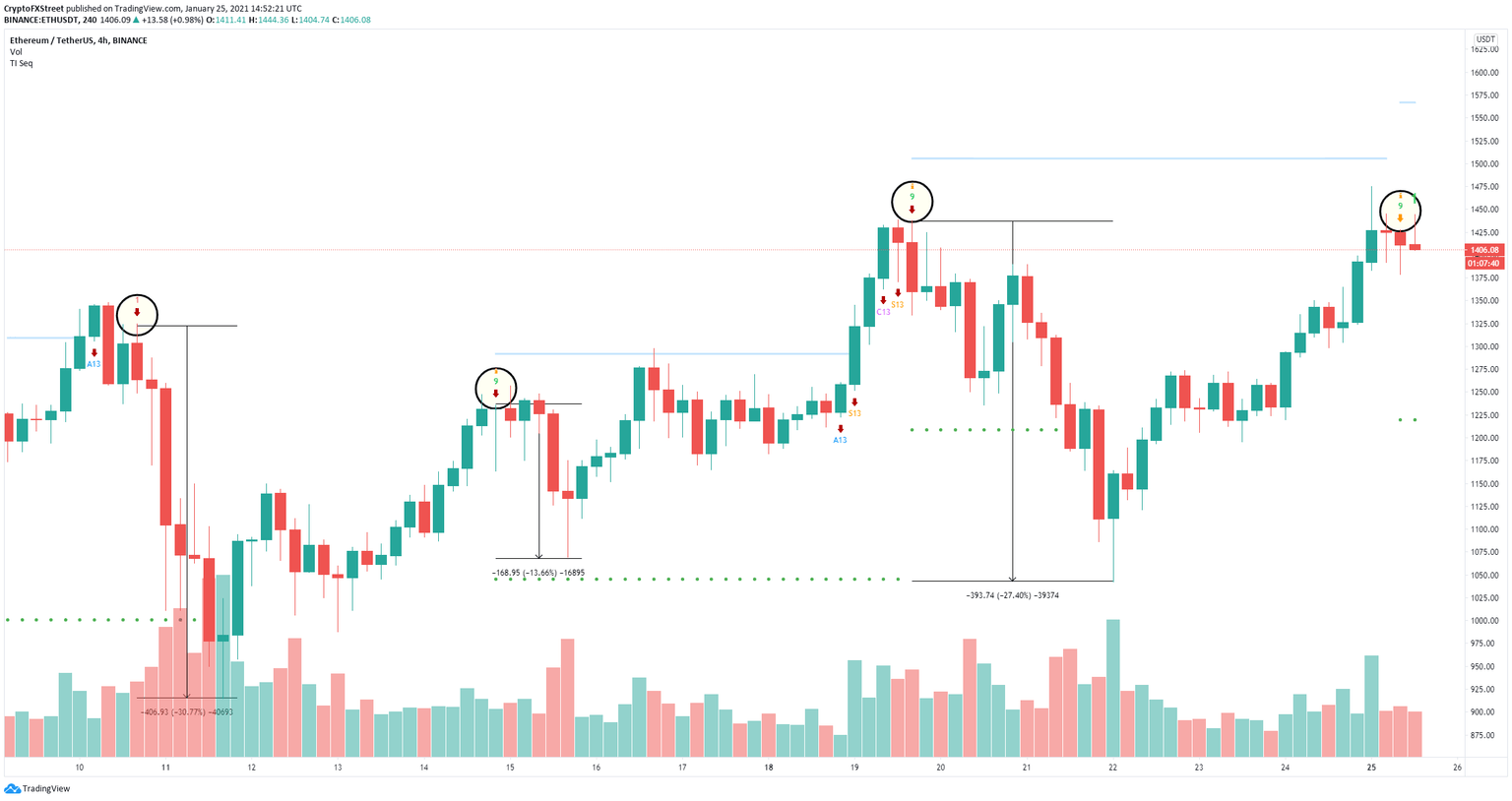

ETH/USD 4-hour chart

However, despite all the positive indicators and on-chain metrics in favor of Ethereum, the TD Sequential indicator has presented a sell signal on the 4-hour chart, which, in the past, has proven to be a reliable call. This could mean that Ethereum price is poised for a short-term pullback before resuming its uptrend.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B15.55.52%2C%252025%2520Jan%2C%25202021%5D-637471836723182819.png&w=1536&q=95)