Breaking: Ethereum refreshes record top towards $1,500 inside short-term rising channel

- ETH/USD takes the bids near fresh all-time high.

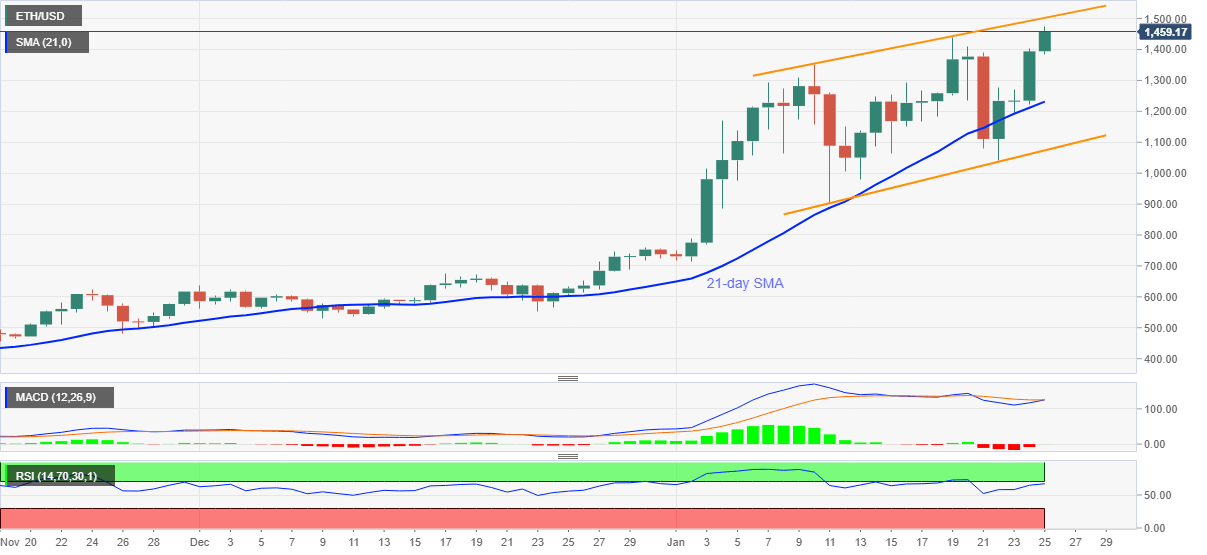

- Two-week-old rising channel, sustained trading beyond 21-day SMA favor bulls.

- Upbeat RSI conditions, news from China’s GT also back Ethereum buyers.

Ethereum buyers dominate sentiment as ETH/USD rises to the fresh high on record during early Monday. That said, the ETH/USD pair pierces the previous high of $1,440 to mark a new all-time top of $1,475.89.

While the broad optimism concerning the cryptocurrencies, taking clues from Bitcoin, seems to have favored the ETH/USD bulls, latest news from China also backed the upside momentum. China’s Global Times (GT) quoted an anonymous industry player while saying, “The pilot testing is only the first step of a 'long march.' Once launched, the digital yuan will reshape China's financial industry and unleash a promising digital finance service sector worth billions of yuan."

It should be noted that the quote’s sustained trading above 21-day SMA and strong RSI conditions, coupled with a switch of the bearish MACD towards the green zone, also amplify the ETH/USD upside strength.

However, resistance line of an upward sloping channel formation, established since January 10, currently near $1,500, will challenge the buyers.

Alternatively, a downside break of 21-day SMA, at $1,230 now, will attack the stated channel’s support near $1,070 to recall the ETH/USD sellers.

In a case where the ETH/USD bears manage to sneak in around $1,070, the $1,000 round-figure will add filters to the downside.

ETH/USD daily chart

Trend: Bullish

Author

FXStreet Team

FXStreet