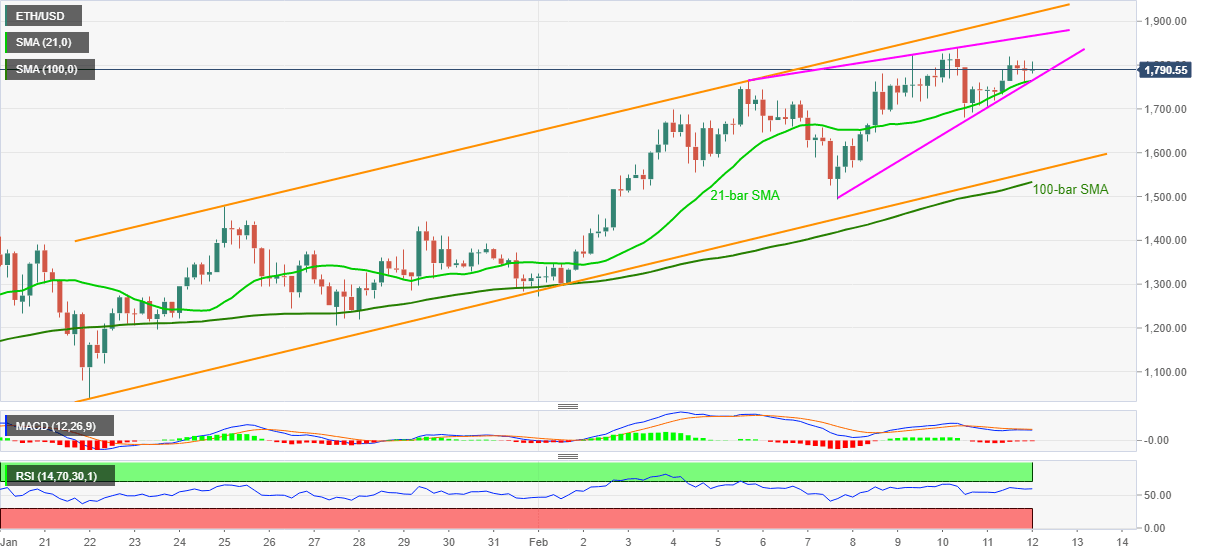

Ethereum Price Analysis: ETH braces for $2,000 amid bullish technical set-up

- ETH/USD wavers around intraday high while extending Thursday’s recovery moves near record top.

- Ascending trend channel, strong RSI joins MACD conditions and sustained trading beyond 100-bar SMA to favor buyers.

- Sellers to have a bumpy road before revisiting early January levels.

ETH/USD eases from the day’s top of $1,807.95 to currently around $1,790 during early Friday. In doing so, the altcoin keeps the previous day’s upside momentum inside a short-term ascending triangle.

Also favoring the ethereum buyers is the strong RSI conditions, receding strength of the bearish MACD and a three-week-old rising trend channel formation.

Considering the quote’s latest pullback moves, the support line of the weekly triangle and 21-bar SMA, near $1,760, can restrict immediate downside. However, any further weakness may not refrain from challenging the bullish chart formation while directing ETH/USD bears toward $1,550.

It should be noted that the sellers need validation from a 100-bar SMA level of $1,533 to challenge the uptrend.

Alternatively, the stated triangle’s resistance near $1,870 and the channel’s upper line near $1,920 can test the ETH/USD bulls targeting the $2,000 psychological magnet.

ETH/USD four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.