Ethereum price needs to cross one hurdle before it can reach $2,000

- ETH/USD refreshes record top as bulls flirt with $1,900.

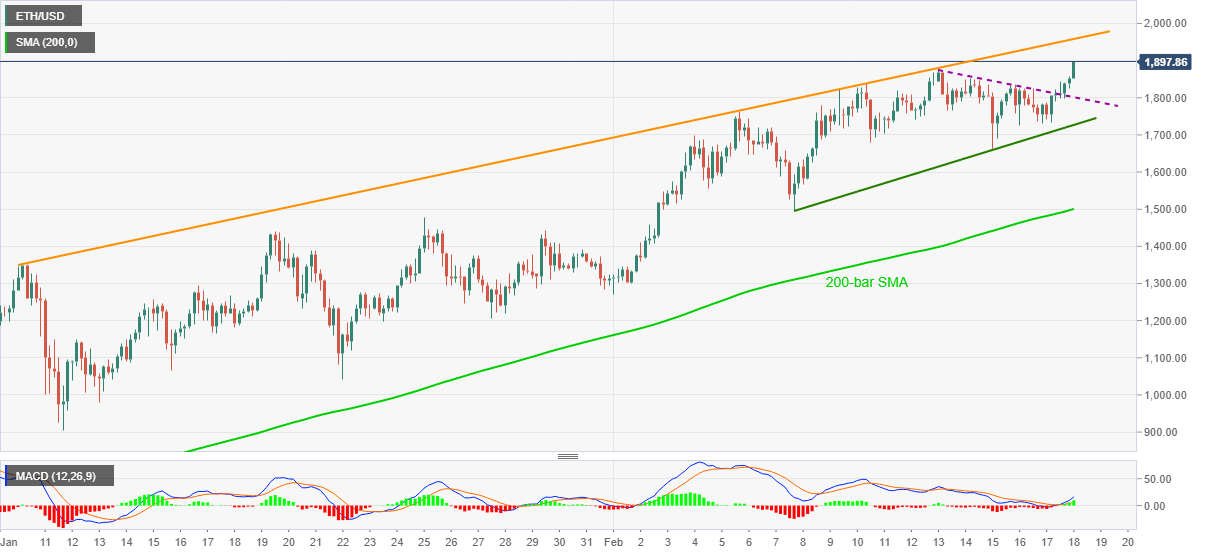

- Six-week-old ascending trend line adds to the upside filters.

- Previous resistance line from Saturday offers immediate support.

Ethereum bulls are unstoppable as the altcoin refreshes record top with $1,899 figure, still rising, amid the early Thursday.

Although bullish MACD joins the cryptocurrency pair’s upside break of a short-term resistance line, now support, to favor the ETH/USD bulls, an upward sloping trend line from January 10, at $1,960 now, may challenge the quote’s further upside.

In a case where the ETH/USD buyers dominate past-$1,960, which is more likely, the $2,000 psychological magnet will pop-up on their radar.

Meanwhile, pullback moves can eye to retest the previous resistance line, at $1,800 now.

If at all the ETH/USD sellers sneak it below $1,800 another support line from February 07, currently $1,725, will test the quote’s further weakness.

To sum up, Ethereum bulls have a bumpy road ahead while the downside moves have multiple filters.

ETH/USD four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.