Ethereum price goes against the wind to retest $3,600

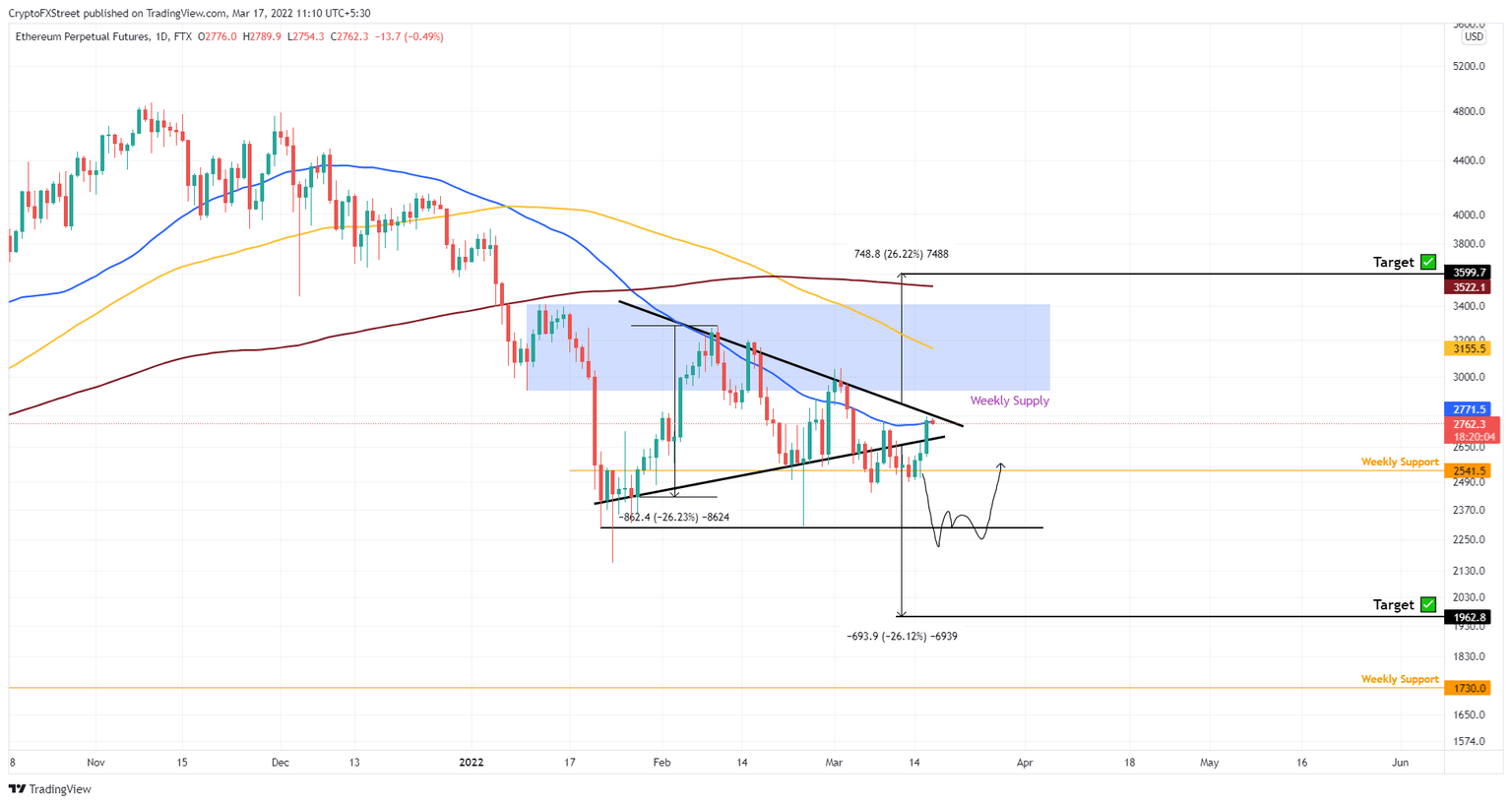

- Ethereum price breached a symmetrical triangle to the downside but is recovering quickly and heading higher.

- The upside for ETH is plagued with multiple barriers including the $2,927 to $3,413 weekly supply zone.

- A retest of $3,600 will set a higher high relative to the January 12 swing high, indicating a narrative flip favoring bulls.

Ethereum price is on the path to recovering its losses from the past week but faces multiple stiff resistance barriers in its path. ETH bulls are likely to face exhaustion if the momentum fails to keep up.

Ethereum price pulls a 180

Ethereum price breached the base of a symmetrical triangle on March 6 but the bears failed to follow through. The weekly support level at $2,541 is one of the major reasons why ETH bears lost and is also why bulls could make a comeback.

After rallying roughly 12%, Ethereum price is currently testing the 50-day Simple Moving Average (SMA) at $2,771. A decisive flip of this hurdle will put ETH on the path to face the weekly supply zone, extending from $2,927 to $3,413.

The last three times ETH tagged this hurdle, it met a massive spike in selling pressure leading to a crash. Therefore, investors need to exercise caution as the smart contract token is heading back to this area.

Moreover, this supply zone also harbors the 100-day SMA at $3,155, making the upswing exceptionally harder for bulls. So, a conservative approach is to assume that Ethereum price upside is limited to $3,000.

In a highly bullish case, there is a chance Ethereum price might shatter all these hurdles and make its way to the 200-day SMA at $3,522. This move would bring the total gains to 31% from the current position - $2,762.

ETH/USDT 1-day chart

On the other hand, if Ethereum price fails to move higher and slides lower, it will indicate a weakness among bulls. If ETH produces a candlestick close below $2,541 support level it will invalidate the bullish thesis and open the path to head lower and retest the $1,927 barrier.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.