Ethereum in a pennant, with bullish breakout as tailwinds reemerge

- Ethereum price recovers from the massive sell-off it saw on Saturday.

- ETH price is set for further bullish action as tailwinds reemerge in global markets.

- Expect the pennant breakout, buying volume to pick up speed as investors want to be part of the rally.

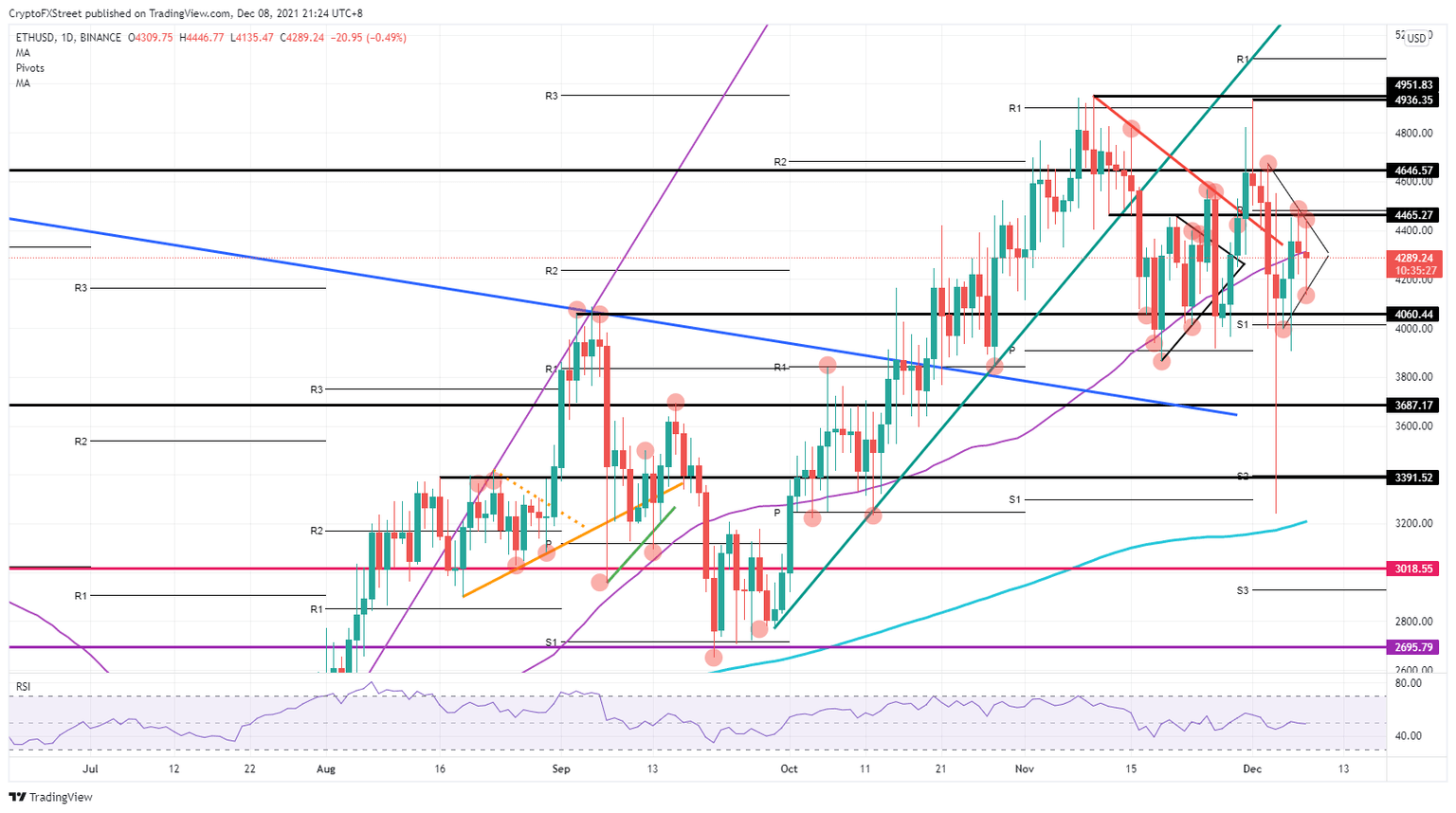

Ethereum (ETH) price has formed a pennant that quit rapidly after the big sell-off during the weekend. Between $4,646 and $4,060, the price ranges from lower highs and higher lows. As momentum builds in that squeeze, expect the tailwinds that are currently reemerging to help bulls push this breakout in their favour. ETH price could quickly see $4,646 to the upside, with new all-time highs not far off from there.

Ethereum bulls get help from tailwinds as new all-time highs could be in the making

Ethereum price has been under pressure from the nose dive correction that happened in the past weekend. But investors were quick to shake that off and instead saw it as a buy-opportunity to buy the dip. ETH price quickly got back above the monthly S1 at $4,000 and has tested $4,465 a few times already to the upside these past few days.

ETH price forms a pennant with lower highs and higher lows, squeezing buyers and sellers towards each other. As current tailwinds are reemerging and starting to dictate market sentiment, expect this breakout to fall in favor of the bulls and see a quick pop towards $4,465. Once that level has been left behind, bulls will want to reclaim $4,646 as a support level, offer some profit-taking and let new investors come in who want to make new all-time highs.

ETH/USD daily chart

Should the tailwinds start to fade as quickly as they reemerged, expect for the pennant to break to the downside and test the floor at $4,000. Once that breaks, a more gradual sell-off would be executed with a target at $3,687 and $3,391. Certainly, that last one should see a halt in any further downside as it falls in line with the monthly S2 support level.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.