Ethereum price pops as this week could be the most profitable one of the year

- Ethereum price sees bulls calling out the bottom for this year.

- ETH performs a perfect technical trade setup that could see ETH jumping to $1,500.

- Expect to see possibly the best week for cryptocurrencies as the crypto winter fades and the real winter outdoors kicks off.

Ethereum (ETH) is booking over 1% of gains this morning, which as such is not that uncommon. What is rather important is that Ethereum price is moving away from the bottom of 2022, and bulls are in the driving seat.It seems set to book the best possible rally for 2022. With ETH soon to break the high of mid-November, expect to see price action rip through the caps and resistances toward $1,500 by the end of this week, bearing 15% gains.

ETH bulls are ready for that 15% profit

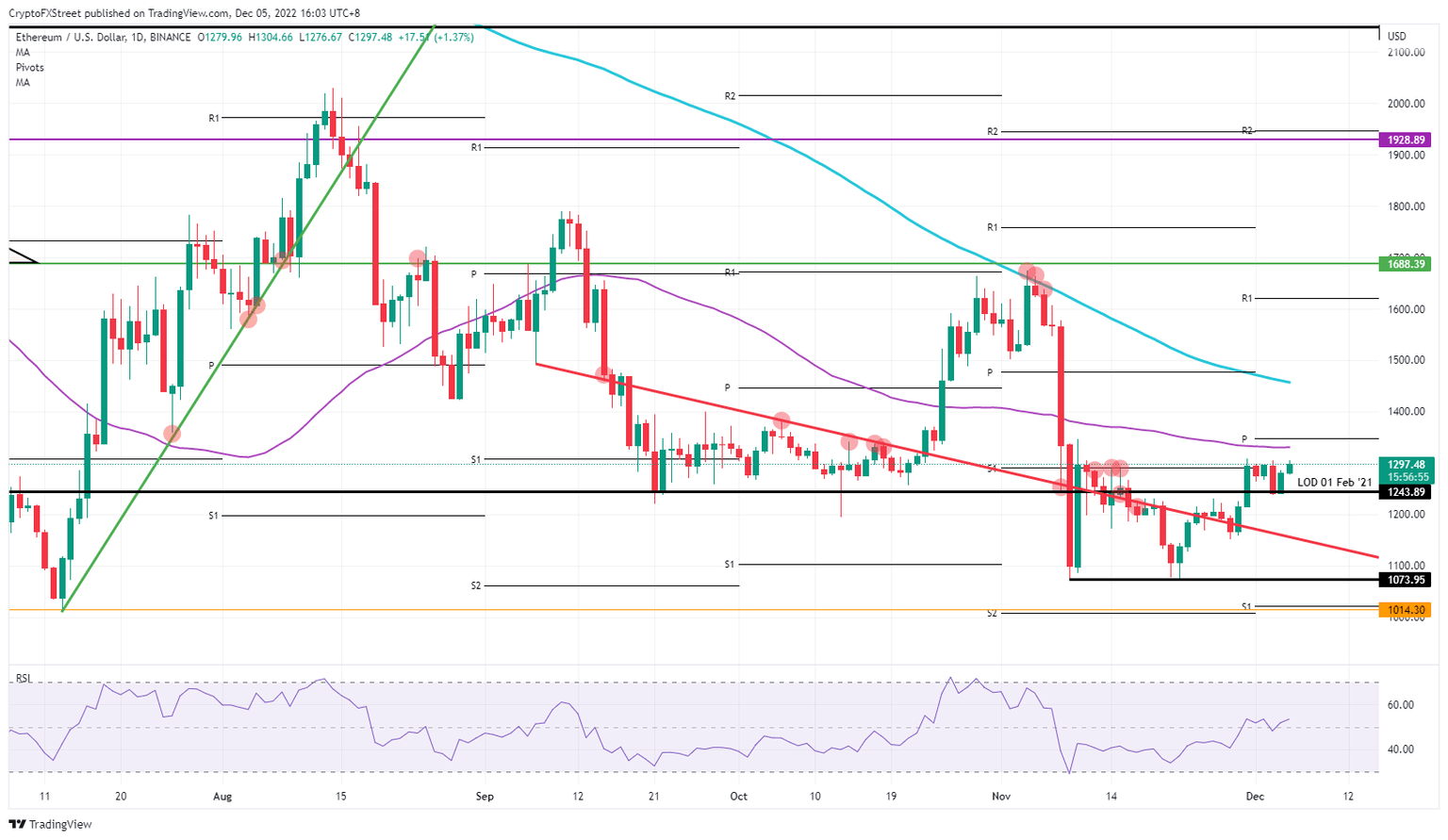

Ethereum price is jumping higher since Sunday as a perfect technical scenario looks to be underway. That scenario comes in the form of ETH breaking above that pivotal level at $1,243 last week, trading sideways for a bit, and on Saturday testing the level for support. The support held overnight through Sunday morning where a bounce got triggered and price action jumped higher, flirting now with the 55-day Simple Moving Average (SMA) and the monthly high of mid-November.

ETH is thus set to continue its path as the faith and trust in cryptocurrencies is recovering from the last few blows after stablecoin Luna, FTX and SBF. Once that mentioned high for mid-November is broken, near $1,346, expect to see a quick rally higher toward the 200-day SMA near $1,463. From there it is only a few percentage points to get to that $1,500 barrier, which will be crucial from a psychological point of view.

ETH/USD daily chart

Risk to the downside comes with the US Dollar that is strengthening this morning. Already in the European trading session it slid over 50 pips lower against the Euro and could strengthen further. The Greenback would put downward pressures on ETH and push it back against that Low of February 1, 2021, at $1,243. Once that breaks, there is a big systemic risk that it falls back to $1,073.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.