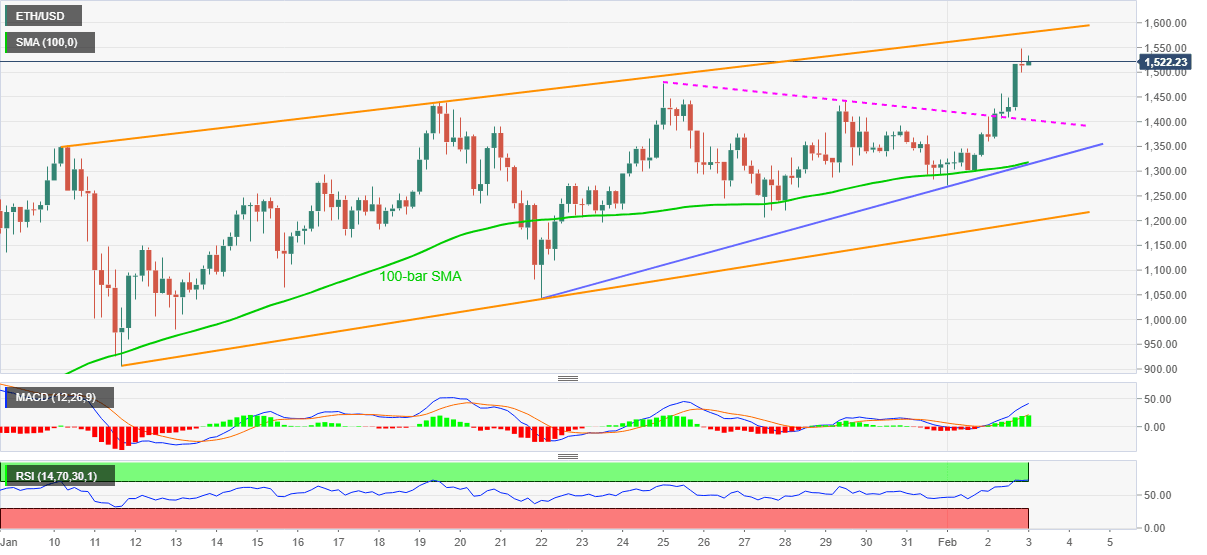

Ethereum Price Analysis: ETH bulls catch a breather above $1,500, three-week-old rising channel in focus

- ETH/USD eases from all-time high amid overbought RSI.

- Sustained break of weekly resistance, bullish MACD hint further upside.

- 17-day-old rising trend channel also portrays bullish momentum.

ETH/USD eases from the record top of $1,549 to $1,517.70 during early Wednesday. The altcoin buyers might have taken a break amid overbought RSI conditions but the bullish momentum, portrayed by MACD and successful break of short-term resistance, now support, keeps suggesting the quote’s further upside.

As a result, the top line of an upward sloping trend channel stretched from January 10, currently around $1,580, gains the ETH/USD buyers’ attention, for now.

However, any further upside will not hesitate to challenge the $2,000 psychological magnet wherein the $1,600 threshold can act as an intermediate stop.

Alternatively, a downside break of the previous resistance line from January 25, currently around $1,400, will be challenged by 100-bar SMA and an eight-day long ascending support line near $1,315.

If at all the ETH/USD sellers manage to break $1,315, the stated channel’s lower line close to $1,200 will be the key to watch.

ETH/USD four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.